- Options Trading University

- Posts

- Why I’m Bullish, Where I’d Buy the Dip, and NVDA CSP

Why I’m Bullish, Where I’d Buy the Dip, and NVDA CSP

Hey Options Trader,

In this week’s newsletter, I’ll walk you through how I’m positioning ahead of CPI, a simple NVDA trade earning over 2% in 30 days, and how sector rotation is creating fresh opportunities. You’ll also hear about one of our newest client success stories a $14,000+ profit this week and get access to my latest portfolio video, where I reveal the brand-new stock I will be adding with a $67K allocation, plus three more I’m buying now.

Here’s what we are covering:

$QQQ and $VIX – CPI Outlook & My Cash Plan

Free Trade Of The Week – NVDA CSP (2% in 30 Days)

Client Profits – $14.5K, 11% ROI & More

$67K Into a New Stock + 3 To Buy Now (Video Breakdown)

QQQ and VIX - Key Levels

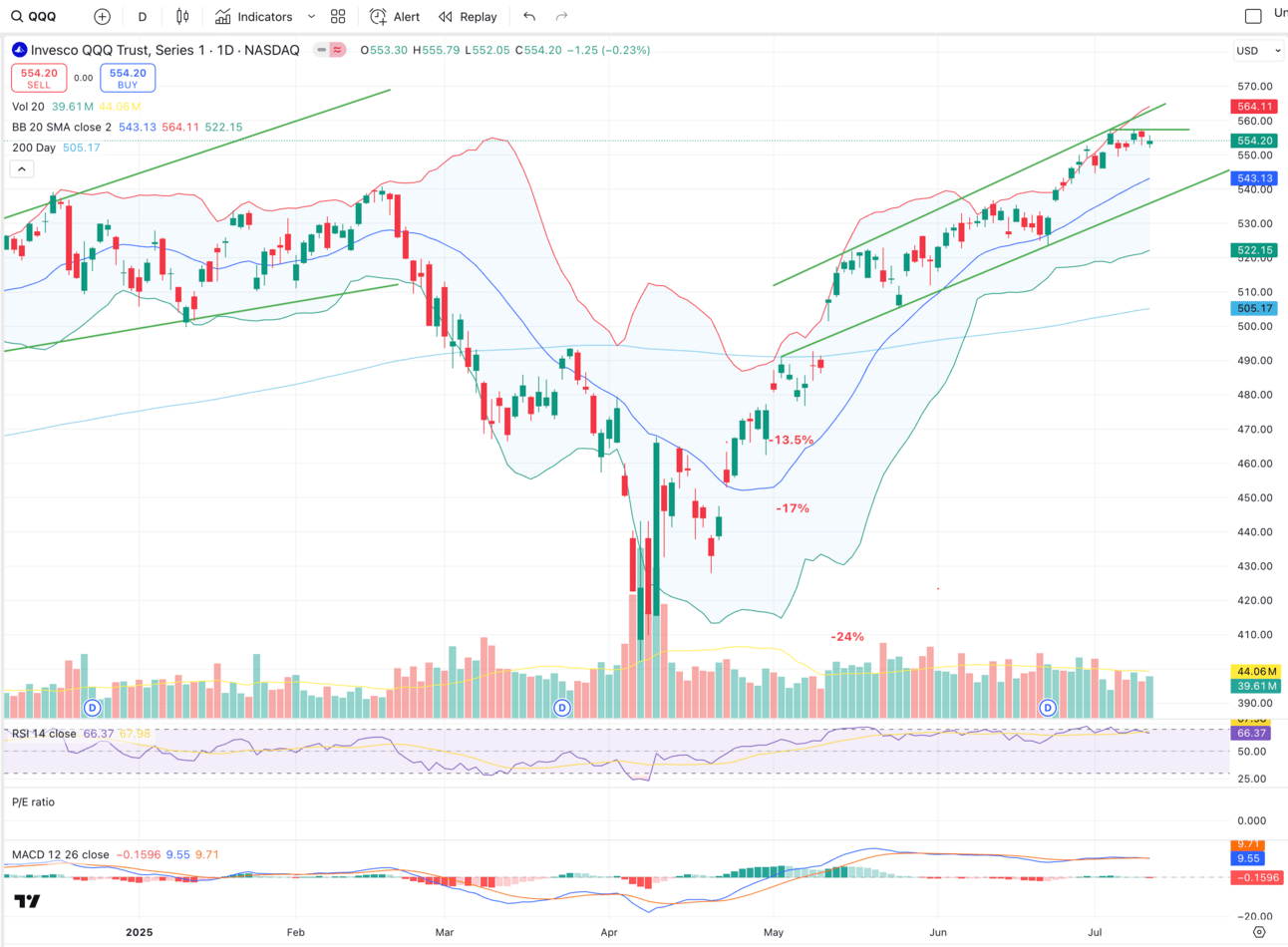

The market is consolidating after a strong run, and I remain bullish. We’re seeing a healthy rotation out of speculative names and back into quality especially among the MAG-7 stocks.

If core CPI comes in near the 2% target, I believe $QQQ has a clean path to 570. But if inflation runs hot, expect a pullback to the 538–540 range, a level I’d treat as a strong dip-buying opportunity.

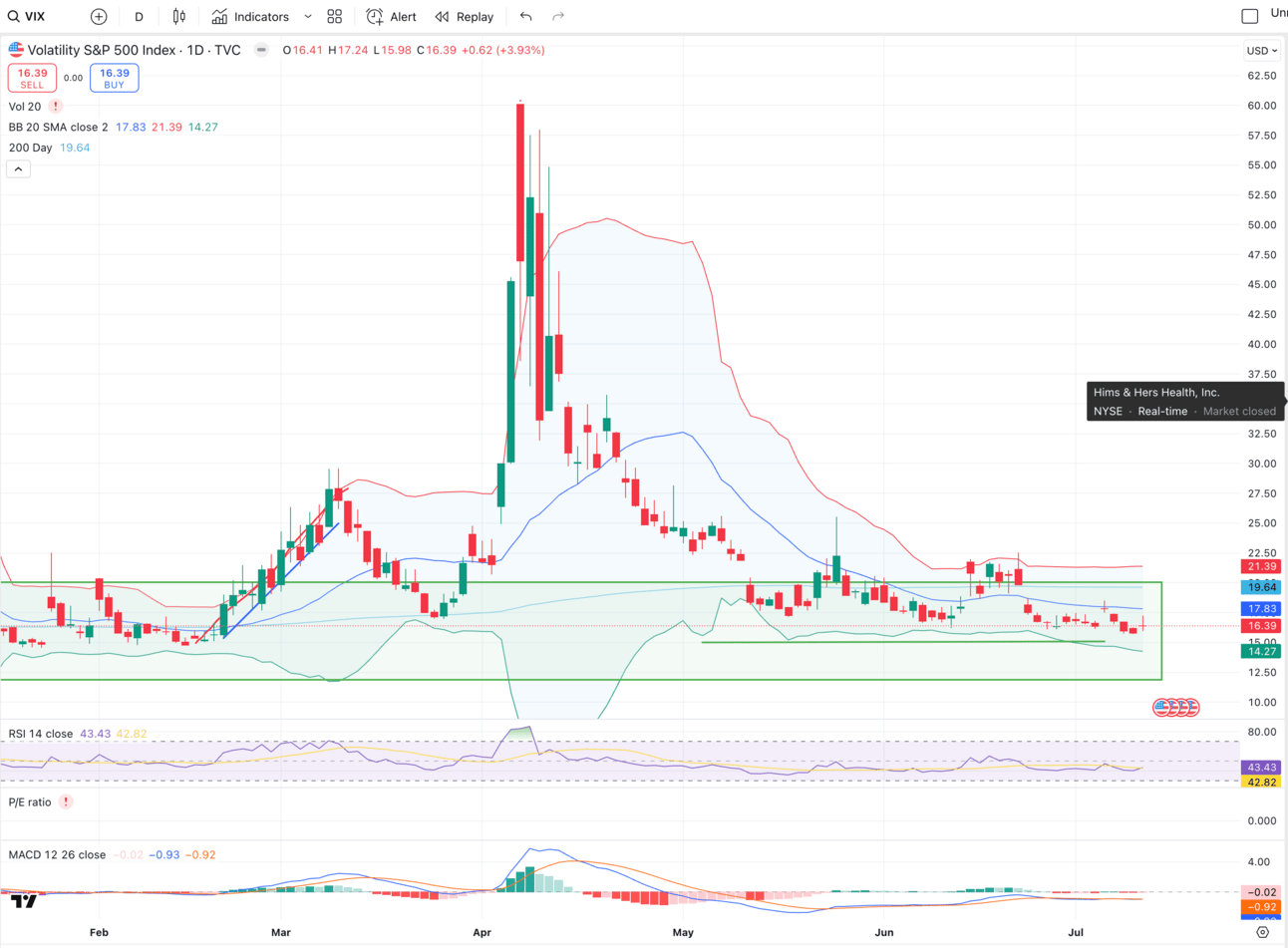

The $VIX is slightly elevated at 16.39 right now. Once it breaks below 15, I’ll start raising 25–35% cash in the portfolio. That will give me dry powder to deploy into the next pullback and take advantage of high-conviction setups.

Consolidation phase around the mid $550’s

VIX hugging the $16 level

Client Win Spotlight – $14K+ In Profits

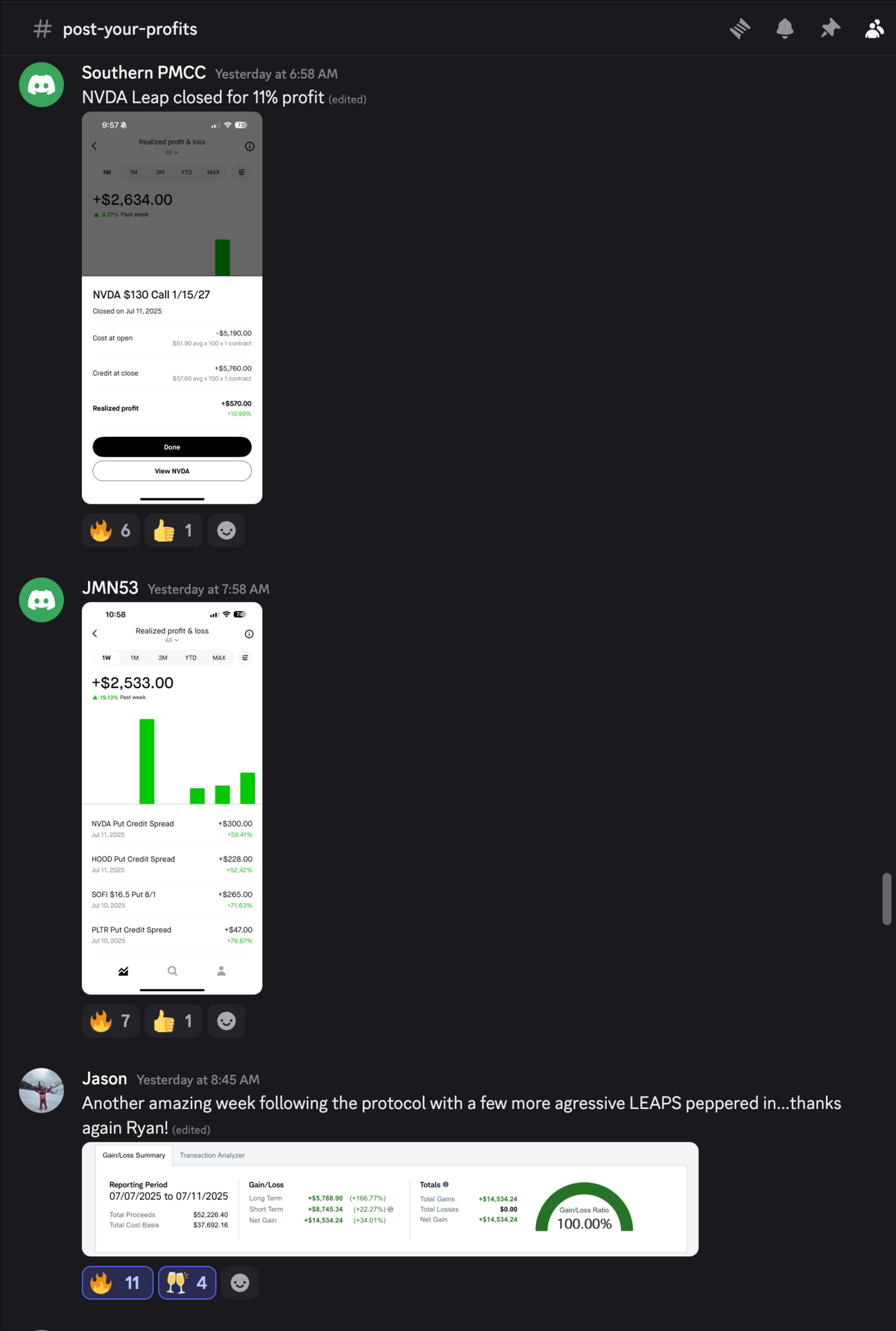

Some huge results from the community this week:

$14,534 in total profits from strategic CSPs and LEAPS

$2,533 closed on a recent high-conviction trade

11% ROI in just one month from another client

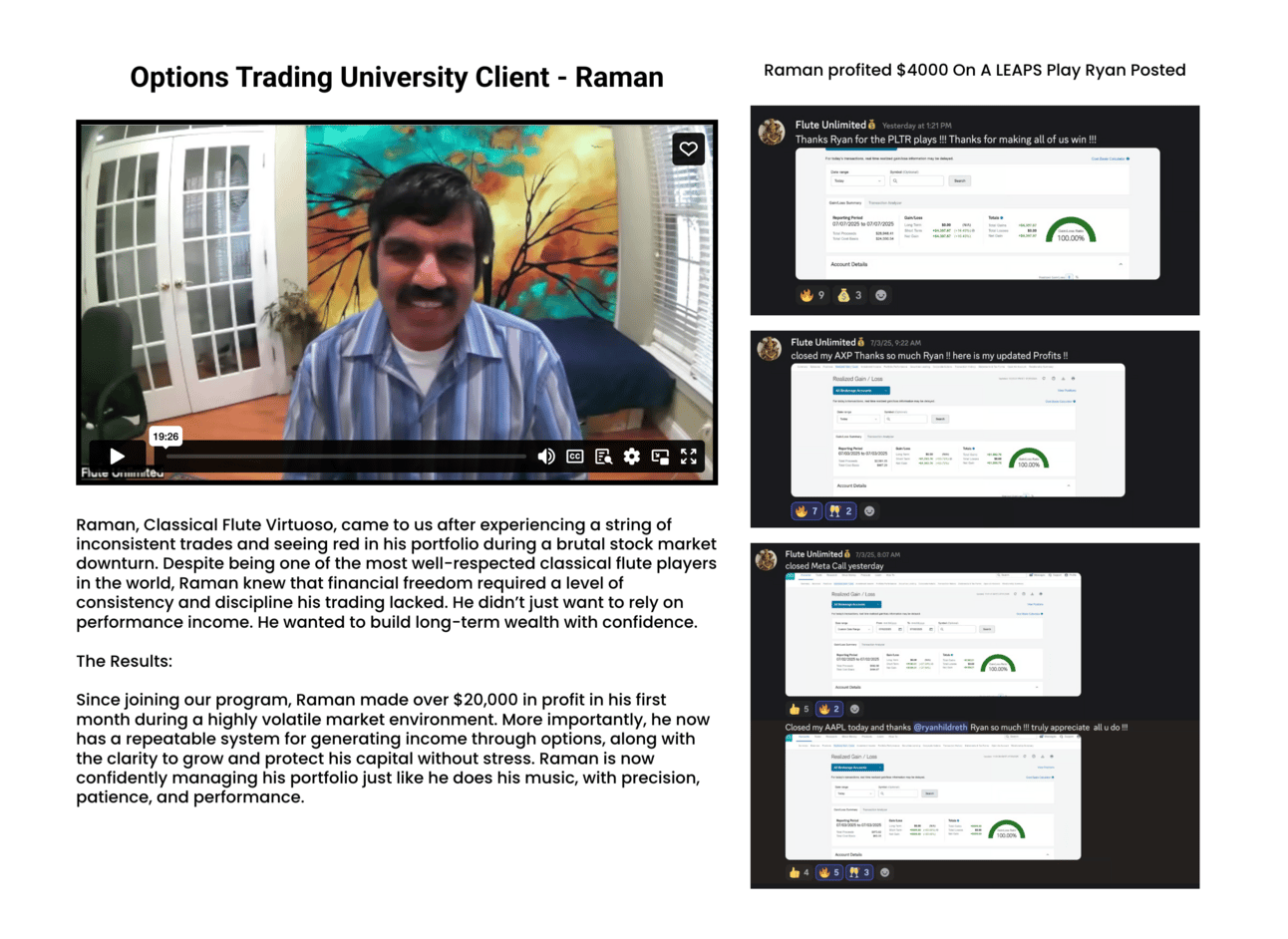

We also just published a brand new live interview with Raman, a world-renowned classical flute player who joined after struggling with consistency in his trading strategy. In his first month with us, he made over $20,000 and completely turned around his confidence.

Some of yesterday’s wins.

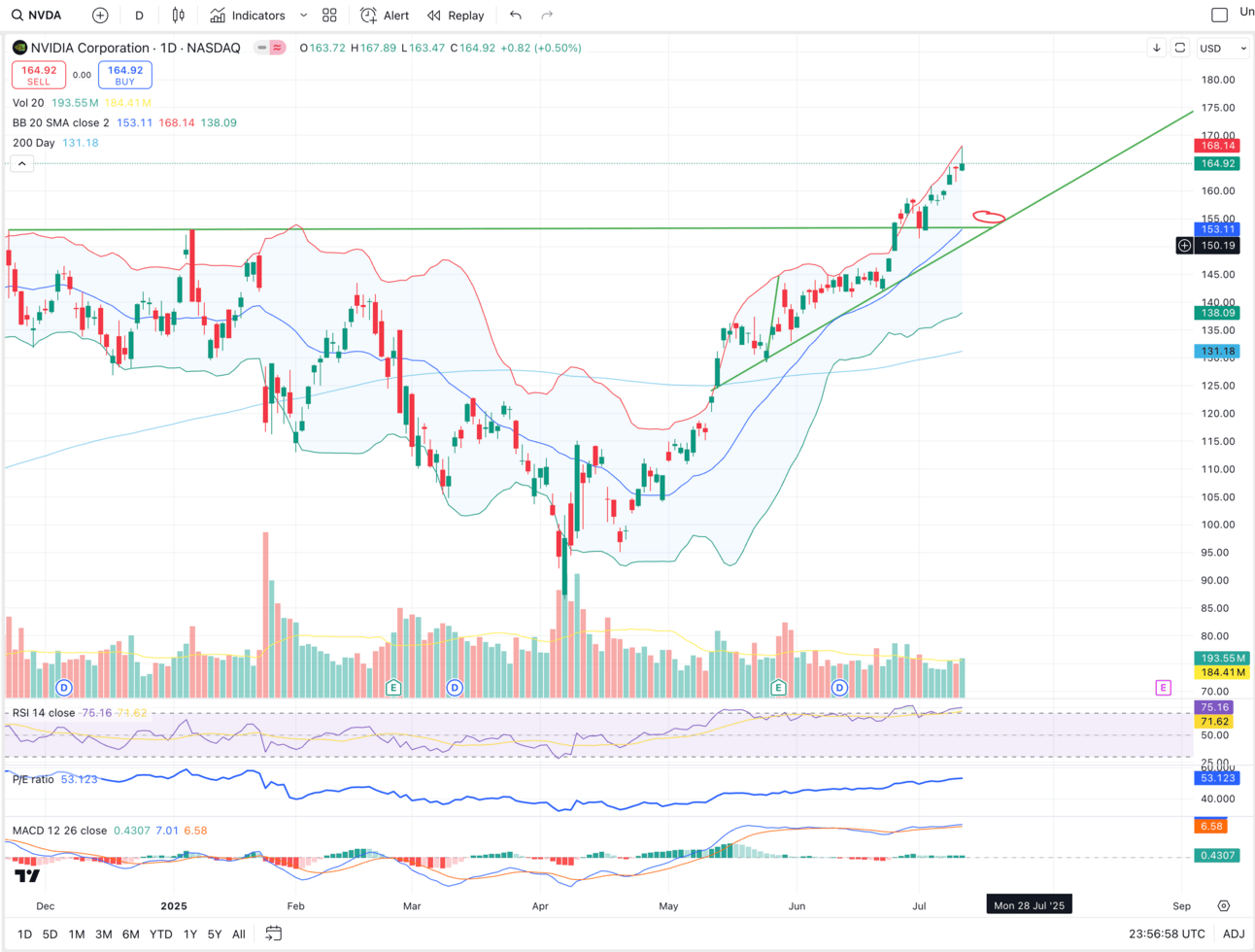

Free Trade Of The Week – NVDA CSP (2.1% ROI)

I’m keeping it simple this week with a high-quality setup on one of the market’s strongest names: NVIDIA.

Trade: Sell August 15th $155 cash-secured put

Premium Collected: $340

Delta: 28 (moderate assignment probability)

ROI: ~2.1% in 30 days

Setup: NVDA is extended, but the fundamentals are still rock-solid. This strike offers a discounted entry below support, with the potential to ride the stock to $180+ over the next couple months if assigned.

This is a clean, conservative trade perfect for income-focused traders who want exposure to quality without chasing strength.

Bonus: $67K Into A New Stock + 3 More To Buy

In my latest video, I break down the brand-new stock I just allocated $67K to — plus three more high-conviction names I’m buying this month.

This video covers:

My macro thesis

Why I’m adding now

How I’m positioning for the rest of Q3

Let’s keep stacking smart trades.

Talk soon,

Ryan