- Options Trading University

- Posts

- VIX Near 13 and Heather’s 7.5% Monthly Run - What I'm Doing Next!

VIX Near 13 and Heather’s 7.5% Monthly Run - What I'm Doing Next!

Hey Options Trader,

The market has continued to grind higher into the holidays, but underneath the surface, risk is quietly building. Volatility has compressed to levels that historically don’t last forever, and that creates both opportunity and responsibility.

Over the next few weeks, this becomes less about chasing upside and more about positioning correctly for the next expansion in volatility. In today’s note, I’ll walk you through how I’m thinking about the market, a standout client result, a high-probability earnings trade, and a resource that explains why I’m raising cash right now.

Here’s what we are covering:

My cautious market outlook as volatility compresses

Client Spotlight with a consistent 7.5% monthly performer

Free Trade of the Week on Seagate heading into earnings

Bonus video on why I’m freeing up cash and the top stocks I’m watching

Market Snapshot

My outlook for the next few weeks is cautious. $VIX ( ▼ 8.29% ) has fallen into the low 14s and could even print a 13 if the market continues to push higher. Historically, VIX stays below 18.5 for about 42 days on average, and we are currently around day 28, meaning each passing day increases the probability of a volatility expansion and a market pullback.

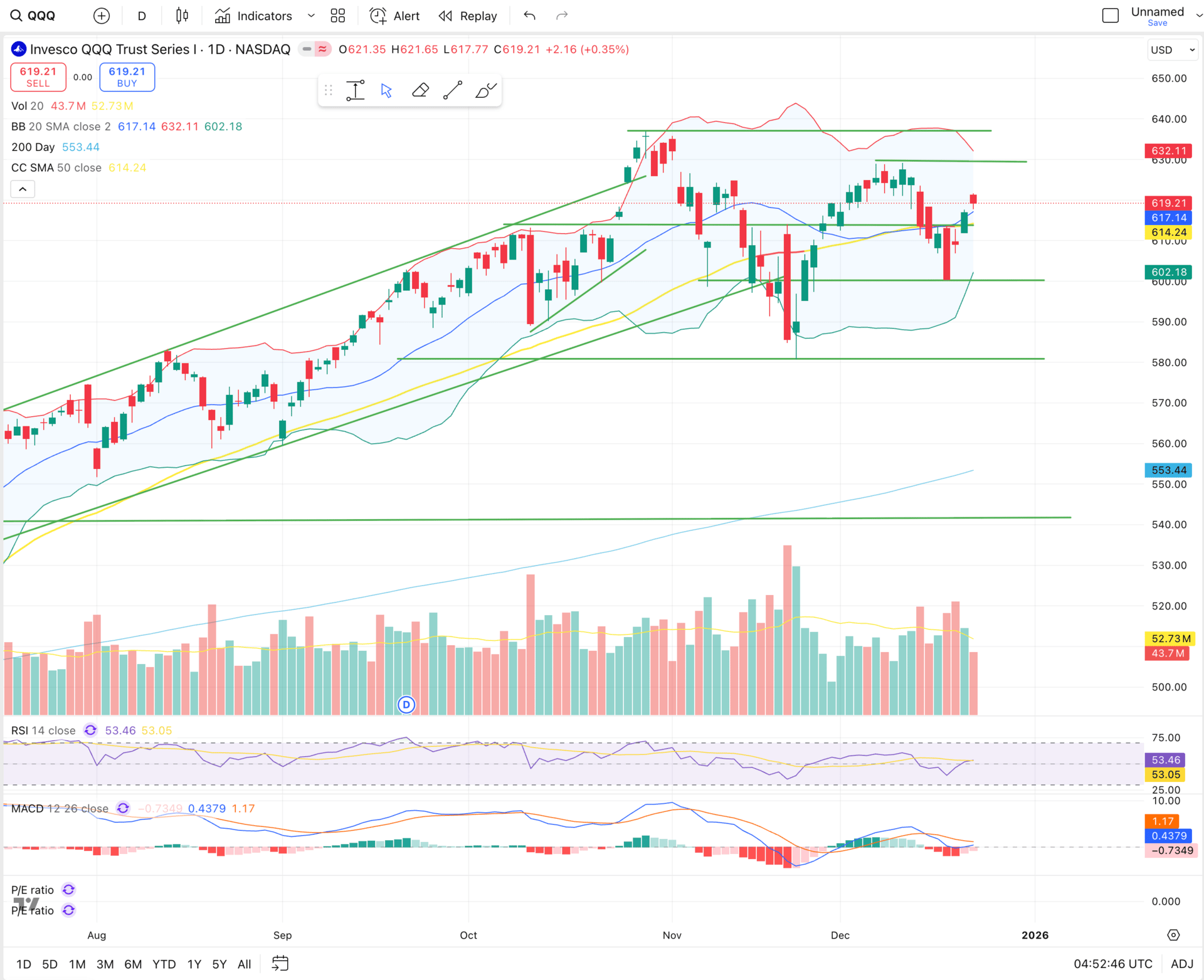

That pullback doesn’t need to be dramatic to create opportunity, which is why I’m prioritizing elevated cash levels right now. I’m currently sitting at 23.5% cash and plan to move closer to 30% by the end of the week as positions get called away. On the technical side, $QQQ ( ▲ 1.45% ) could drift up toward 629 by the end of the week, possibly a bit higher if momentum surprises to the upside, but I’m not expecting a powerful Christmas rally. Volume remains light, RSI just made a bullish crossover, and MACD is close to confirming as well, which supports some upside drift while we stay disciplined on risk.

QQQ Bullish Crossover on RSI

VIX Record 52 week low…we could see $13 this week

Client Spotlight

This week we interviewed our client Heather, who has consistently averaged 7.5% per month since joining six months ago. She started with an account under $50,000 and focused on executing the process with patience and consistency rather than chasing trades. Her results are a great example of what disciplined position sizing and repeatable strategies can accomplish over time. The full interview is linked below if you want to hear her story directly.

Free Trade of the Week

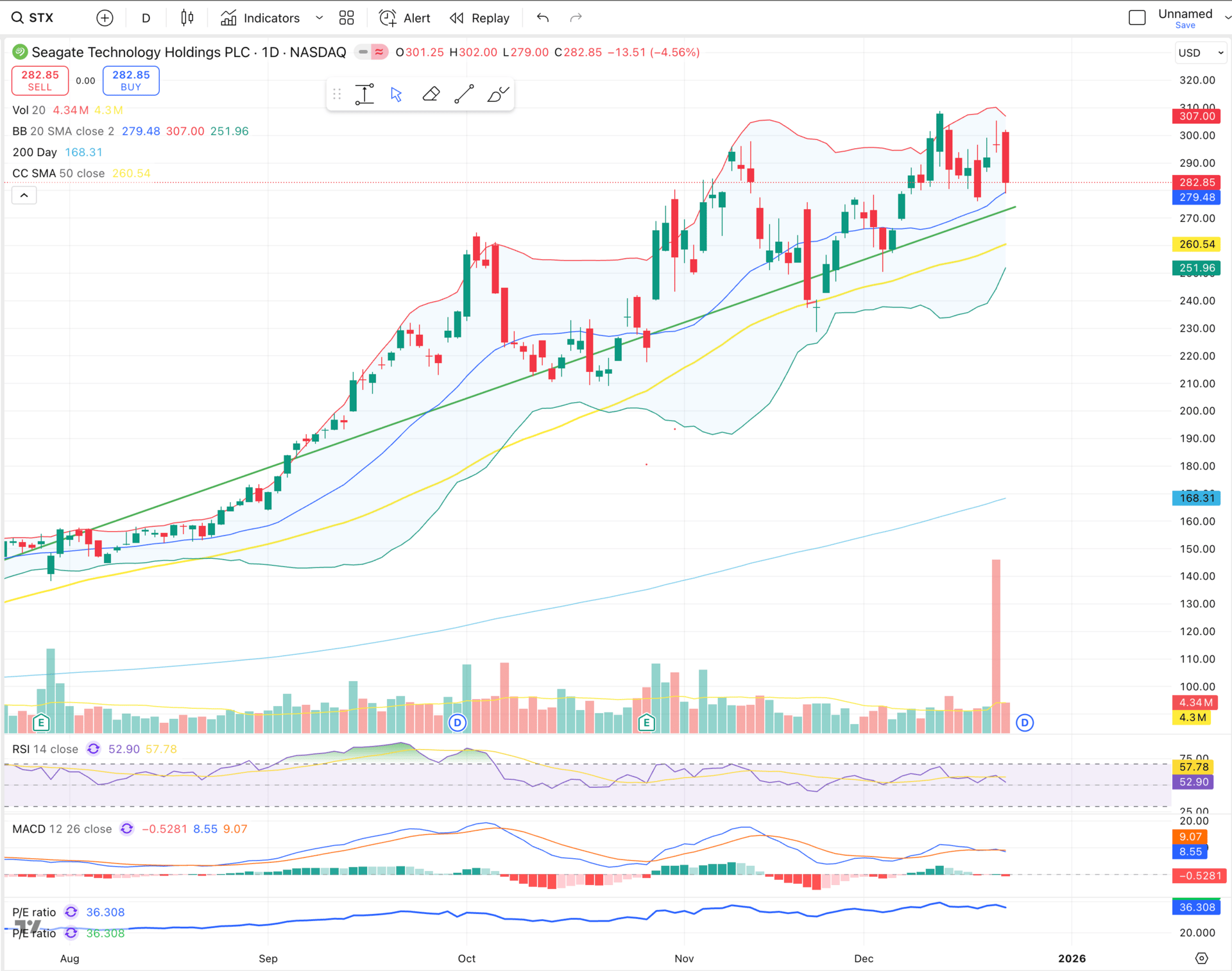

Ticker: $STX ( ▲ 6.52% )

Strategy: Sell the January 23rd 255 cash-secured put

Premium Collected: $850

Duration: 30 days

ROI: 3.47%

Annualized Return (compounded monthly): approximately 50.6%

Risk: Assignment risk below $255, which is within the expected downside move around earnings

Seagate pulled back roughly 4.5% today, creating a strong earnings setup with elevated implied volatility. This trade allows us to collect a solid return on a high-quality company while defending a strike that sits within the expected move. If assigned, $255 would represent an attractive entry, but odds favor the stock stabilizing or moving higher post-earnings.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

What Happens When $4.7T in Real Estate Debt Comes Due?

A wave of properties hit the market for up to 40% less than recent values. AARE is buying these income-producing buildings at a discount for its new REIT, which plans to pay at least 90% of its income to investors. And you can be one of them.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Bonus Video

I just released a YouTube video breaking down why I’m actively freeing up cash right now and the top three stocks I’m watching next. It provides additional context around volatility, positioning, and how I’m preparing for the next opportunity cycle.

Stay patient. Capital preservation is what allows capital to compound when opportunity finally arrives.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.