- Options Trading University

- Posts

- VIX In $14's, CPI Ahead and Raman’s $30K Monthly Options Income

VIX In $14's, CPI Ahead and Raman’s $30K Monthly Options Income

Hey Options Trader,

This week’s market environment is presenting a unique setup that requires patience, discipline, and preparation. Volatility remains extremely low, major economic data is approaching, and earnings season is right around the corner. That combination creates opportunity, but only if capital is positioned correctly. In this newsletter, we’ll walk through how I’m viewing the current market, highlight an inspiring client story, and share a high-probability earnings trade idea.

Here’s what we are covering:

My cautious market outlook heading into CPI and earnings

A Client Spotlight featuring Raman’s trading success and lifestyle freedom

Free Trade of the Week on Palantir ahead of earnings

Bonus resource with my full portfolio update

Market Snapshot

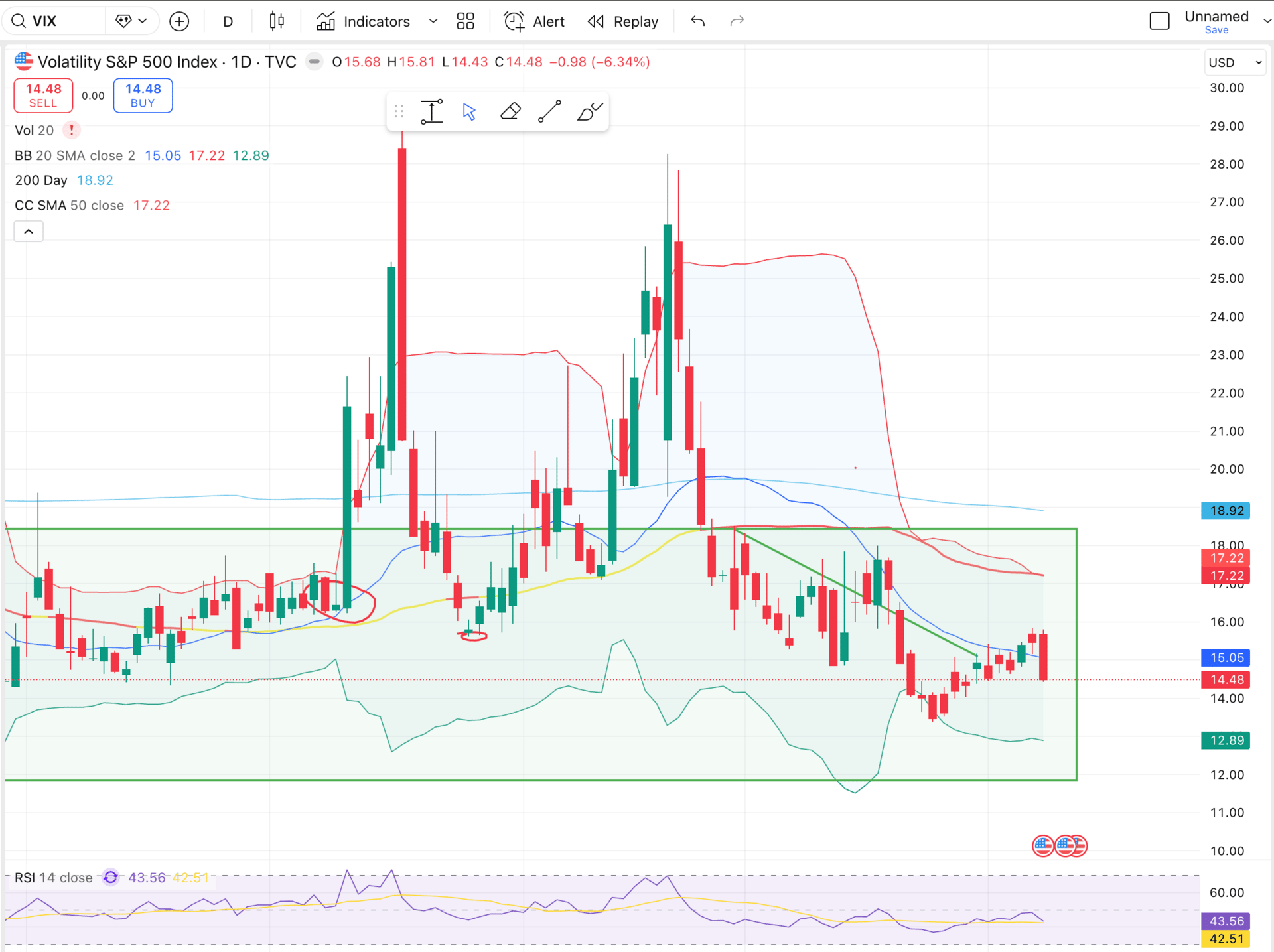

I’m approaching this week with a more cautious tone as volatility continues to sit near cycle lows, with the $VIX ( ▼ 8.29% ) in the mid-14s. We have CPI inflation data coming out Tuesday, and according to CME FedWatch, the next expected interest rate cut has been pushed out to June. While that longer-term outlook remains bullish, the first quarter could be choppier as markets digest inflation data and earnings results.

$QQQ ( ▲ 1.45% ) is currently around the 626 level, and market makers are pricing in roughly a plus or minus $13 move over the next two weeks, putting upside near 639 and downside near 613, with 600 acting as strong absolute support.

With earnings season approaching, holding cash here makes sense so we can deploy capital if stocks pull back on earnings or take advantage of elevated implied volatility after reports. Seasonally, volatility tends to rise in February and March, so I’ll be watching closely for a clearer direction after Tuesday’s inflation data.

QQQ heading back towards all time high with RSI and MACD bullish momentum

VIX sub $15

Client Spotlight

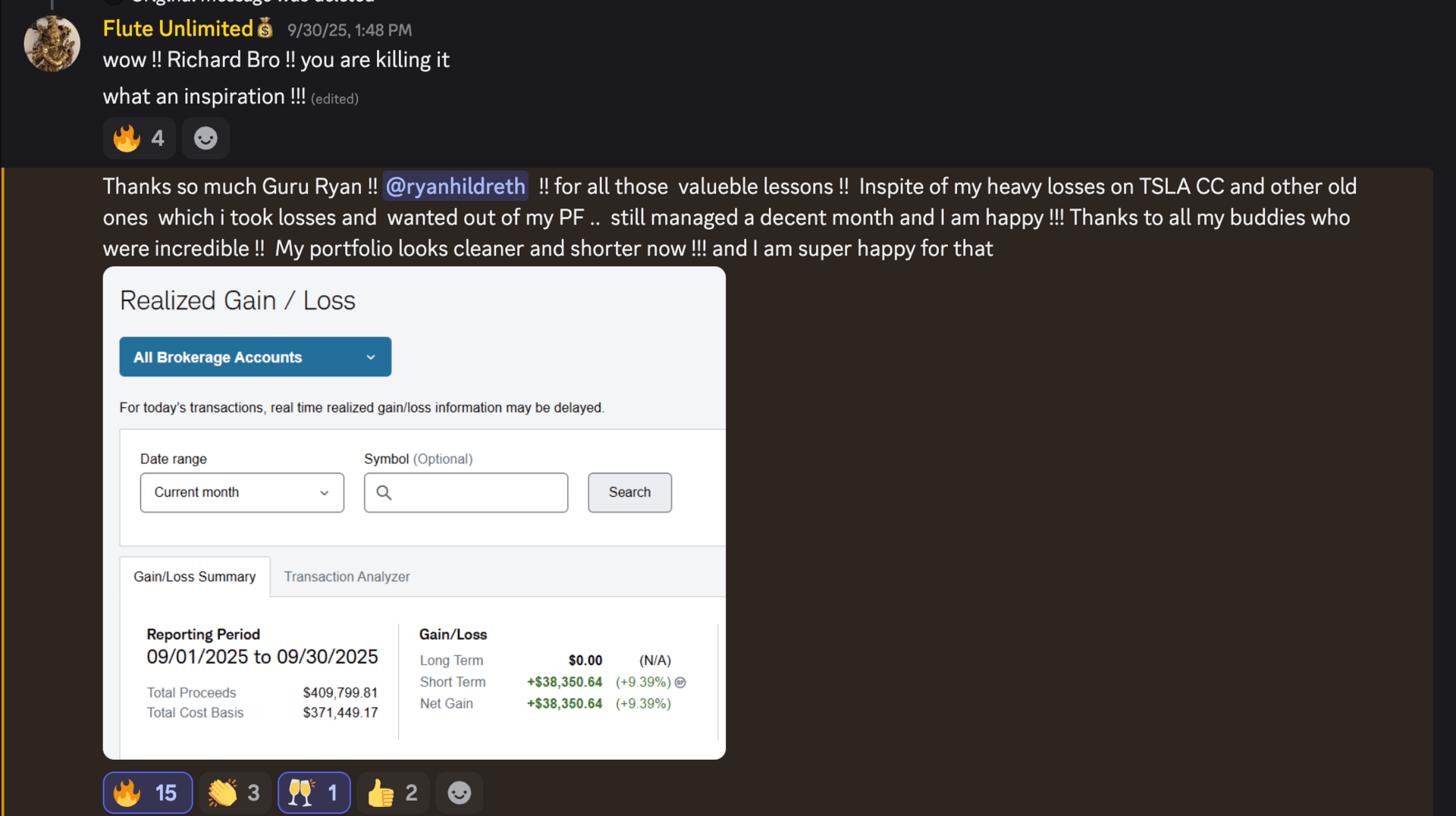

This week’s Client Spotlight goes to Raman. We had the pleasure of interviewing Raman several months ago, and since then he has consistently generated $20,000 to $30,000+ per month from his portfolio with ease. What makes his story even more impressive is that he’s doing this while traveling the world as a renowned flute player, showing how a structured options strategy can support both financial growth and lifestyle freedom.

Free Trade of the Week

Ticker: $PLTR ( ▲ 4.15% )

Strategy: Sell the February 13 $160 cash secured put

Premium Collected: $540

Duration: 34 days

ROI: 3.42%

Annualized Return (compounded monthly): 49.7%

Risk: Assignment below $160, which aligns with a favorable technical entry near the lower Bollinger Band

Palantir has earnings coming up in the final week of January, and I believe the stock is well positioned for a positive move on strong results. Selling the $160 cash secured put allows us to collect meaningful premium while positioning ourselves to potentially own a high-quality stock at a discounted level. With the put sold below the lower Bollinger Band on the daily timeframe, this sets up as a high-probability income trade with favorable long-term risk.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Bonus Video

Be sure to check out my latest full portfolio update video where I walk through every position, including HIMS, HOOD, SOFI, Palantir, NVIDIA, CLS, STX, and more. I break down what’s working, what I’m trimming, and which stocks I plan to add more of as we move through 2026.

Success in trading isn’t about forcing trades, it’s about waiting patiently for the right conditions.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.