- Options Trading University

- Posts

- The Final Leg Up? $68K Into a New Stock + HOOD Earnings Trade

The Final Leg Up? $68K Into a New Stock + HOOD Earnings Trade

Hey Options Trader,

We’ve officially entered the caution zone. $VIX ( ▲ 6.6% ) has dropped into the 14s, signaling that fear is drying up and when that happens, it’s usually not long before the market gives us a pullback.

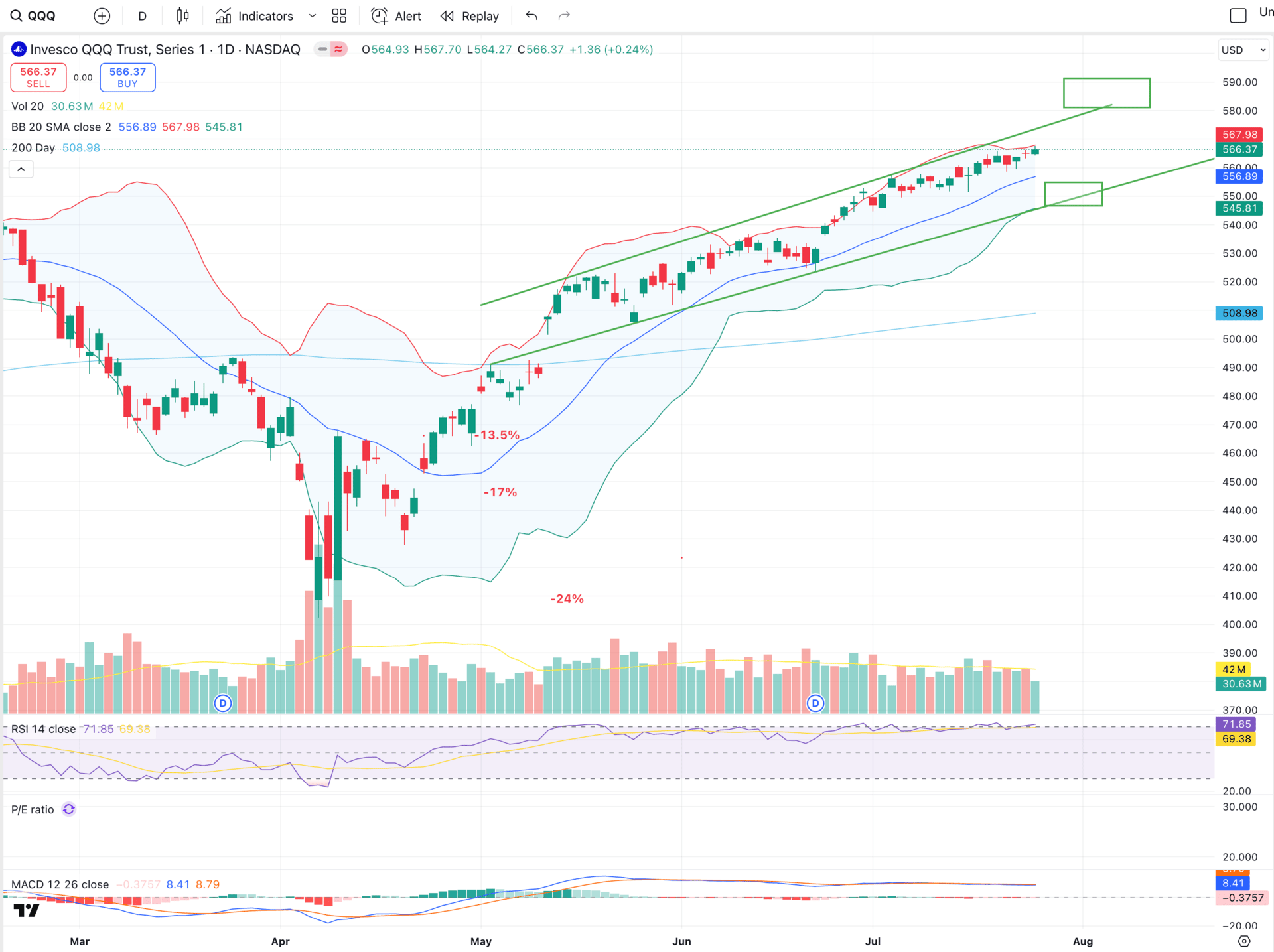

I'm still bullish for one final leg up on $QQQ ( ▼ 0.32% ) potentially to $580–$590, but I'm preparing now. Today, I freed up over $100,000 in capital to bring my portfolio to 22% cash, ready to strike if the market dips.

In this week’s newsletter, I’m giving you a short-term earnings trade on Robinhood $HOOD ( ▼ 4.53% ) , a look at the critical levels I’m watching on $QQQ and $VIX, and two inspiring client wins including a new interview with Anoop, who’s averaging up to 20% monthly returns.

Here’s what we are covering:

Market Outlook – Caution Builds as VIX Dips Below 15

$40K in 4 Months – Mark’s 100K Account Growth

Free Trade of the Week – 1.20% ROI in 7 Days on HOOD

Bonus Video – The Stock I Sold + Where I’m Putting $68K Next

Market Snapshot – Cash is a Position

I still believe the market has one last bullish pop left especially if earnings from Apple, Meta, and Microsoft come in strong. That could take QQQ to the 580–590 range, about 4 percent higher from here.

But make no mistake, I’m getting cautious.

VIX is in the 14s and could fall into the 13s or high 12s on strong earnings. The Fed rate decision, GDP data, unemployment numbers, and core PCE are all on the calendar this week. That adds fuel for a potential pop, but also opens the door for profit-taking.

Many names, like Google, have shown a blow-off top after earnings. I expect a similar pattern this season. That’s why I’m sitting on 22% cash, ready to buy the next high-conviction dip.

$580-$590 higher probability, bad earnings may lead to dip to $550

VIX in the $14’s

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Client Spotlight:

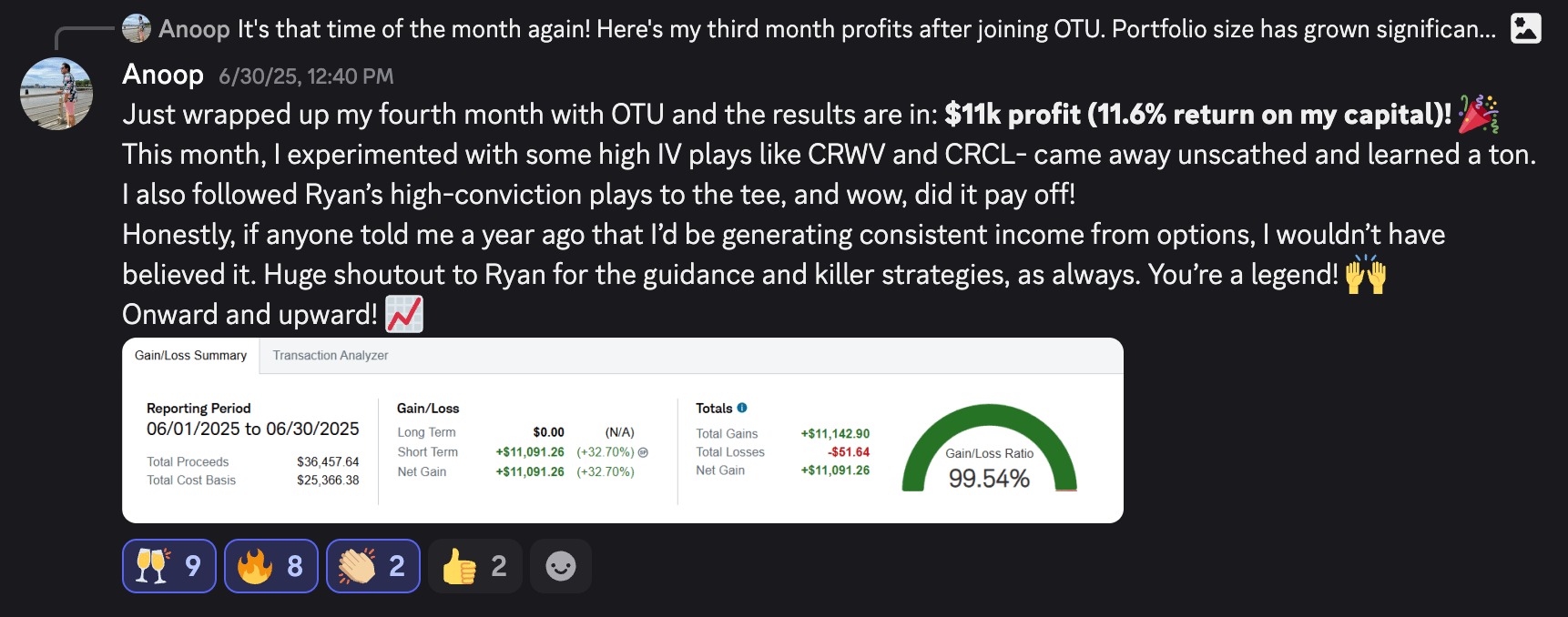

Anoop is in his fourth month inside the program and just closed out an 11.6% return on capital in July. His average month-to-month gains have ranged between 10 and 20 percent since joining.

He started with no structure and now trades with confidence and consistency.

Another Client Win:

Mark joined with a $100K account and has made over $40,000 in just four months. That’s a 40 percent gain in his main account and over 50 percent in his Roth IRA.

This is the power of applying the system and staying disciplined.

Free Trade of the Week

Here’s a clean, short-duration trade with strong yield into earnings:

Ticker: HOOD

Strategy: Sell August 1st $94 cash-secured put

Premium: $113

Days until expiration: 7

Return: 1.2% in 7 days (annualized return: ~62.7%)

This strike is just outside the expected move. If HOOD drops on earnings, we’re picking up shares at a 10% discount and getting paid to do so. Then we flip to covered calls and let the position work long-term.

This is already in my portfolio, high reward for minimal time at risk.

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

Bonus Video

In my latest video, I break down:

The one stock I completely sold out of

A new position I’m adding $68,000 in CSPs on Monday

My earnings strategy for SOFI and HOOD

This week is critical, stay tactical and don’t miss the setups.

Talk soon,

-Ryan