- Options Trading University

- Posts

- The $200K Student Win + My Favorite Earnings Week Trade (Free Trade Idea)

The $200K Student Win + My Favorite Earnings Week Trade (Free Trade Idea)

Hey Options Trader,

We’ve got a few big catalysts on the horizon and this week’s trade setup is designed to take advantage of them with both upside and downside protection. I’ll walk you through a high-premium NVDA play for earnings week, my thoughts on the market heading into late July, and the inspiring story of Jason, a client who went from total beginner to banking over $200,000 since joining in March.

Plus, I just filmed a new video on NVIDIA and Robinhood where I break down exactly what I’m expecting for earnings, and how I’m positioning my portfolio now.

Here’s what we are covering:

Market Momentum – Why I’m Bullish, But Preparing for a Shift

Client Spotlight – $200K Profit Since March?!

Free Trade of the Week – NVDA CSP (2.94% in 41 Days)

NVDA & Robinhood – Full Portfolio Breakdown (Video)

Market Momentum – Why I’m Bullish, But Preparing for a Shift

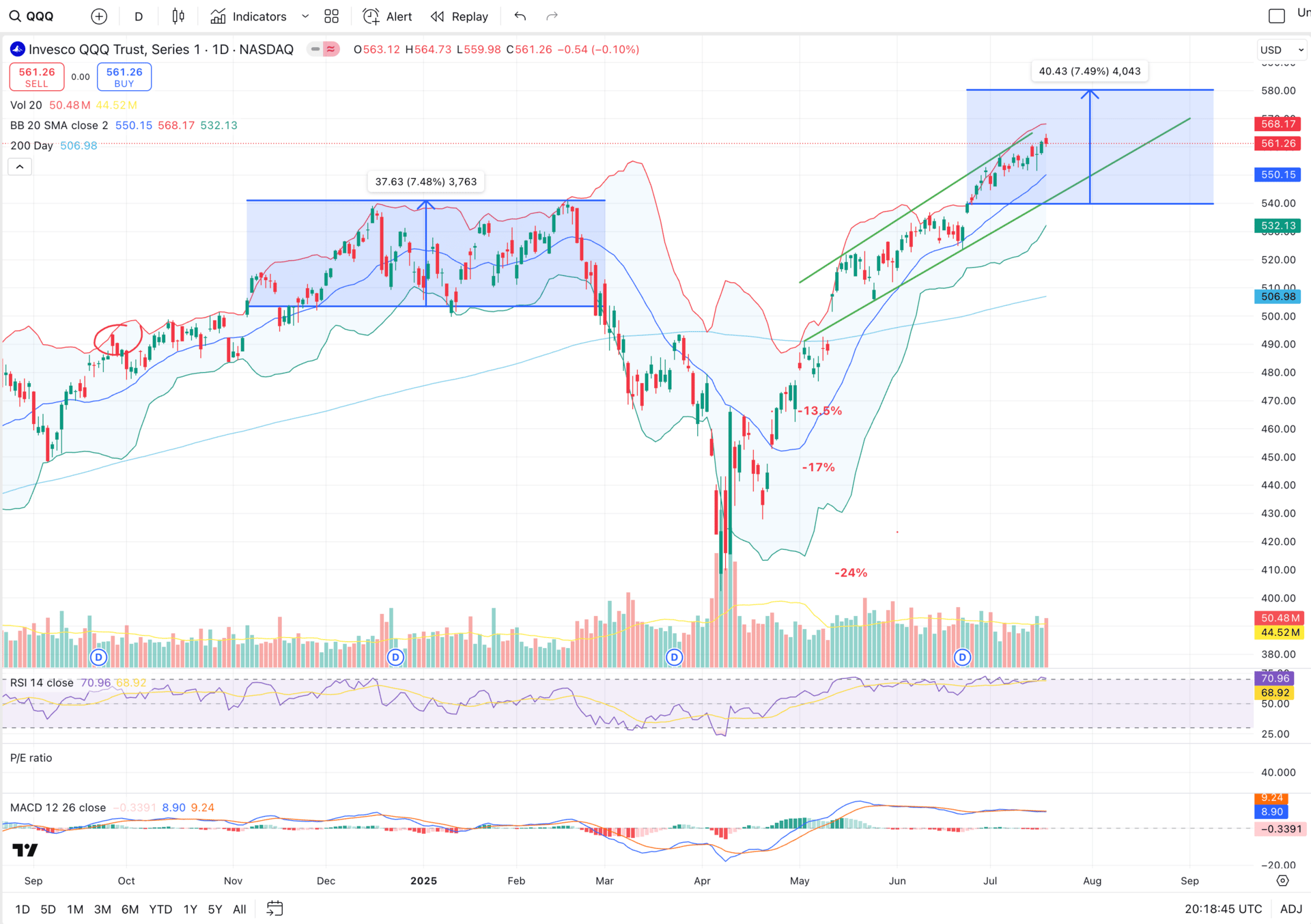

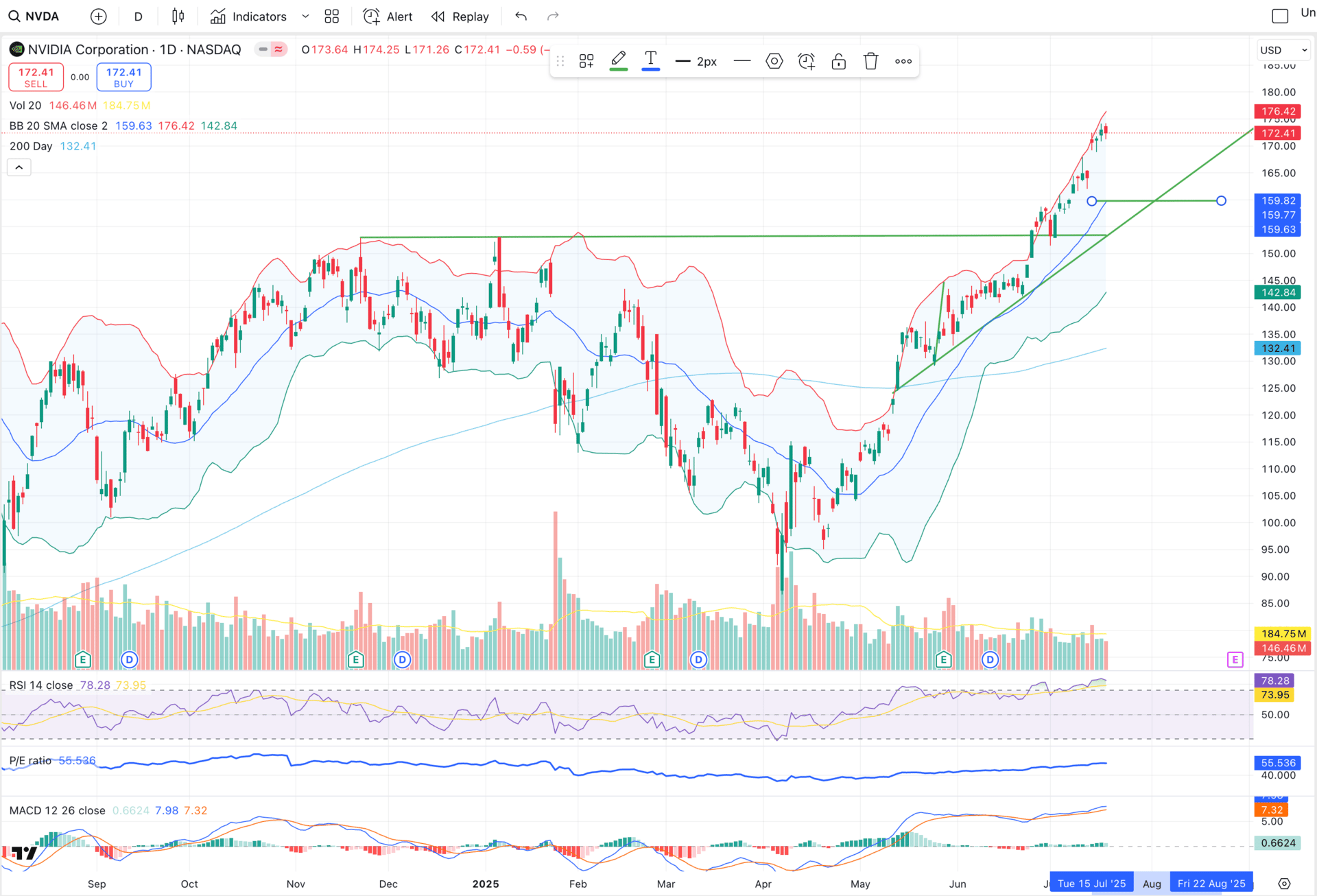

Right now, I’m bullish heading into the next couple weeks. $QQQ ( ▼ 1.21% ) is climbing steadily and I believe we could see a breakout up to $580, especially with the right news from the Fed.

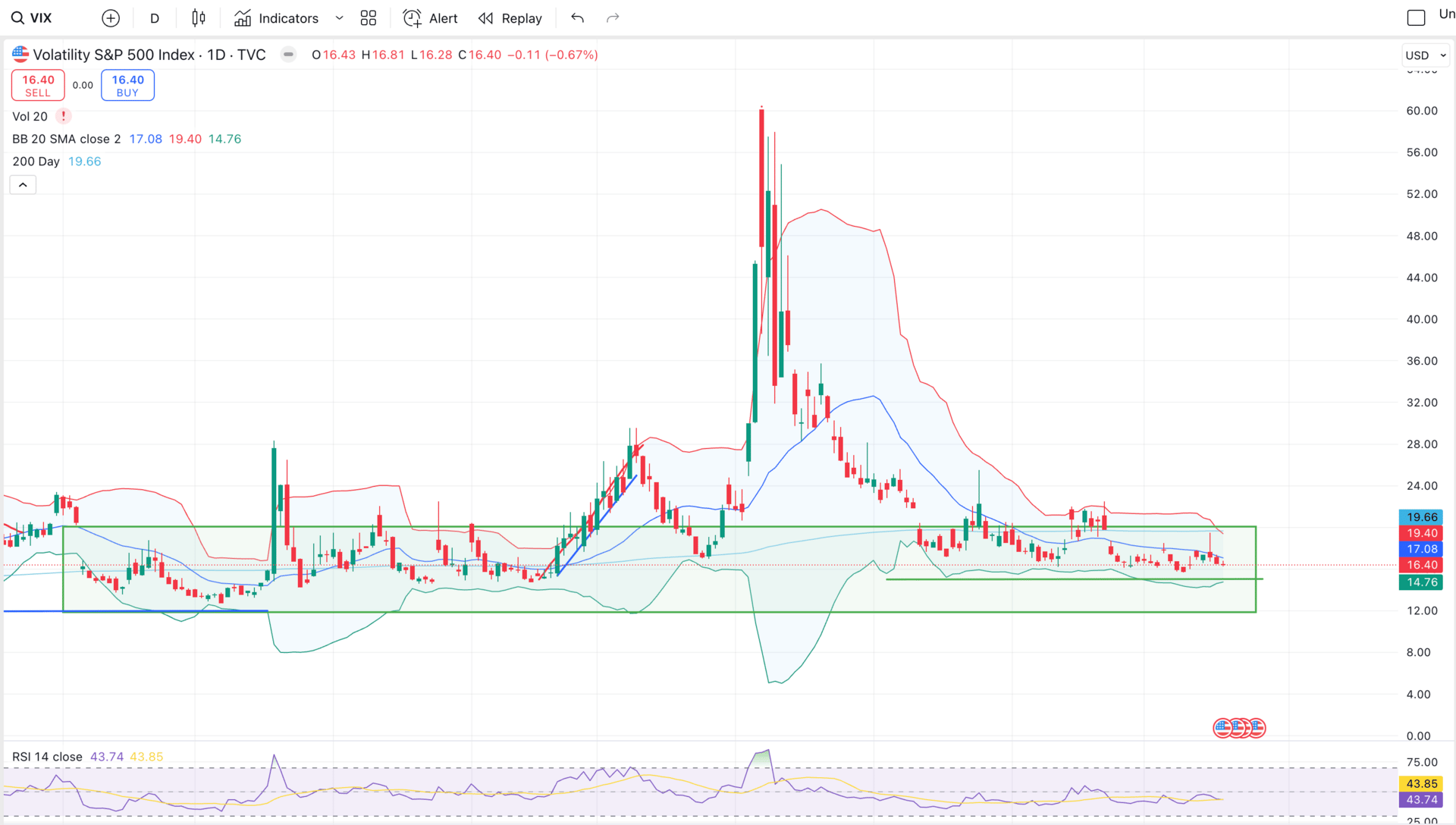

That said, I’m watching $VIX ( ▲ 3.9% ) very closely. It’s still hovering around 16.40, but once it drops below 15, I’ll start shifting more cautiously. That’s usually a sign that volatility is bottoming, and a market pullback could follow.

Key catalysts coming soon:

July 30th – Fed Rate Decision, GDP, and ADP Employment

Earnings Week – Palantir, Robinhood all reporting around August 1st

QQQ potential levels

VIX remaining in the $16’s

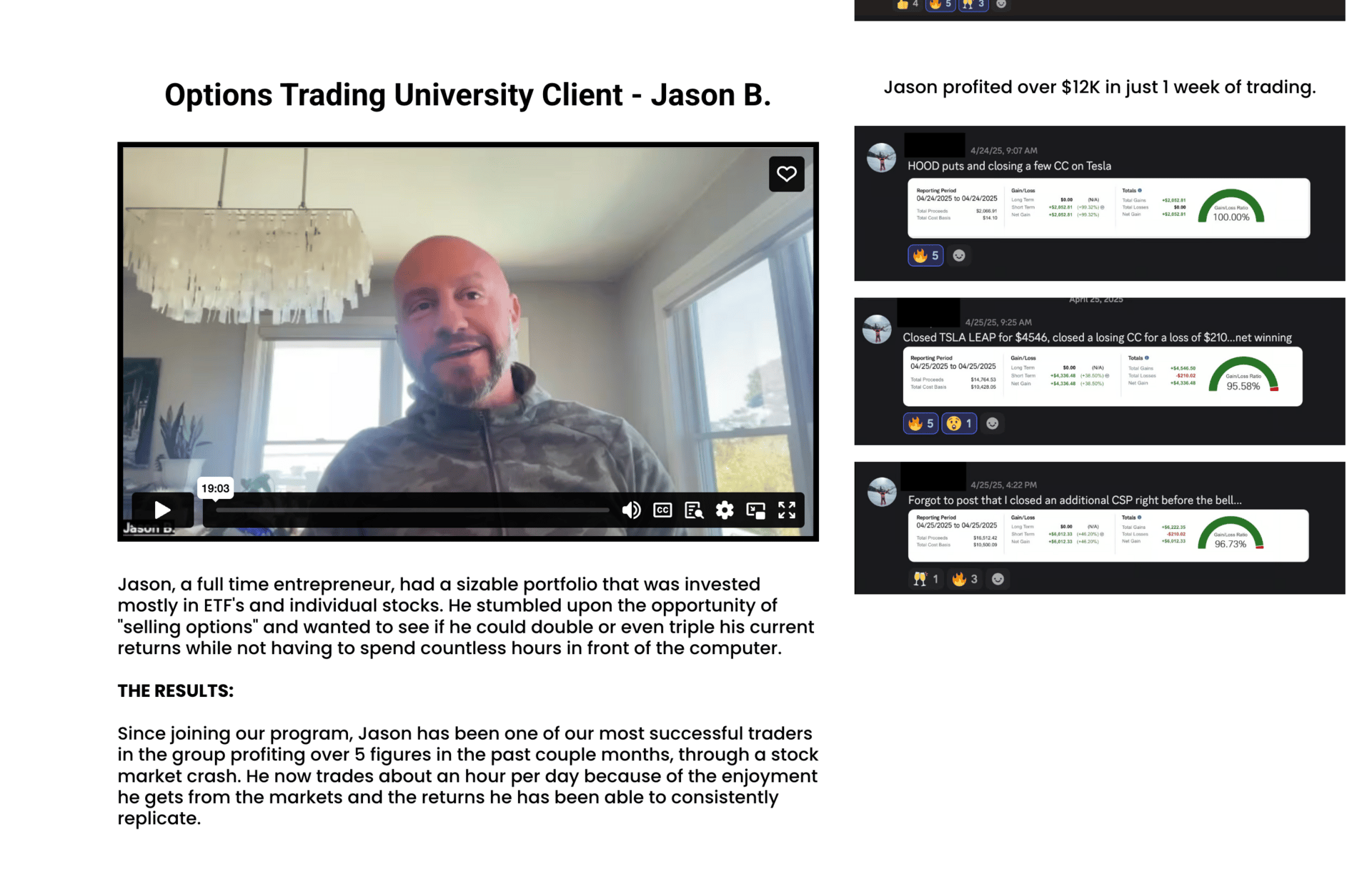

Client Spotlight – $200K Profit Since March?!

Jason joined us back in March, right before the market got choppy. He had never sold an option before… but fast-forward a few months, and he’s now one of the top traders in our group.

He’s locked in over $200,000 in gains, dialed in his portfolio structure, and is trading with absolute conviction.

If you want to hear exactly how he did it, I just recorded a brand-new interview with him.

Free Trade of the Week – NVDA CSP (2.94% ROI)

$NVDA ( ▼ 5.46% ) is shaping up for a major move. With earnings approaching and AI demand still surging, I’m positioning with a risk-managed CSP that benefits from both short-term volatility and long-term conviction.

Here’s the setup:

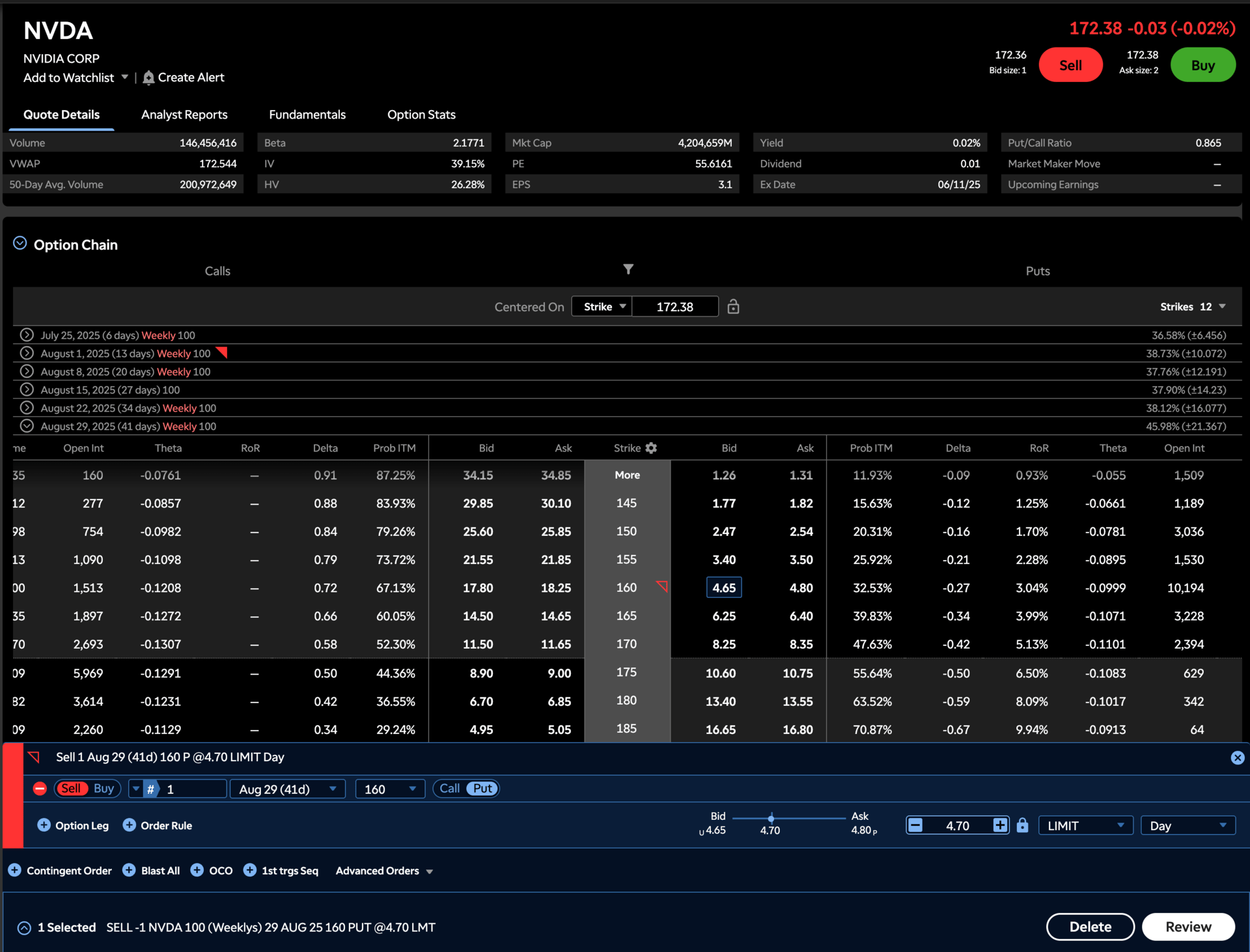

Trade: Sell August 29th $160 cash-secured put

Premium Collected: $470

Days Until Expiration: 41

ROI: 2.94% in 41 Days (~26.15% annualized)

Why I Like It: If NVDA crushes earnings, I see it heading to $185+. If it drops, the $160 area offers a beautiful reentry near the mid-Bollinger Band — and I’d be happy to get assigned at that level.

This is one of the cleanest trades going into earnings week, strong fundamentals, strong premium, strong structure.

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

NVDA & Robinhood – Full Portfolio Breakdown (Video)

In this week’s portfolio update, I go deep into:

My NVDA earnings thesis and price targets

Why I expect a mini-correction in Robinhood

The exact trade I executed on HOOD this week

How I’m allocating for volatility around August 1st

Let’s stay sharp this earnings season — the right trades now can set up your next 90 days.

Talk soon,

Ryan

Options Trading University