- Options Trading University

- Posts

- S&P 500 Mini Crash Into Elections, Prepare

S&P 500 Mini Crash Into Elections, Prepare

From the last analysis, the market is not heading in the direction expected

Hey Options Trader,

In just 2 days, the market has done the opposite of expected. The 20% odds of a broad market pullback have GONE UP SIGNIFICANTLY!

Here’s what we are covering:

Apple earnings good, but stock tanks. Why? My current position.

$SPX - where is the market headed into next week

Election uncertainty isn’t fading!

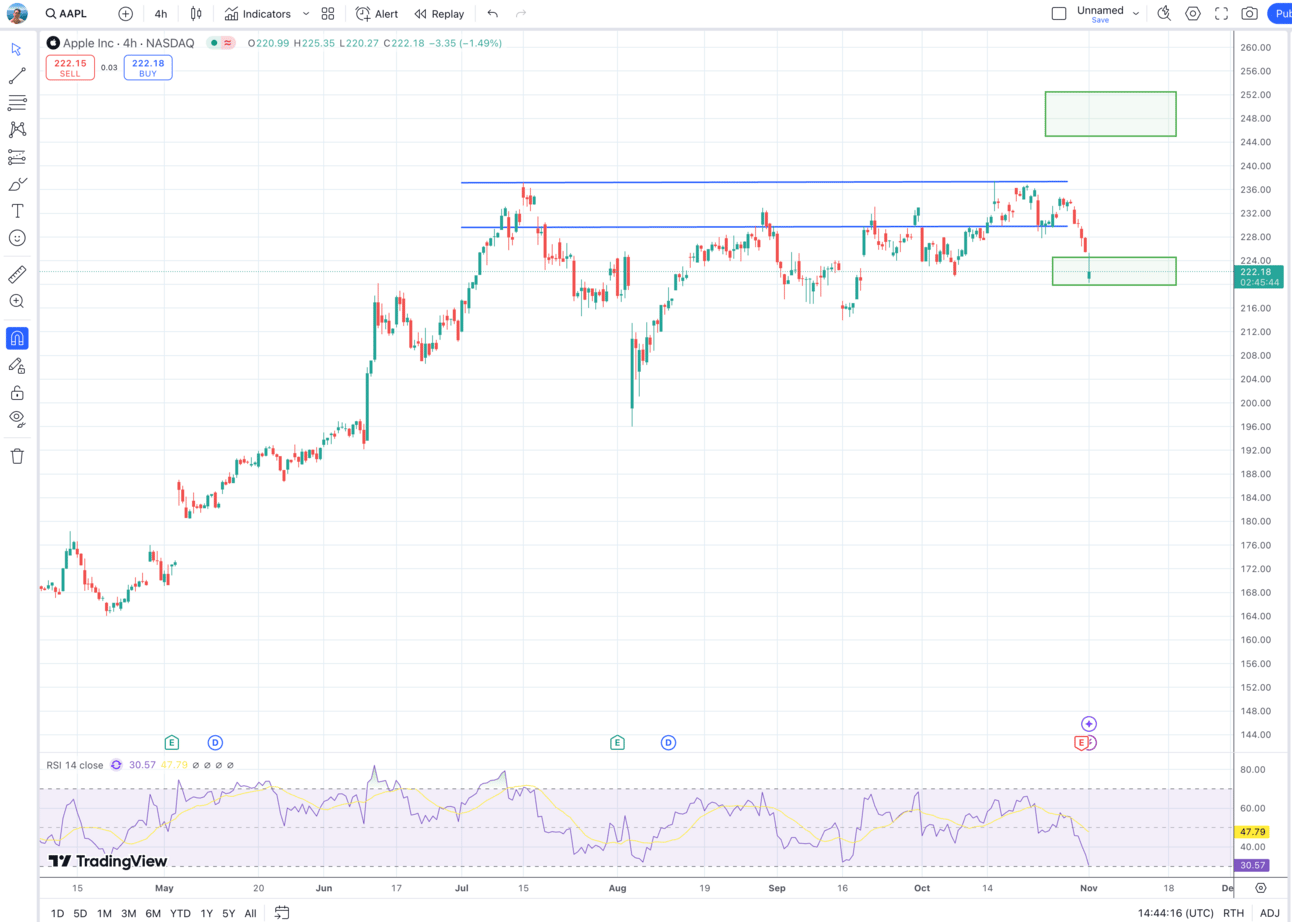

$AAPL Earnings Beat, But Stock Tanks Today

The darling child Apple can’t seem to get out of it’s own way!

Apple's fiscal fourth-quarter results exceeded Wall Street's expectations for both revenue and earnings per share, although net income declined due to a one-time charge related to a tax decision in Europe.

iPhone sales and total sales each increased by 6%.

According to Apple CEO Tim Cook, sales of the iPhone 15 were "stronger than the 14 in the same quarter last year, and the 16 was stronger than the 15," as he shared with CNBC's Steve Kovach.

My current position:

I have 6 Cash Secured Puts @ $225 that expire today so I will be assigned on 600 shares. I’m still very bullish on Apple and I think this is fair value. I will however be waiting for one up day to sell the $240 covered calls against my shares as I want to collect income while I wait for Apple to push higher.

Apple landed right in my target, next level of support is $215 and resistance at $237.

Lets talk about the overall market….

Keep This Gold Stock on your Watchlist 🇨🇦 $ESAU 🇺🇸 $SEKZF

Gold prices hit an all-time high

ESGold stock is up over 50% this month

Committed to eco-friendly mining practices

Disclaimer: This ad is paid for and disseminated on behalf of ESGold Corp (it is sponsored content). We do not own any securities of ESGold Corp. This ad contains forward-looking statements, which are not historical facts. These statements are based on the current beliefs and expectations of ESGold Corp’s management and involve known and unknown risks, uncertainties, and other factors that could cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Words such as “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” and similar expressions often identify forward-looking statements. This is not financial advice, please do your own DD. See SEDAR+ for more information.

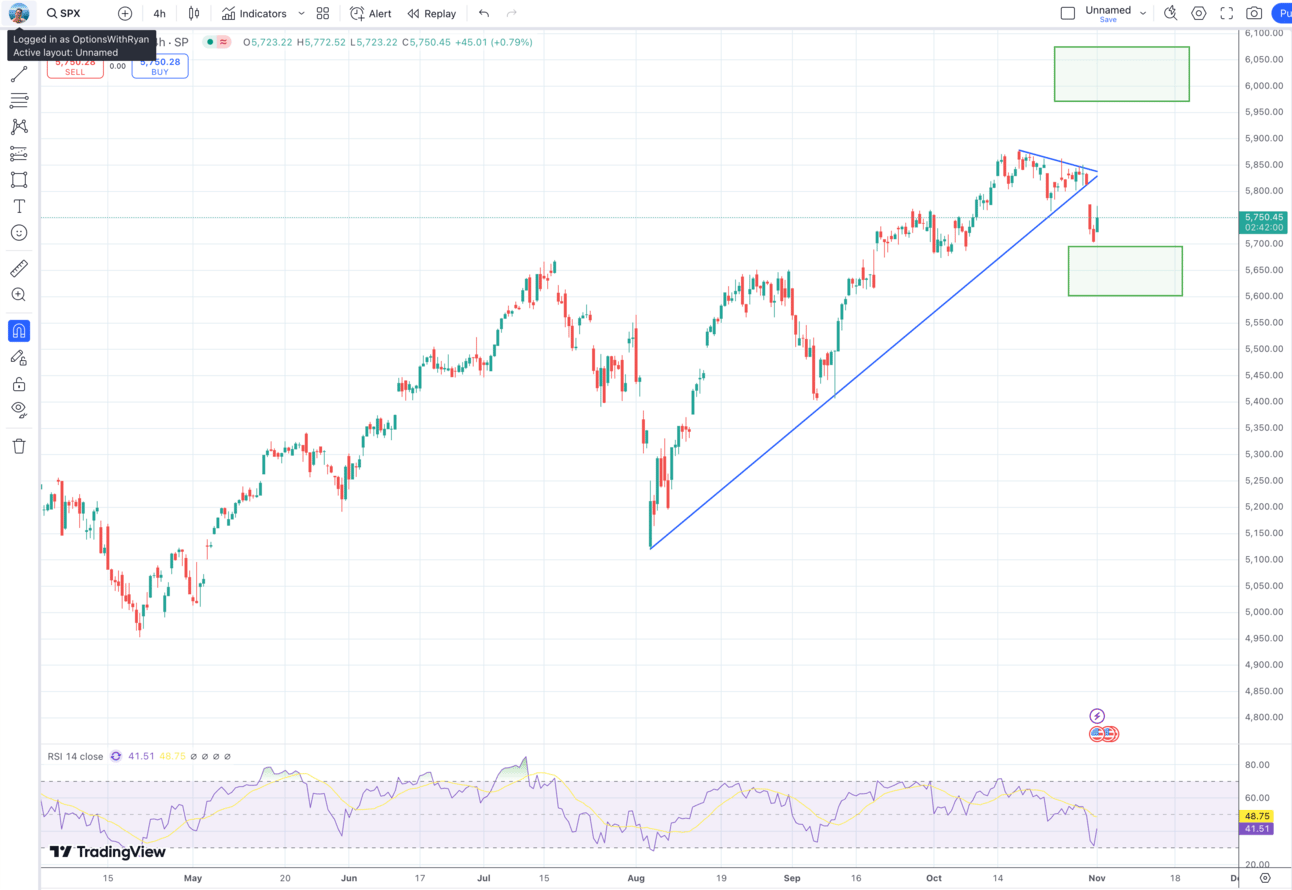

$SPX - Mini Crash Into Elections?

While there was a small probability of the market pulling back, it looks like we might be getting a rare opportunity.

While most people are scared of the market pulling back, we see this as opportunity to load up before the next run. Especially in an environment of quantitative easing (The Federal Reserve finally lowering interest rates) and GDP growth of 2.8% in Q3.

There’s a good probability we see a pullback on $SPX into the 5600 range before continuing to 6000 by end of year.

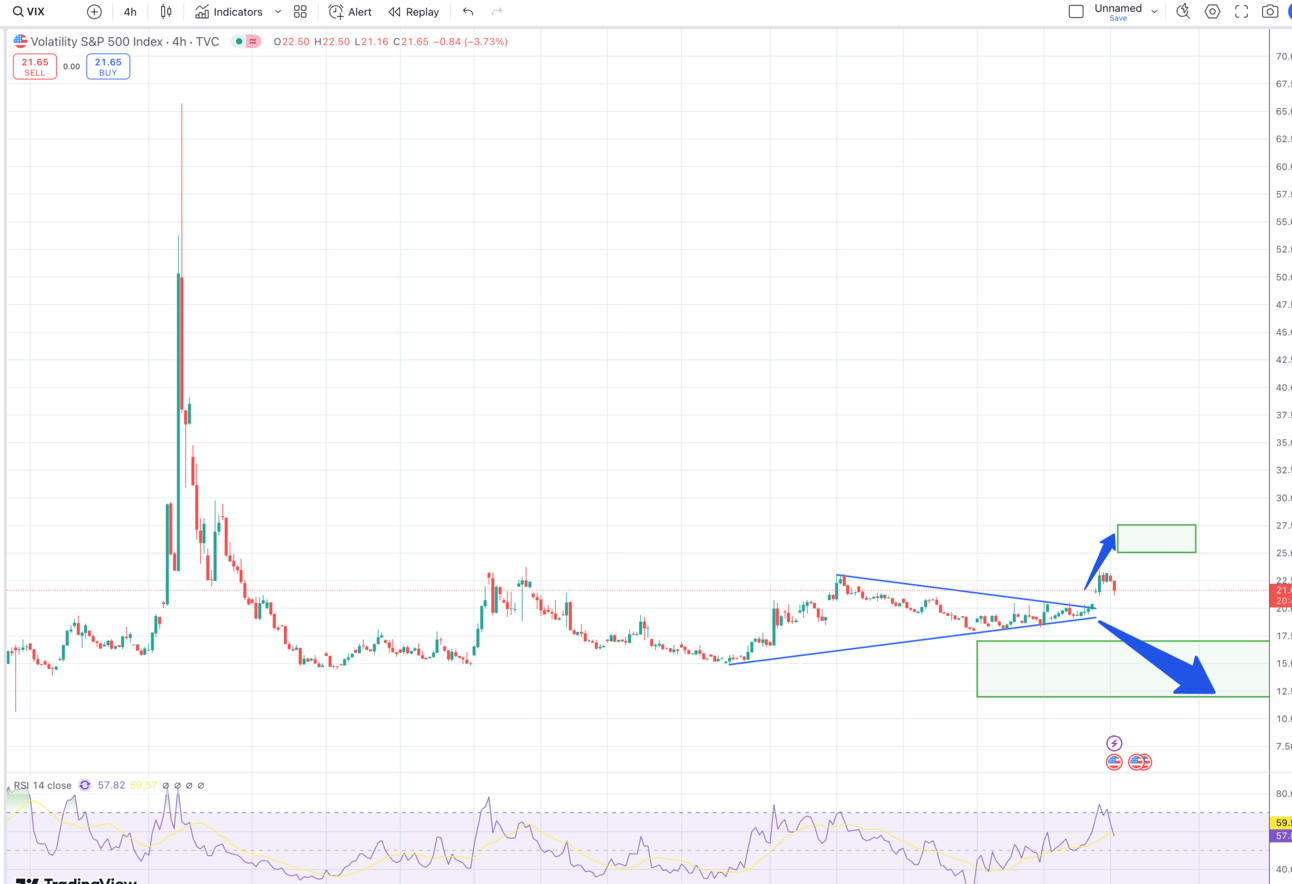

The VIX (S&P 500 Fear Index) is a sure tell of what may happen. Remember last newsletter I talked about a 20% chance VIX may spike to 25, well we hit 23 today.

What does this mean for how much capital I allocate? when VIX is between 20-30 im 100% in. It’s very hard to call the bottom. VIX could go to 30 and I miss out on more opportunity to sell options on the dip, but thats okay. The VIX always reverts back to the mean price of 15.

Once the fear subsides expect an even bigger rally upwards for the S&P 500.

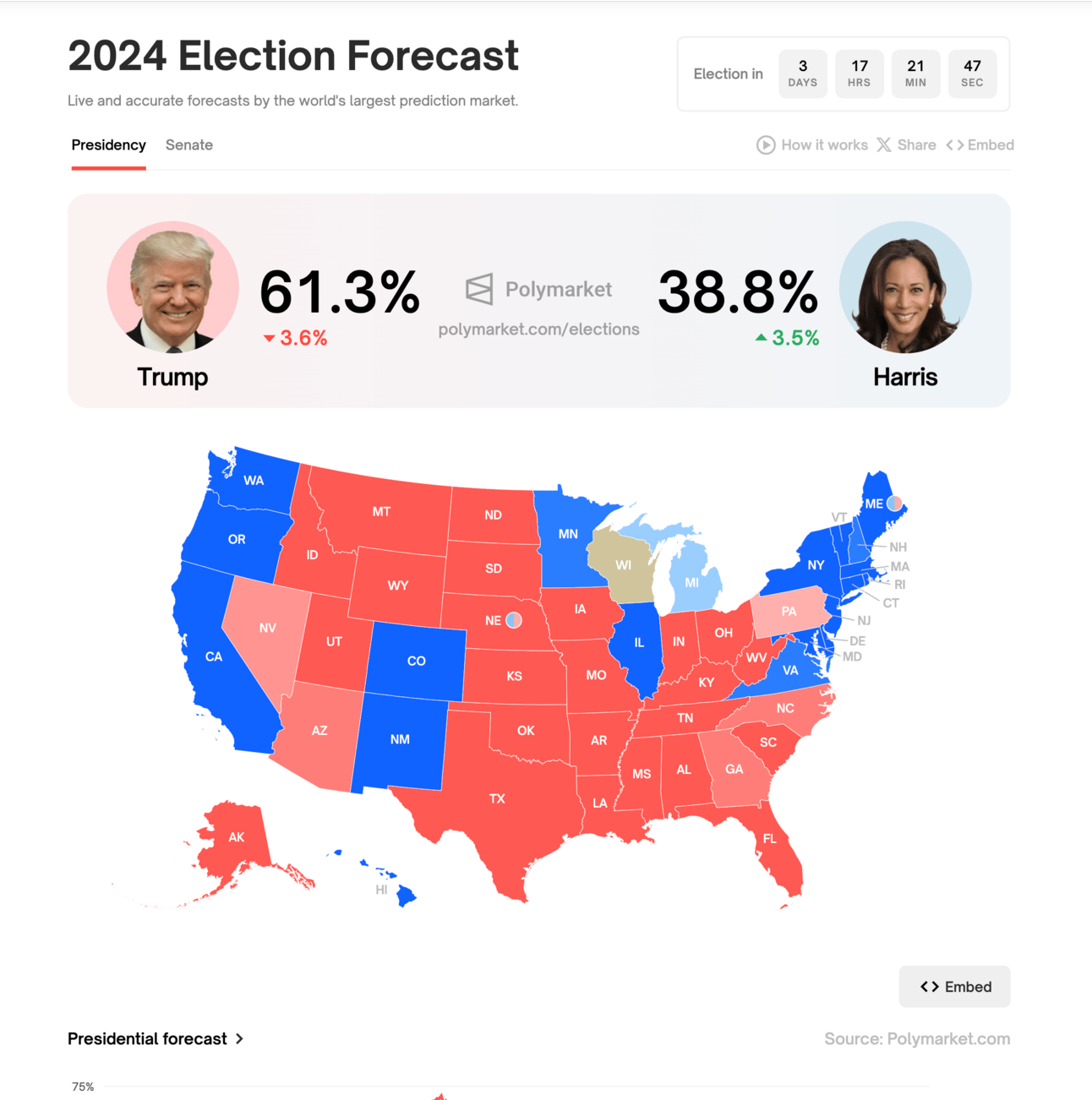

Election Odds Update

Kamala odds up by 3.5% and Trump odds down by 3.6%…

Uncertainty still remains. I can’t wait for this to be over so the market can continue onwards.

How did we do today? |

-Ryan