- Options Trading University

- Posts

- Richard’s Six-Figure Journey+ DoorDash Earnings Play 1% in 3 Days

Richard’s Six-Figure Journey+ DoorDash Earnings Play 1% in 3 Days

Hey Options Trader,

Quick reminder before we dive in: prices for Options Trading University are increasing this Friday, November 7th. If you haven’t booked your call yet, this is your last chance to secure your spot at current rates before the price adjustment goes live.

Here’s what we are covering:

My cautious outlook heading into a volatile earnings week

Client Spotlight: Richard’s six-figure months from zero experience

A free DoorDash earnings play paying 1% in 3 days

Bonus Resource: The 3 AI stocks I’m loading up on for November

Market Snapshot

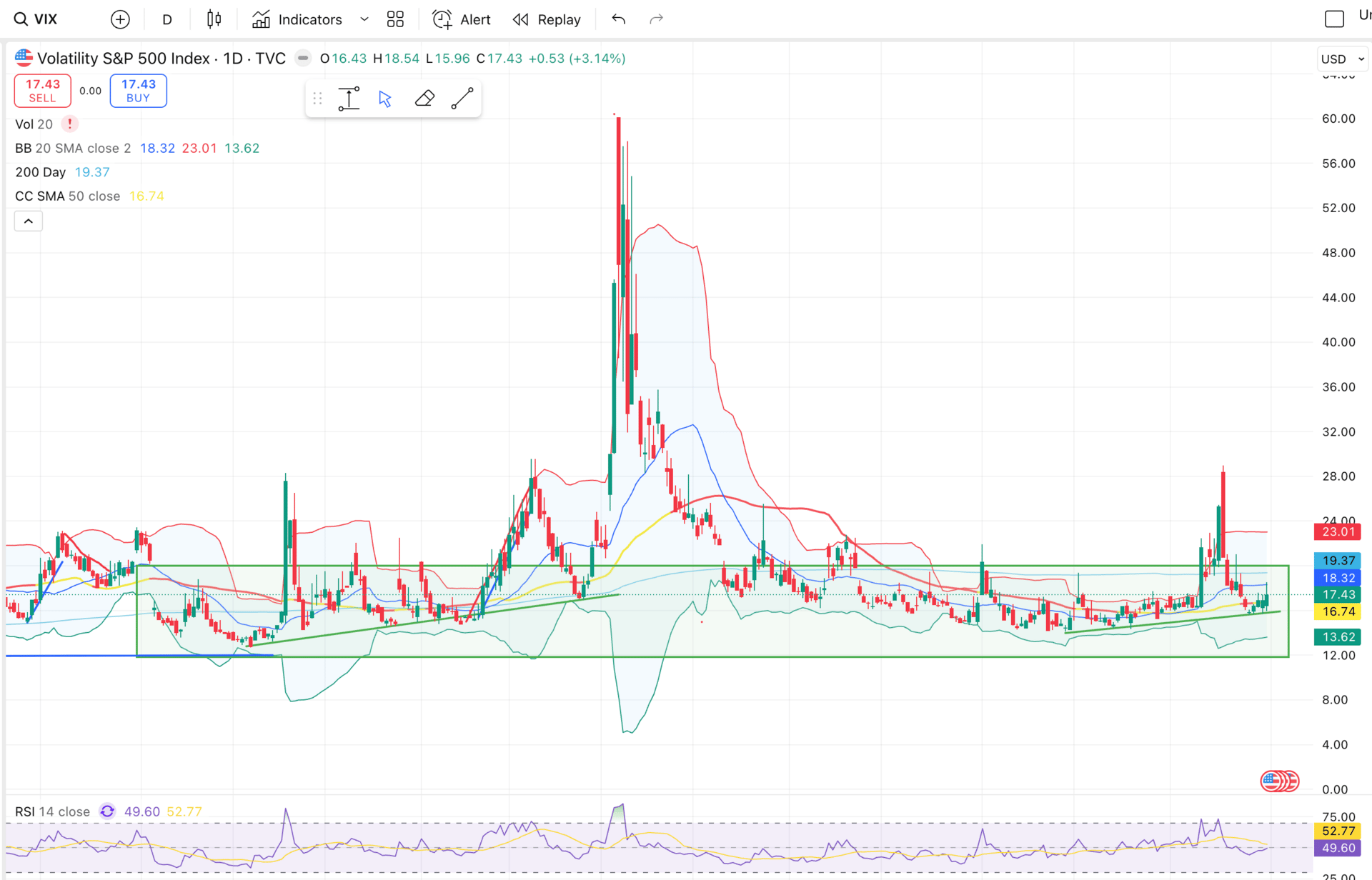

Right now, I’m leaning cautious. $VIX ( ▲ 3.18% ) ticked up into the 17s on Friday, showing that fear is creeping back into the market. Next week could bring a wave of volatility with multiple big earnings reports on deck: Palantir, Robinhood, Hims & Hers Health, IREN, Uber, and DoorDash all reporting.

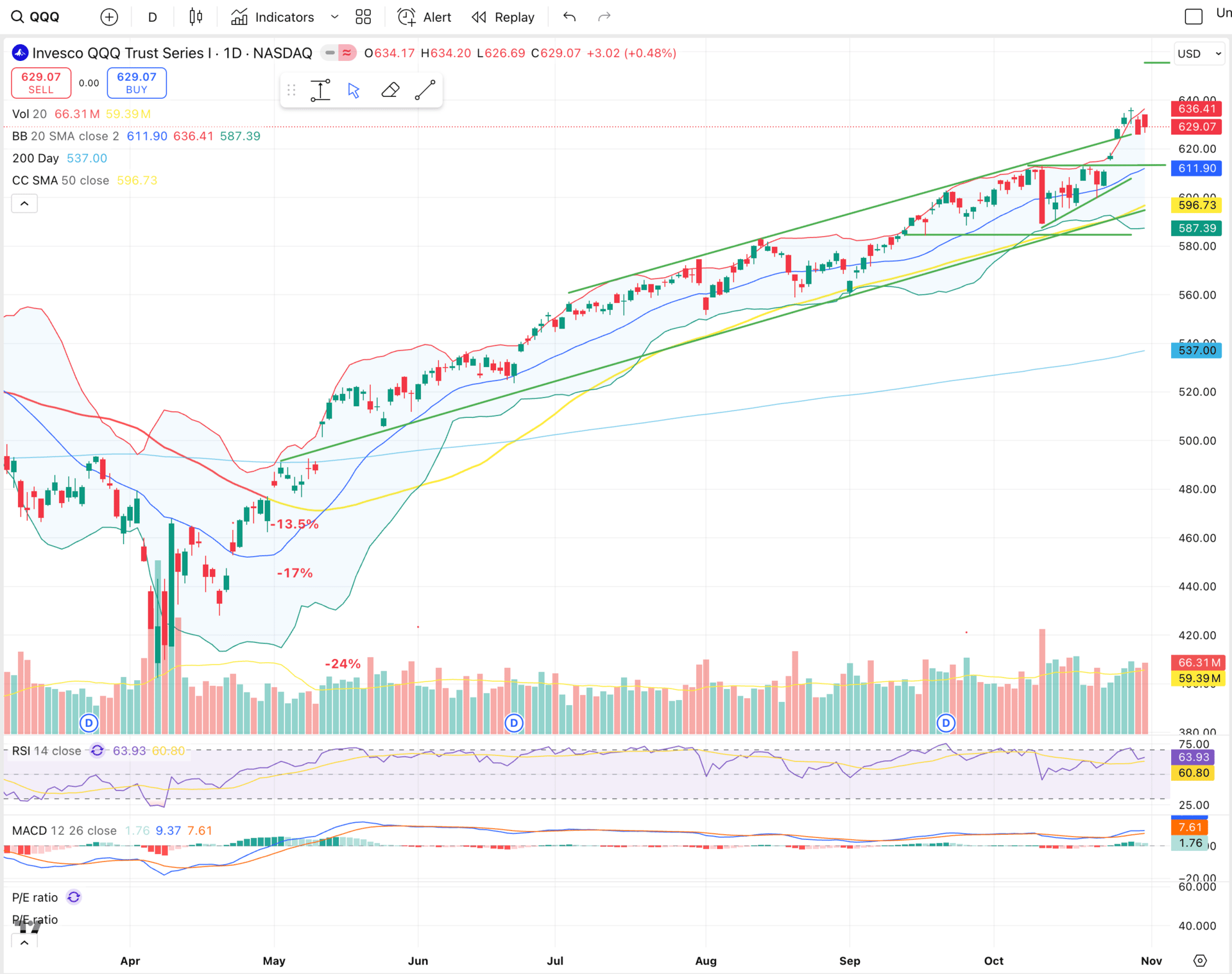

$QQQ ( ▼ 0.57% ) is trading around 629 and struggling to break through the 636 resistance level. If earnings come in weak, we could easily see a pullback toward 613 before the next rally. This would be a healthy setup heading into what I still expect to be a strong Christmas run.

The tone has shifted slightly as the Fed is unlikely to cut interest rates in December. The next cut is expected in January or even March. Combine that with trade headlines out of China and the U.S., and you have the recipe for a choppy week ahead.

QQQ plateauing at upper bollinger band

VIX trending back up with market at all time highs

Client Spotlight

If you’ve been waiting to join Options Trading University, now’s the time, rates are increasing Friday. Watch Richard’s story below before booking your call.

Richard came to us with zero options trading experience. Within months, he was generating consistent six-figure months by applying the same strategies we teach inside the program. He’s now one of the top traders in our community, focusing on safe, repeatable income every single month.

Free Trade of the Week

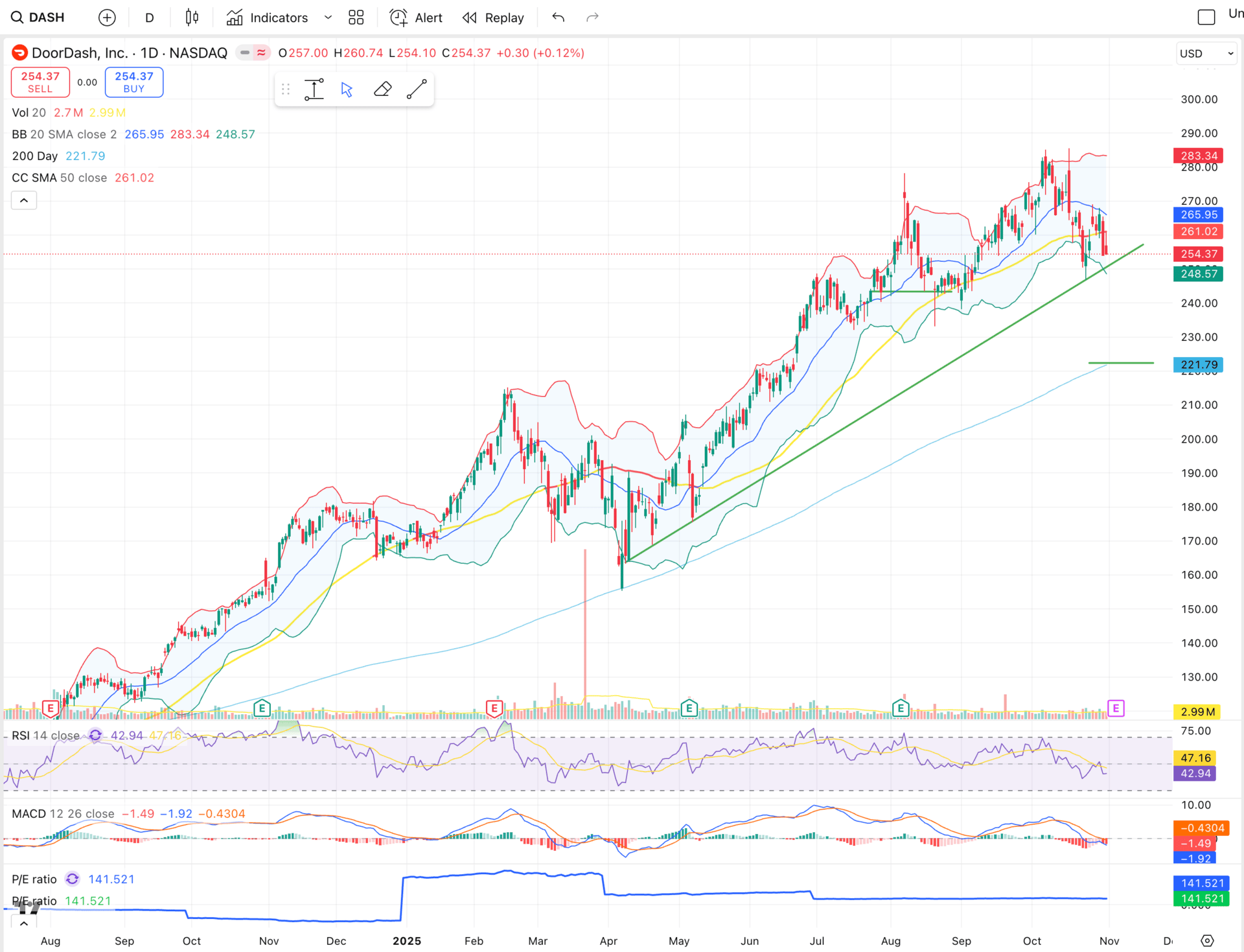

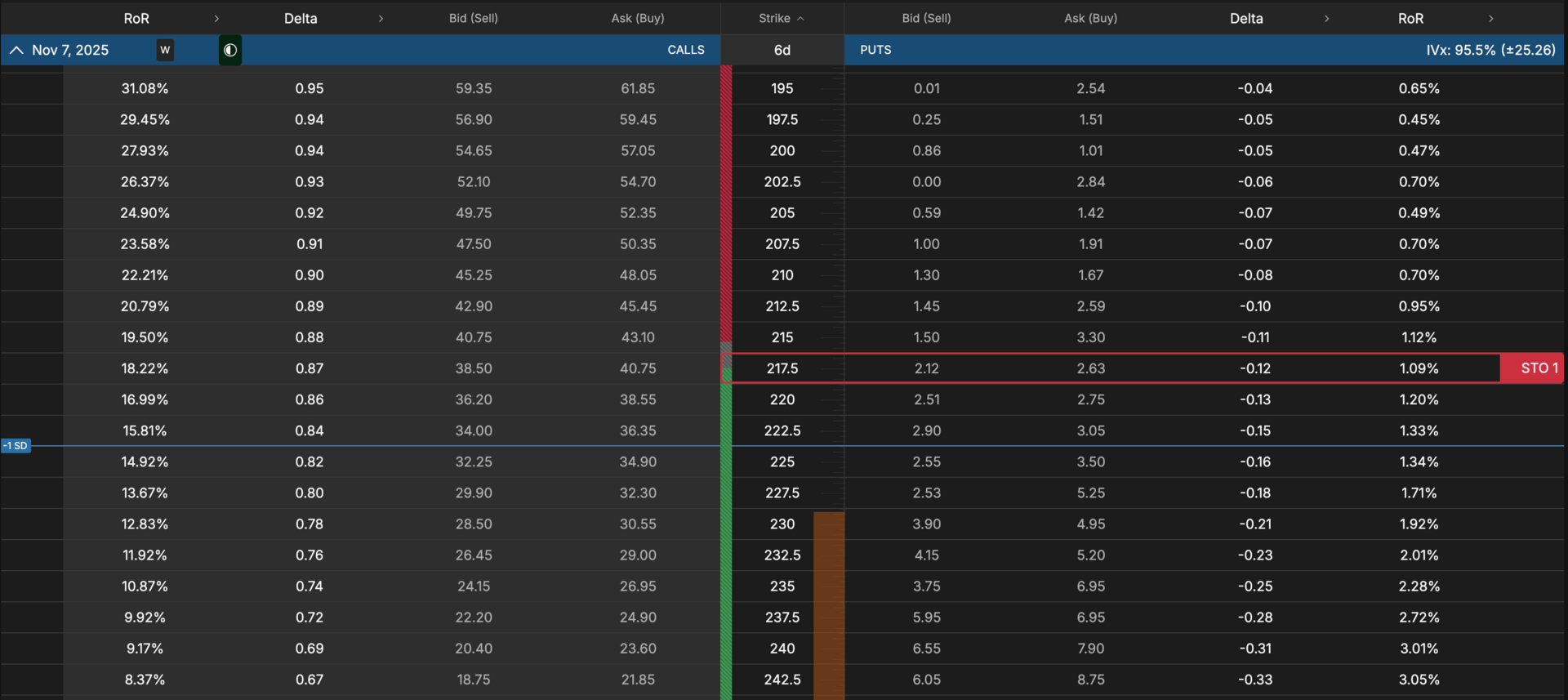

Ticker: $DASH ( ▲ 2.92% ) (DoorDash)

Strategy: Cash-Secured Put (Earnings Play)

Expiration: 3 Days (This Week)

Strike: 217.5

Premium Collected: $220

ROI: 1% in 3 Days

DoorDash is currently trading near $254, right above its lower Bollinger Band. Selling the 217.5 put keeps you safely outside the expected move while earning 1% in just three days on a strong company. This is a quick, low-risk setup that I’m personally taking ahead of earnings.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

Bonus Video

In my latest weekly update, I break down the three AI stocks I’m loading up on heading into November and share the exact price levels I’m targeting. I also go over how I’m positioning my portfolio for what could be a volatile but opportunity-filled week ahead.

Stay focused, stay tactical, and use this week’s volatility to your advantage.

Talk soon,

Ryan