- Options Trading University

- Posts

- Rate Cut Odds Hit 87 Percent and Richard Clears $371K

Rate Cut Odds Hit 87 Percent and Richard Clears $371K

Hey Options Trader,

The market is setting up for a powerful finish to the year as momentum builds ahead of the December rate cut decision. Several names across tech and AI are already breaking out, and next week’s catalyst could be the spark that sends QQQ back toward all-time highs. Today’s newsletter breaks down what I’m watching, a massive client win, a high-quality free trade you can model, and a new video showing the two stocks I’m doubling down on.

Here’s what we are covering:

Market outlook for next week - Key Levels

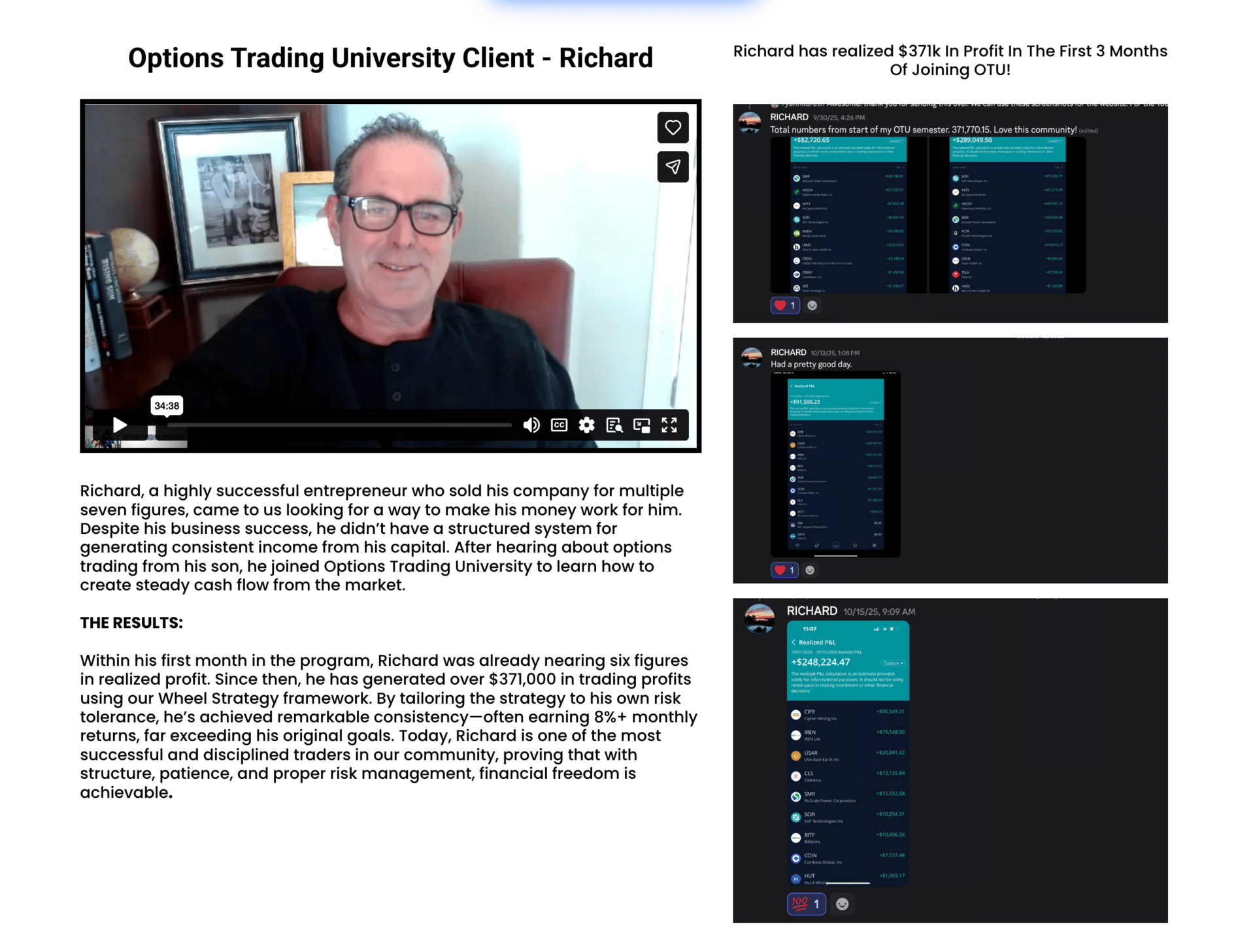

Client Spotlight - Richard $371k Win

Free Trade of the Week - New Favorite Stock

Bonus Resource - $226k Into This Stock

Market Snapshot

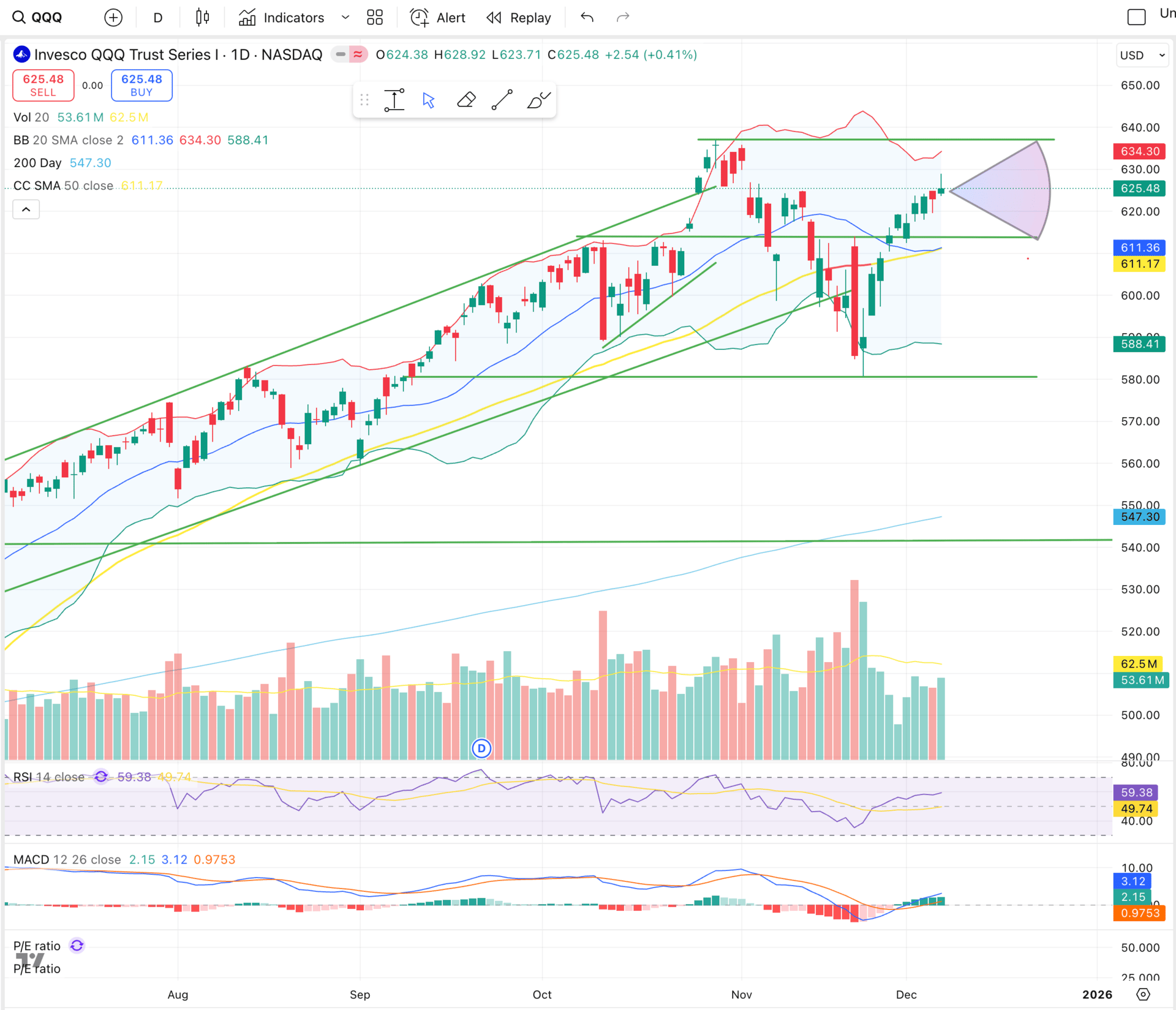

The outlook heading into next week is very bullish as rate cut odds for December hover around 87.2 percent. That decision alone could drive a strong rally across tech and AI, and we are already seeing names like Palantir, CLS, HIMS, and Apple start to pick up momentum.

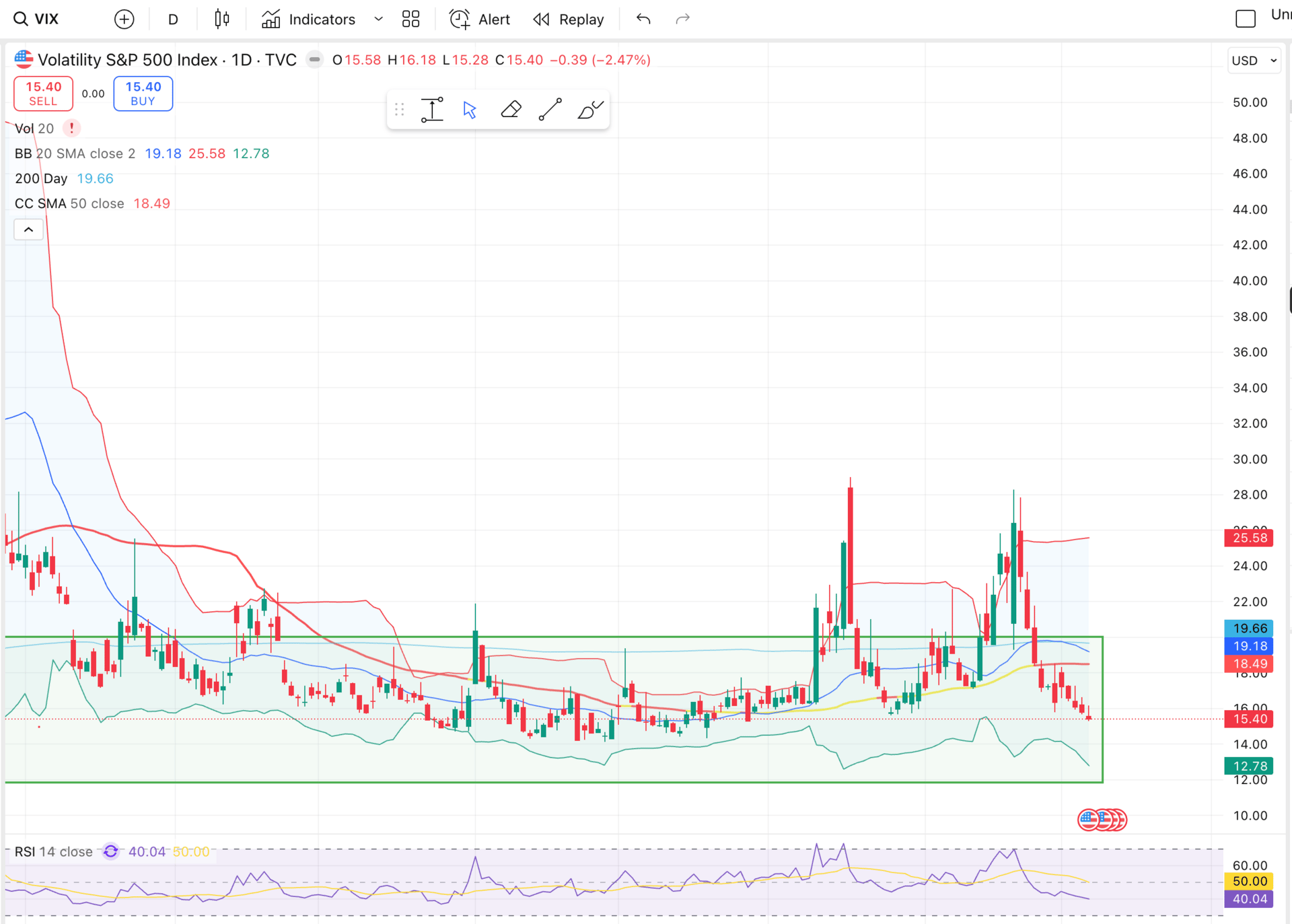

$QQQ ( ▼ 1.22% ) looks poised to retest the 637 all-time high, with only a slim 10 percent chance that a surprise no-cut scenario sends it down toward 613 or even 600. The best hedge against unexpected volatility is staying aligned with the $VIX ( ▲ 10.06% ) cash allocation levels. I am currently holding 18 percent cash, with 20 percent being ideal at these VIX readings. VIX remains in the 15s, and if it breaks below 14, the probability of new market highs increases significantly as fear gives way to accelerating greed.

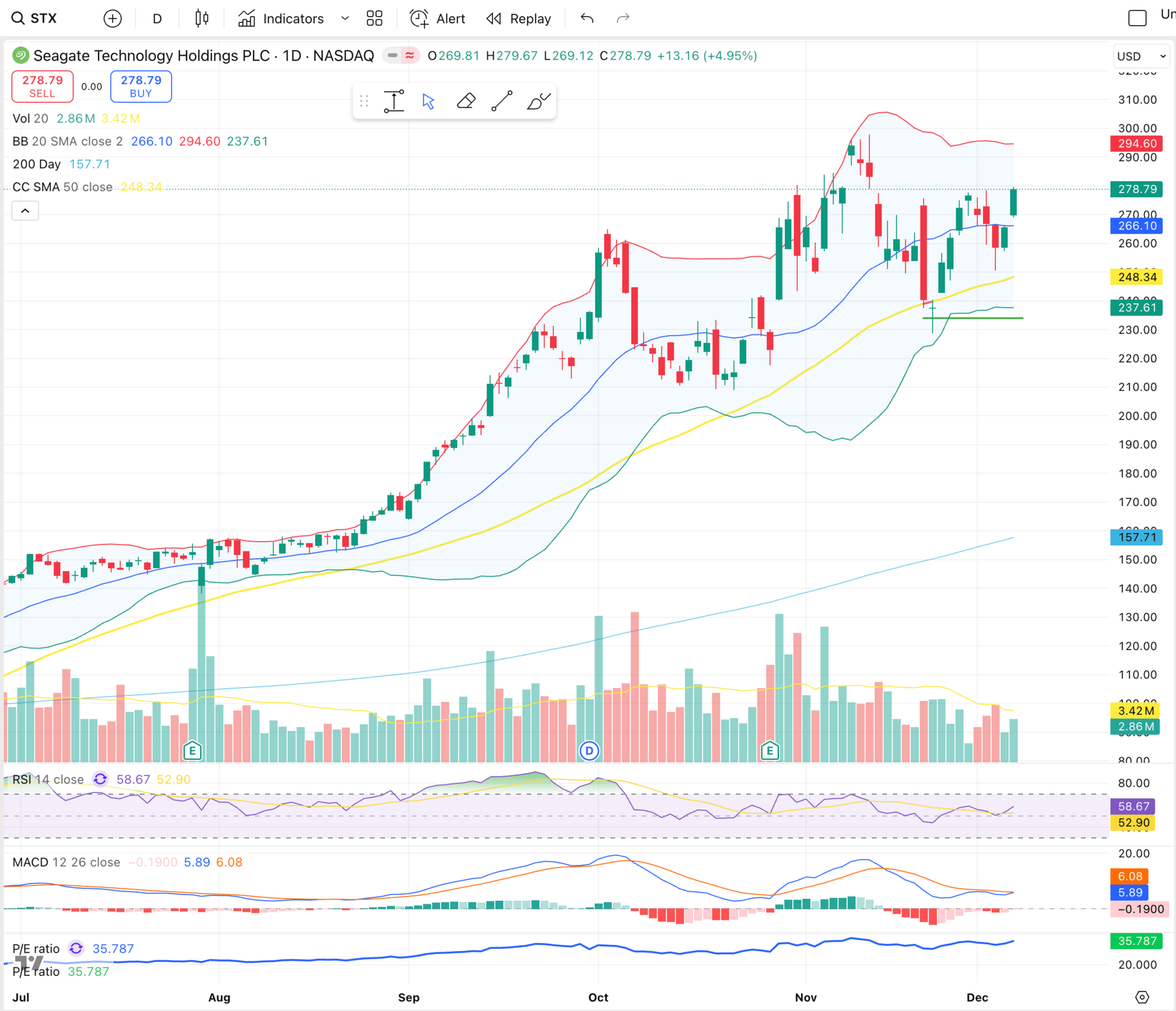

Bullish momentum continues on RSI and MACD

Greed zone sub $15 approaching

Client Spotlight

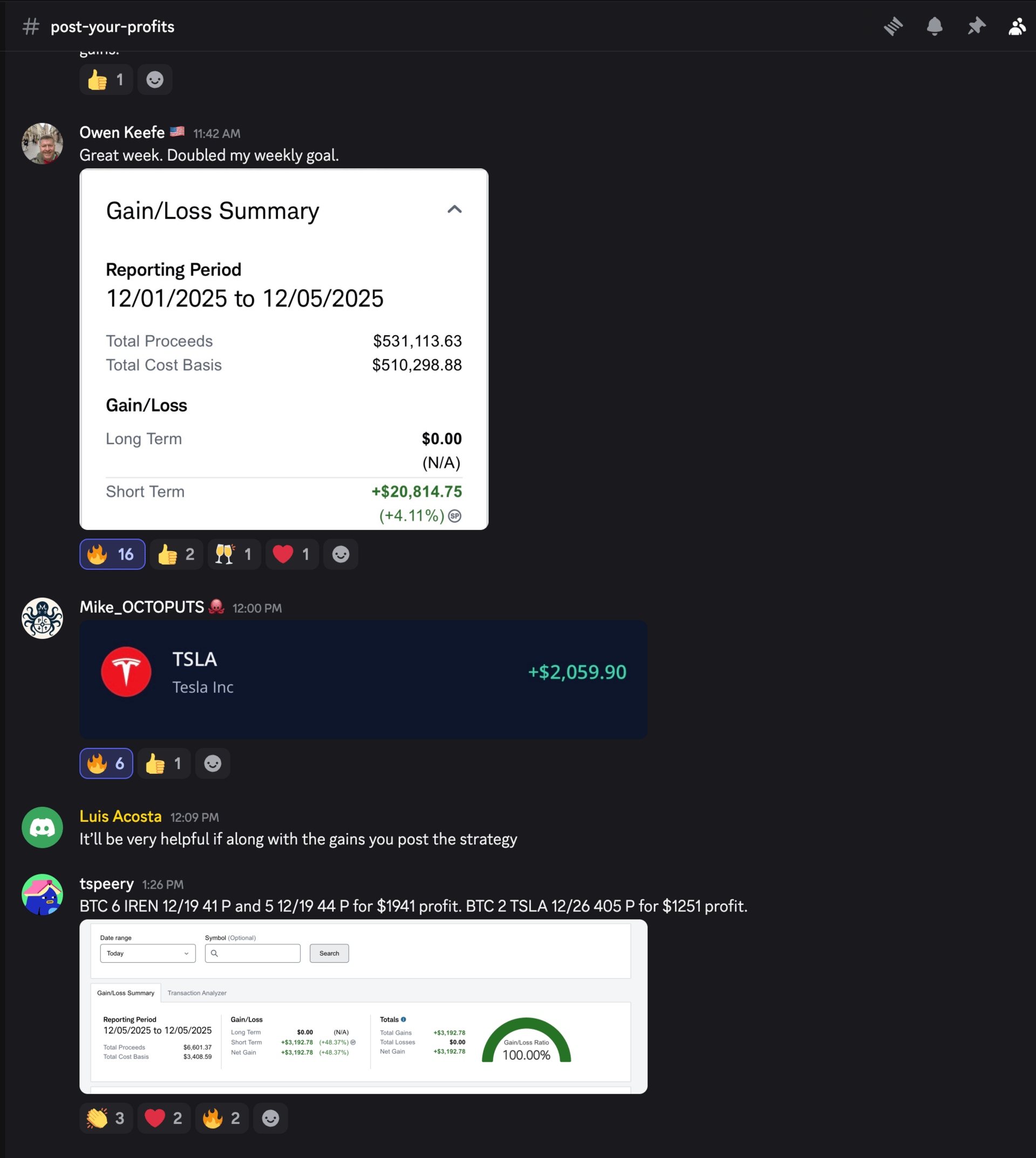

Richard joined the program just a few months ago and made $371,000 in his first stretch following our principles. Since then, he has now crossed over $600,000 in total gains since our interview. His growth has been incredible to watch, and today several other clients also closed out strong trades, including one who made $20,000 for the week, Mike who closed a $2,000 winner, and Terry who locked in $1,200 heading into the weekend.

Free Trade of the Week

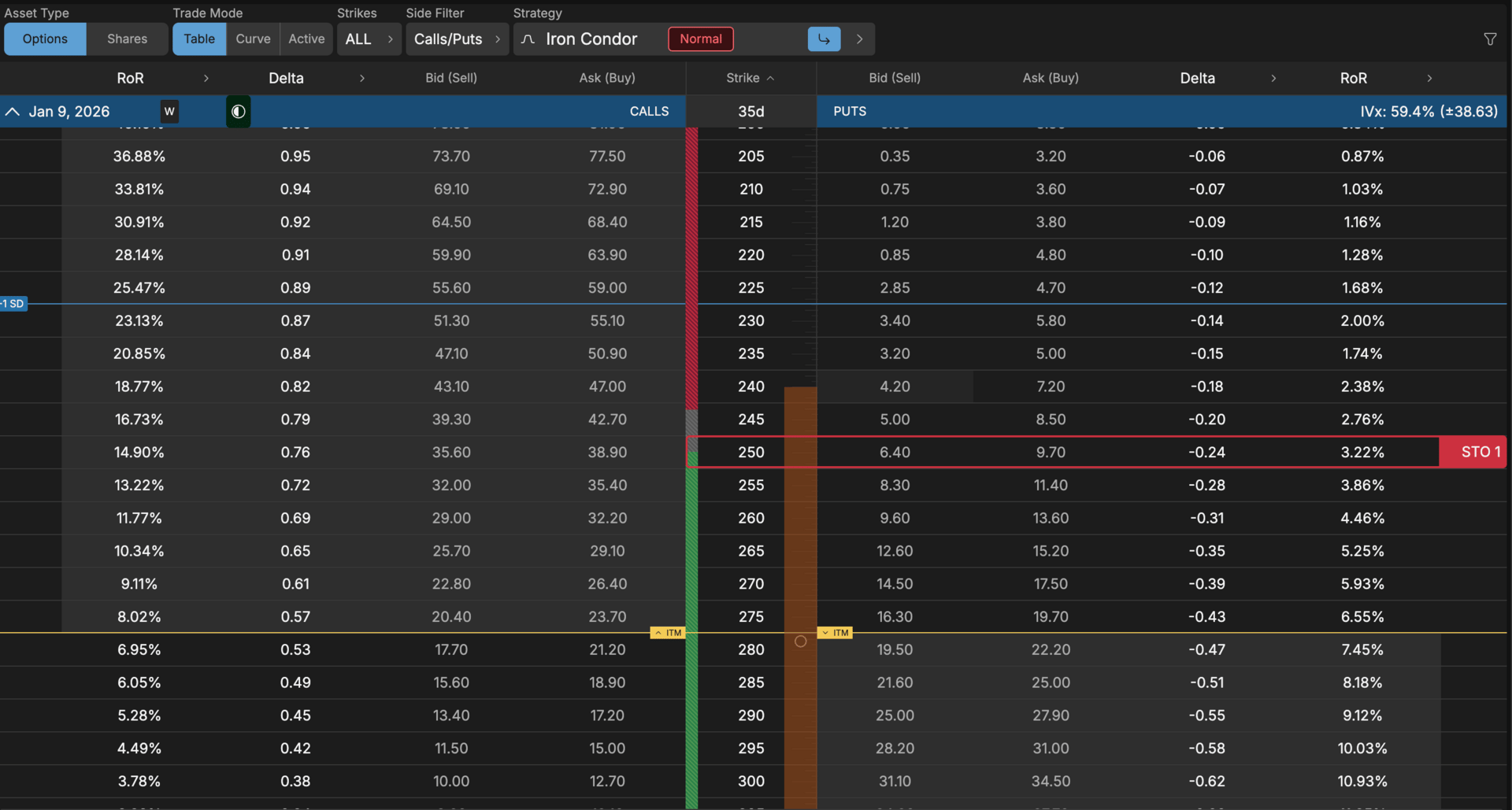

Ticker: $STX ( ▼ 0.9% )

Strategy: Sell the January 9th 250 strike put

Premium Collected: $640

Duration: 35 days

ROI: 3.2 percent

Annualized Return (compounded monthly): 37.4 percent

Risk: Standard assignment risk at the 250 strike if STX pulls back, defended by strong fundamentals and clear technical uptrend.

Seagate Technologies remains a high-quality company with a strong chart and improving fundamentals, especially within AI-driven data storage. Demand for storage capacity continues to increase, and Seagate is well-positioned to capture that growth. This setup offers attractive premium with a favorable technical backdrop.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Bonus Video

I just released a brand-new video breaking down the two stocks I’m doubling down on before 2026, including the one I just bought $226,000 worth of. This walkthrough explains exactly why I’m scaling up and what I’m seeing in the charts.

The best opportunities always appear when others hesitate.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.