- Options Trading University

- Posts

- Raman’s $30K Months and My Next $157K Move

Raman’s $30K Months and My Next $157K Move

Hey Options Trader,

Earnings season is heating up and this week is all about patience and positioning. While some big names are disappointing, others are holding strong, setting us up for opportunities on the dip.

Here’s what we are covering:

My cautious outlook heading into earnings week

Client Spotlight: Raman’s consistent $20K–$30K months

The safe Robinhood trade paying 3.3% in 16 days

Bonus Resource: What I sold and what I bought with $157K this week

Market Snapshot

Right now I’m leaning slightly cautious going into next week’s earnings. Netflix $NFLX ( ▲ 2.17% ) and Tesla $TSLA ( ▲ 0.03% ) came in under expectations, while IBM $IBM ( ▲ 0.34% ) actually delivered strong numbers but still sold off 5% after hours. That tells me we’re seeing some profit-taking across the board.

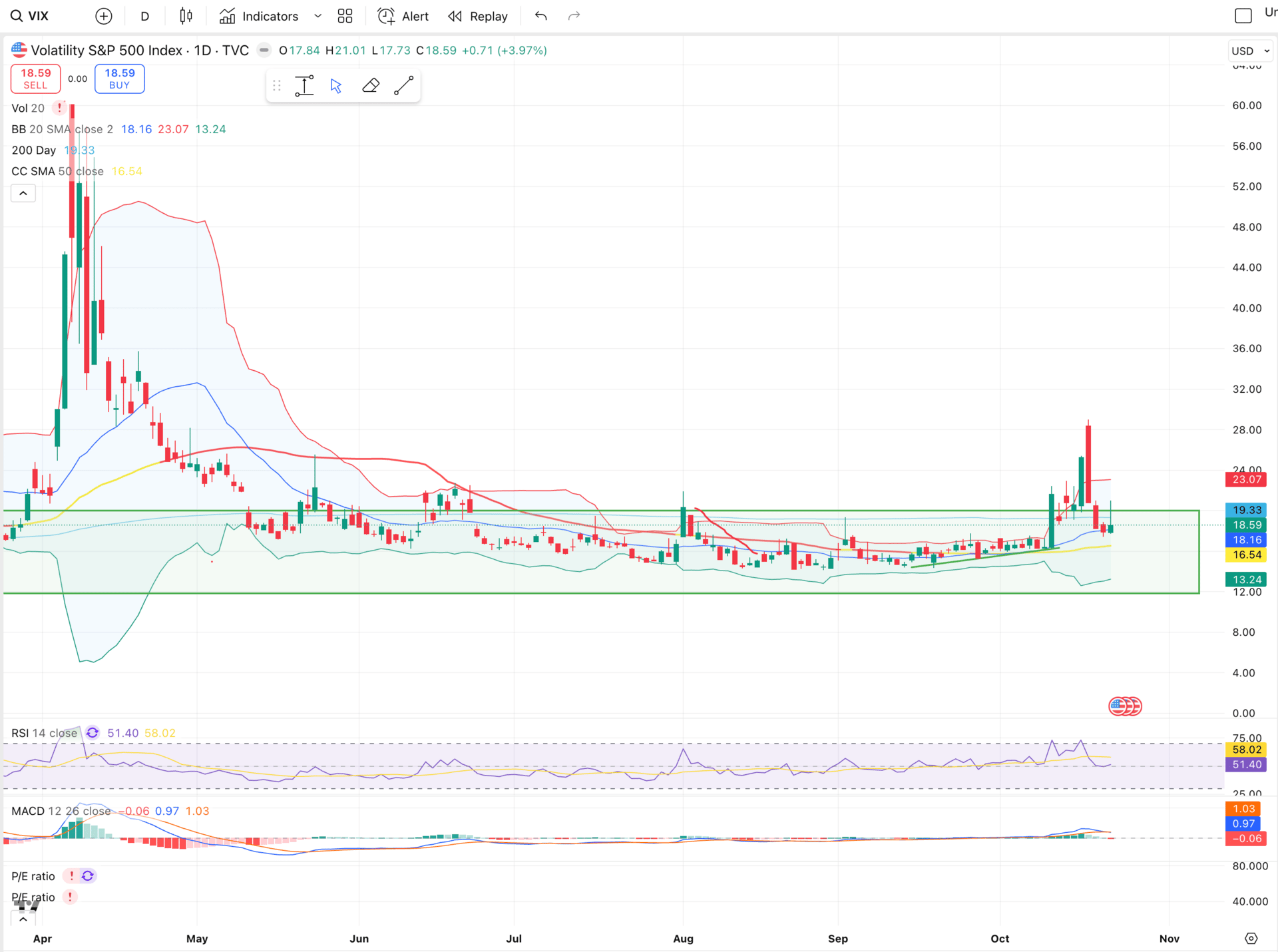

QQQ was rejected right at 613 today, so short term, we could see a move down toward 590 before building a new base and potentially heading higher. VIX traded in the 18s and even spiked above 21 earlier, signaling that volatility remains bid here.

Catalysts to watch: Core CPI data releases this Friday at 8 a.m. Eastern, and next Wednesday brings the FOMC Fed interest rate decision, both could create short-term volatility.

I’m sitting at 19% cash, right in line with my VIX cash allocation levels, and waiting for prime setups to emerge.

QQQ rejected off $613 level

VIX remaining elevated at $18

Client Spotlight

This week’s spotlight goes to our client Raman. Since joining Options Trading University, he’s consistently hit between $20,000 and $30,000 months. His discipline and consistency have not only produced results but inspired several of his friends and colleagues to join the program as well.

Free Trade of the Week

Ticker: $HOOD ( ▲ 0.61% )

Strategy: Cash-Secured Put

Expiration: November 7 (16 days)

Strike: 115

Premium Collected: $360

ROI: 3.3% (Annualized Compounded Return: 94%)

Robinhood has pulled back sharply from its highs, hitting 122 today. Selling the 115 put offers an excellent discount entry and strong premium yield in just over two weeks. Fundamentally, Robinhood remains one of my favorite long-term holdings, and this trade keeps risk minimal while capitalizing on earnings volatility.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Bonus Video

In my latest YouTube video, I break down how I sold $93,000 worth of one stock and redeployed $157,000 into a new position going into earnings week. I show the chart, the setup, and exactly what I’m watching next.

The best traders aren’t lucky, they’re patient, prepared, and positioned.

Talk soon,

Ryan