- Options Trading University

- Posts

- QQQ Near $600, CPI Risk Ahead, How a Beginner Client Hit $600K+

QQQ Near $600, CPI Risk Ahead, How a Beginner Client Hit $600K+

Hey Options Trader,

This week’s market action is shifting from momentum to patience, and risk management is taking center stage. We’re seeing early signs of a potential pullback, with volatility likely to rise around key economic data. That said, pullbacks often create opportunity when approached with discipline. In today’s email, I’ll walk through my current market stance, highlight a standout client result, share a high-probability income trade, and point you to a new video breaking down how I’m positioning into 2026.

Here’s what we are covering:

My market outlook for the week - Key Levels

Client Spotlight - $600k Win

Free Trade of the Week - Safer Income Trade

Bonus Resource video - 2 Stocks Down Big and 2 Stocks Im Doubling Down On

Market Snapshot

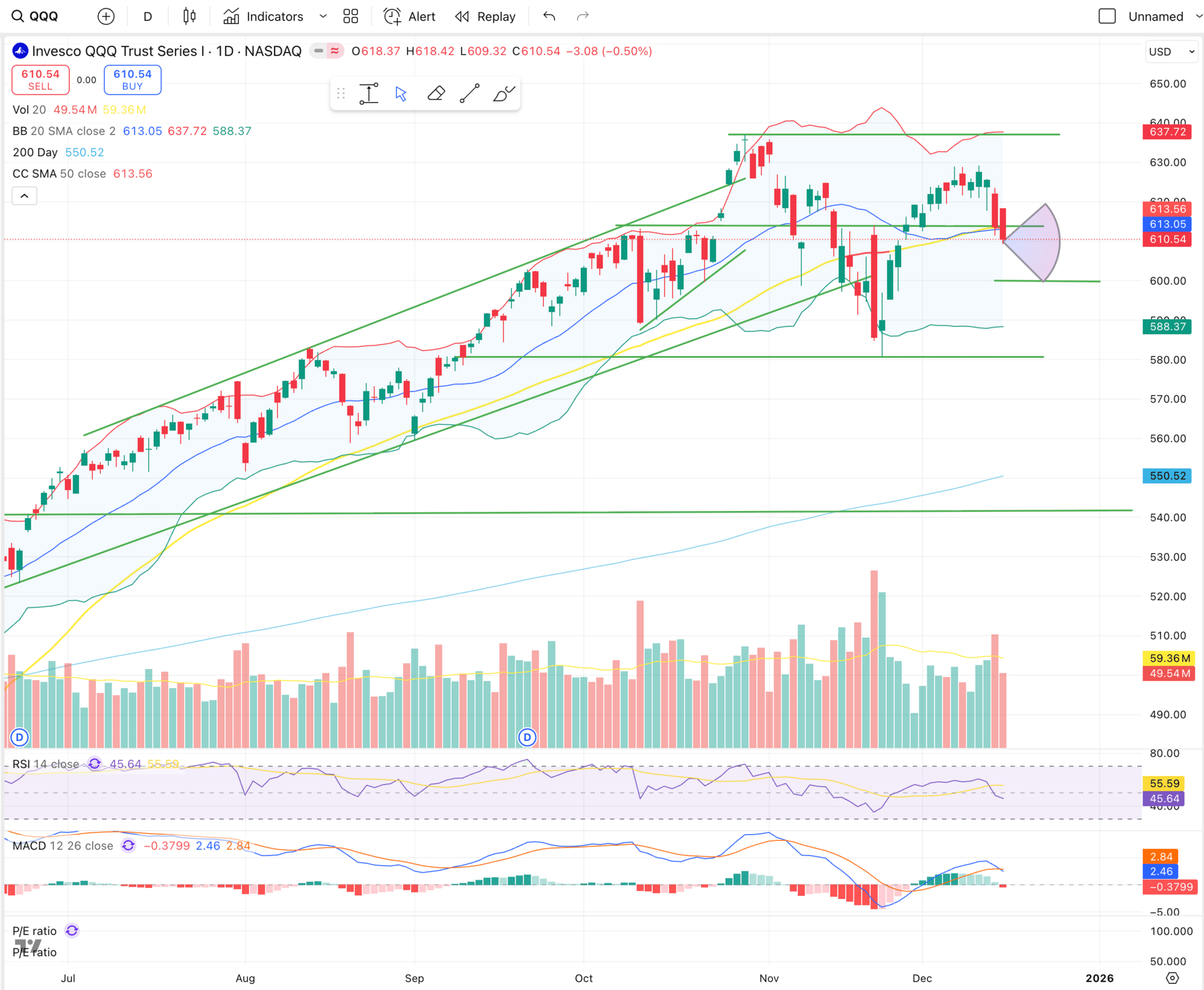

My outlook for the week is neutral to cautious. After hours, $QQQ ( ▲ 1.16% ) has pulled back to the $606 area, and a move toward $600 tomorrow is very viable, especially with unemployment data tomorrow and core CPI inflation data on Thursday.

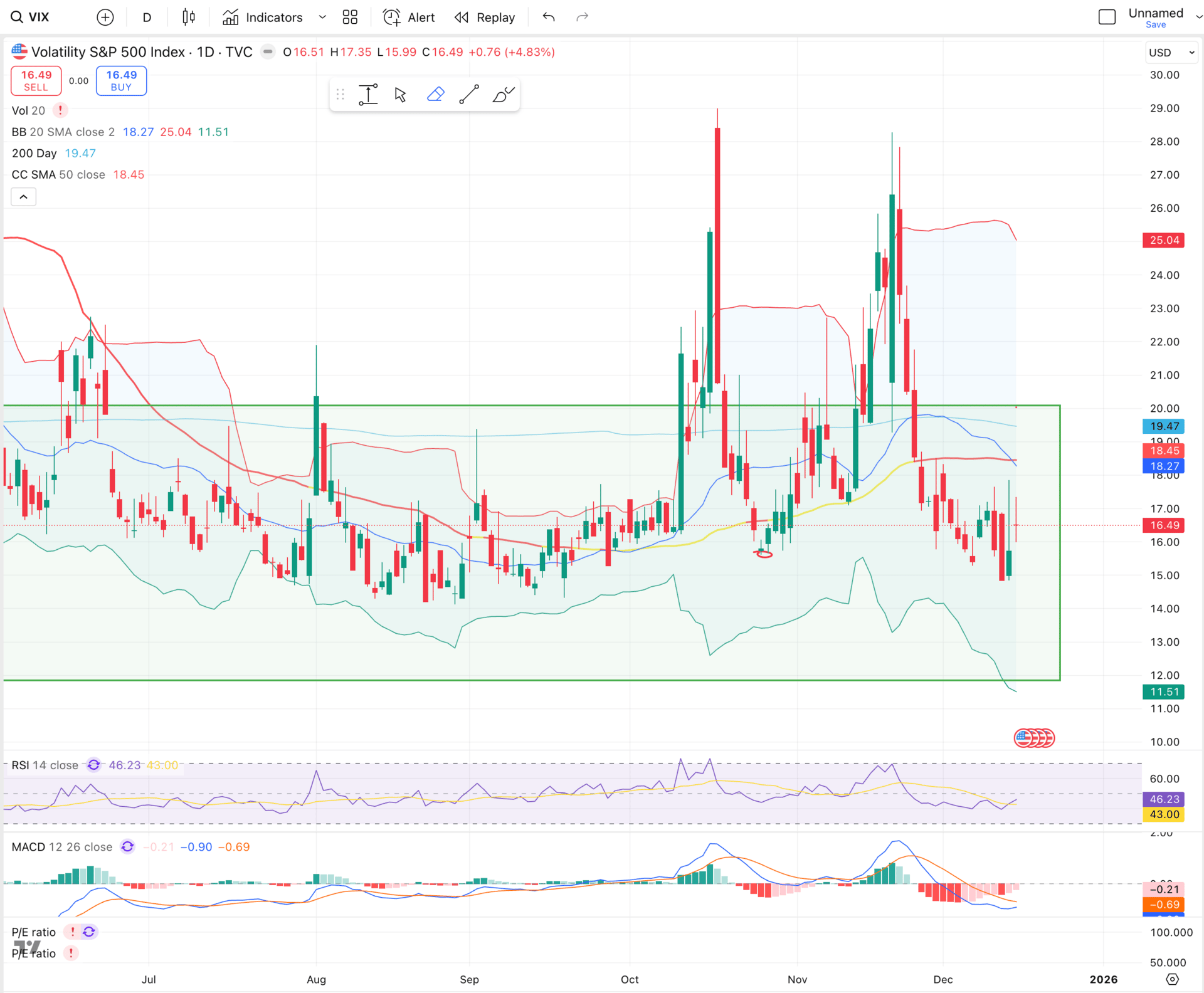

$VIX ( ▼ 6.85% ) closed today around 16.49, but a spike above 20 is absolutely possible, and that would be a level where I’m comfortable starting to deploy capital. I currently have roughly 19% cash on the sidelines and plan to stay patient rather than force trades with QQQ finishing around $610 and the MACD crossing bearish.

Historically, the period from December 17th through year-end has averaged about a 1.4% gain in the S&P 500, so if we do see a flush here, it could set up a strong Christmas rally. For now, I’m keeping cash levels healthy and letting the data guide the next move.

$600 in the cards tomorrow for a flush. Bearish crossover on MACD.

VIX potential spike to $20 incoming.

Client Spotlight

Richard joined Options Trading University as a complete beginner, with no prior options experience. Within his first three months, he generated $371,000 in profit, and since joining, he’s now well over $600,000 total while consistently averaging more than 8% per month.

Even on down market days like today, clients continue to execute with discipline, with multiple members closing profits including $1,300+, $2,000 to hit an 8% monthly goal, and another $1,331 in gains.

Free Trade of the Week

Free Trade of the Week

Ticker: SOFI

Strategy: Sell the January 16th 23 put

Premium Collected:

Duration: 32 days

ROI: 2.61%

Annualized Return (compounded): approximately 34%

Risk: Assignment below the $23 strike if shares break down significantly

This is a more defensive, income-focused setup. SOFI closed around $25.82 and is nearing the lower Bollinger Band on the daily chart, with the 23 strike sitting well below that level. With additional rate cuts still expected next year and SOFI already beaten down, this trade offers a high probability of simply collecting income without assignment.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Bonus Video

I just uploaded a new video breaking down two stocks in my portfolio that are currently down big and exactly how I’m managing those positions. I also cover two stocks I’m actively doubling down on as we position into 2026.

Stay disciplined. Cash is a position, and patience pays best when volatility rises.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.