- Options Trading University

- Posts

- QQQ Breakout + Erin’s Full-Time Trading Leap (Free Trade Inside)

QQQ Breakout + Erin’s Full-Time Trading Leap (Free Trade Inside)

Hey Options Trader,

This week’s market action brought a strong shift in momentum as QQQ finally pushed through a major resistance zone and volatility cooled off. In today’s newsletter, we’ll walk through why bullish forces are building, the key events I’m watching into December, and a powerful trade setup on SOFI that aligns with the macro backdrop. Plus, I’m highlighting a client who made a massive transition and is thriving, along with a new video covering the stocks I’m buying now.

Here’s what we are covering:

My market outlook for the week

Client Spotlight

Free Trade of the Week

Bonus Resource video and updates

Market Snapshot

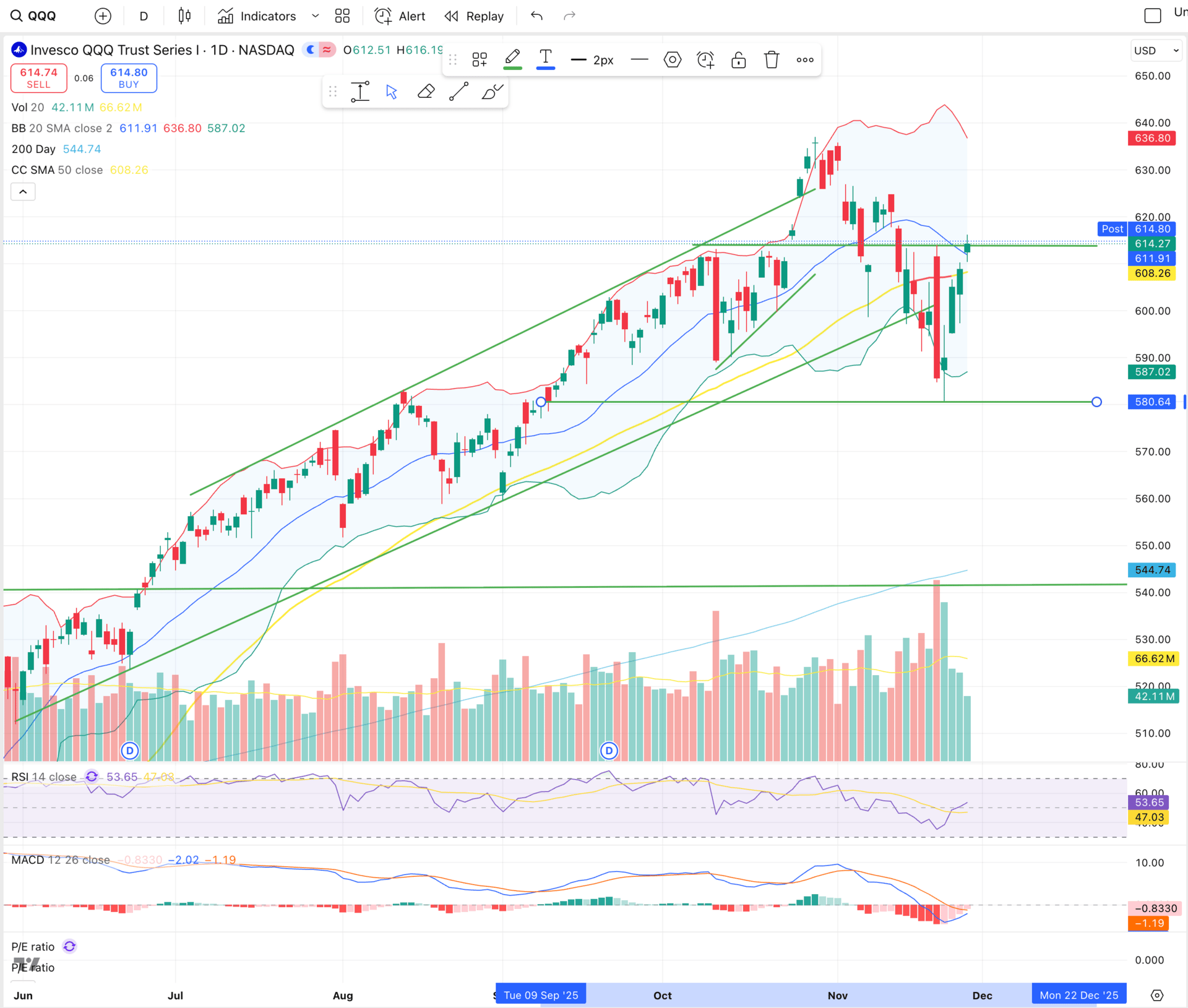

Momentum remains firmly bullish here as $QQQ ( ▲ 1.45% ) closed above the 614 level, which had been a major area of resistance. RSI is showing a bullish crossover, MACD looks ready to confirm a bullish crossover as well, and we closed above the 50-day moving average, all pointing to continued strength.

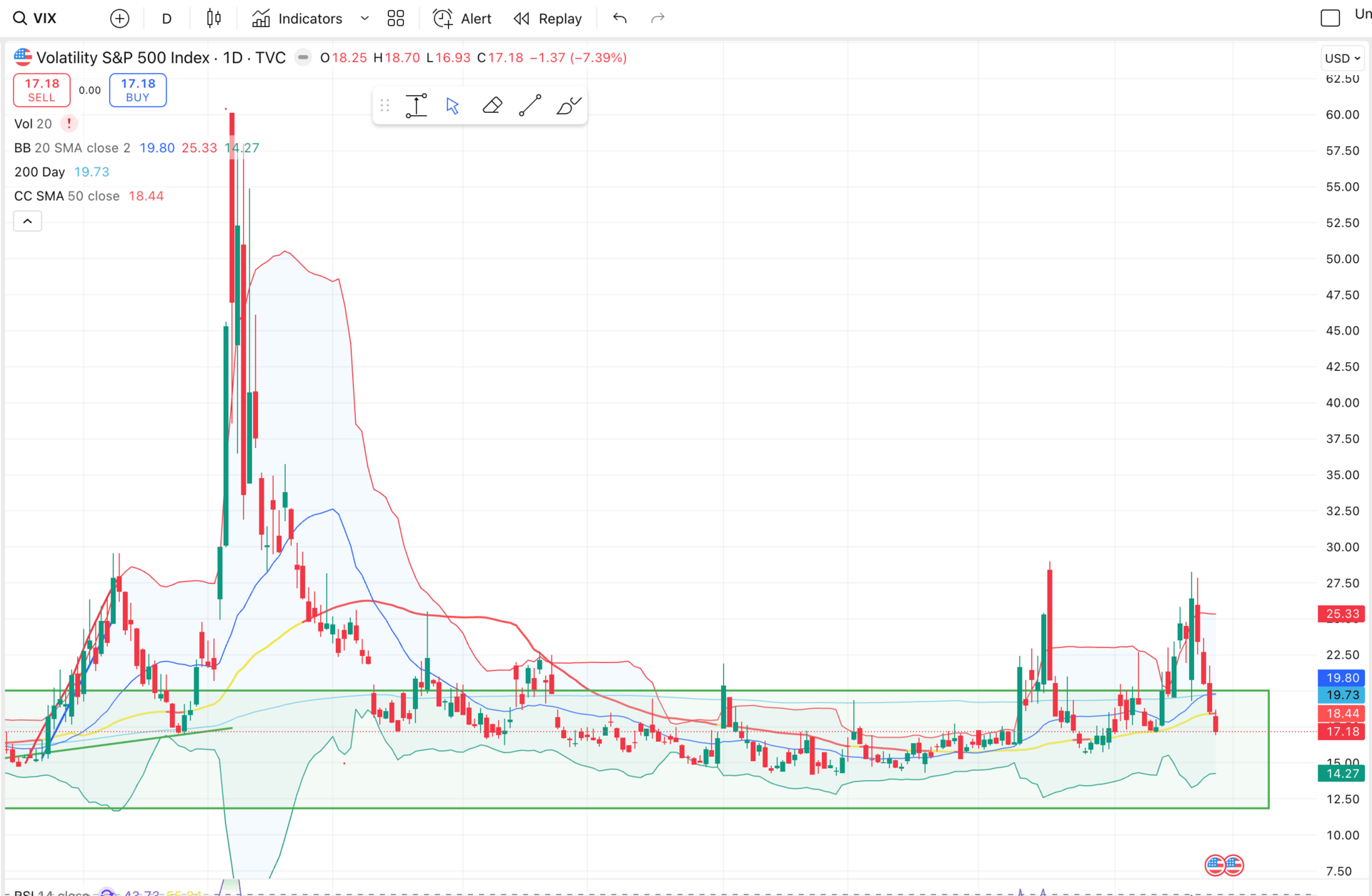

$VIX ( ▼ 8.29% ) dropping to 17 signals that confidence is returning to the market and fear is subsiding. While I’m bullish, I’m also keeping cash levels aligned with my VIX cash allocation strategy and sitting at around 23 percent cash. Catalysts to watch include the December 10th Fed meetings. Rate cut odds sit at 82 percent, but if the Fed disappoints, we could see a temporary spike in volatility. For now, momentum favors further upside.

Very bullish indicators, RSI bullish, MACD bullish, Close above 50MA.

VIX back below 20

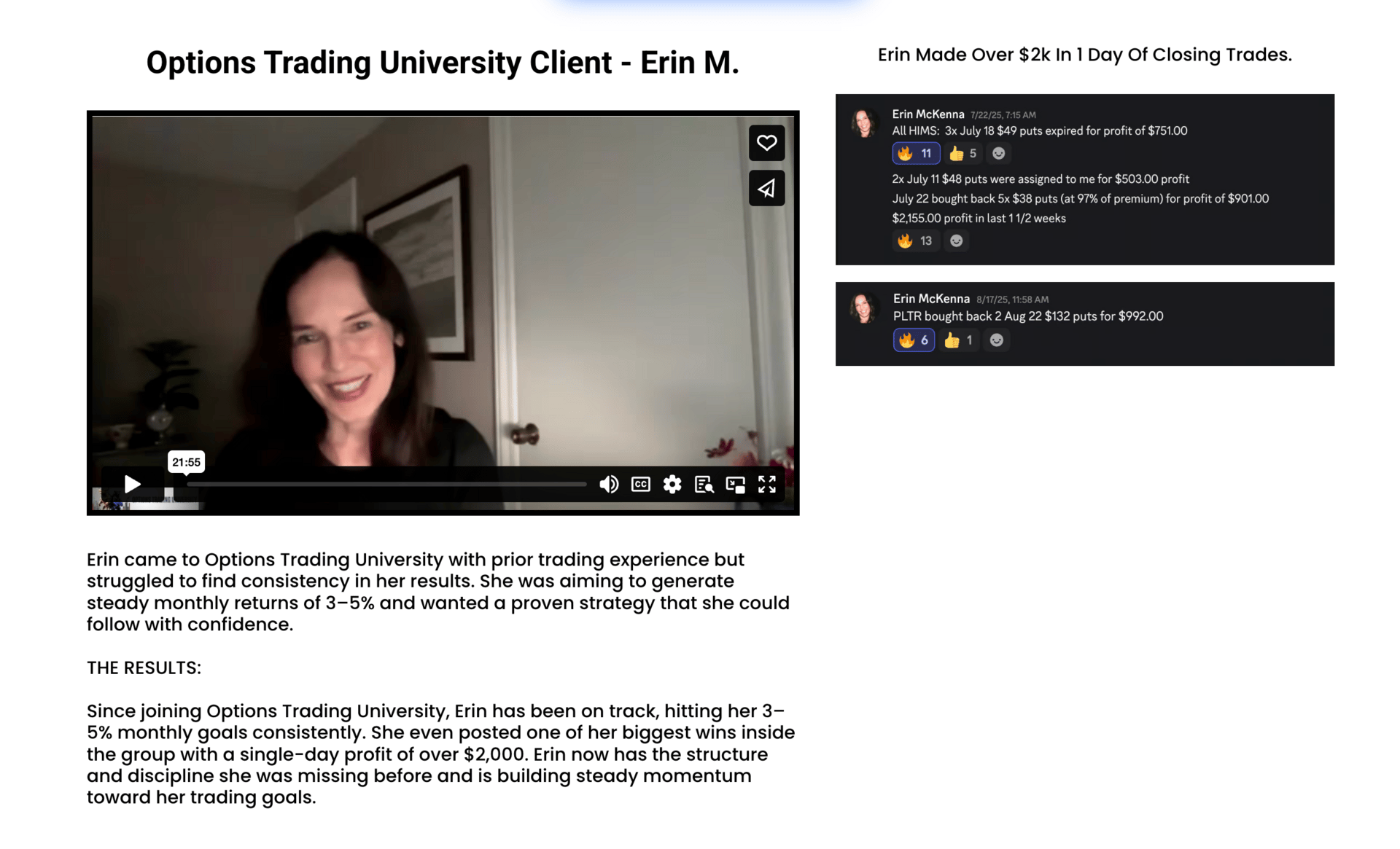

Client Spotlight

This week’s spotlight is on Erin, who began with us hitting consistent 3 to 5 percent monthly goals and has now transitioned into trading full-time after leaving her corporate job. Her growth has been remarkable.

We also had clients closing out strong LEAPS and one member who realized a ten-thousand-dollar gain in just the past two days.

Free Trade of the Week

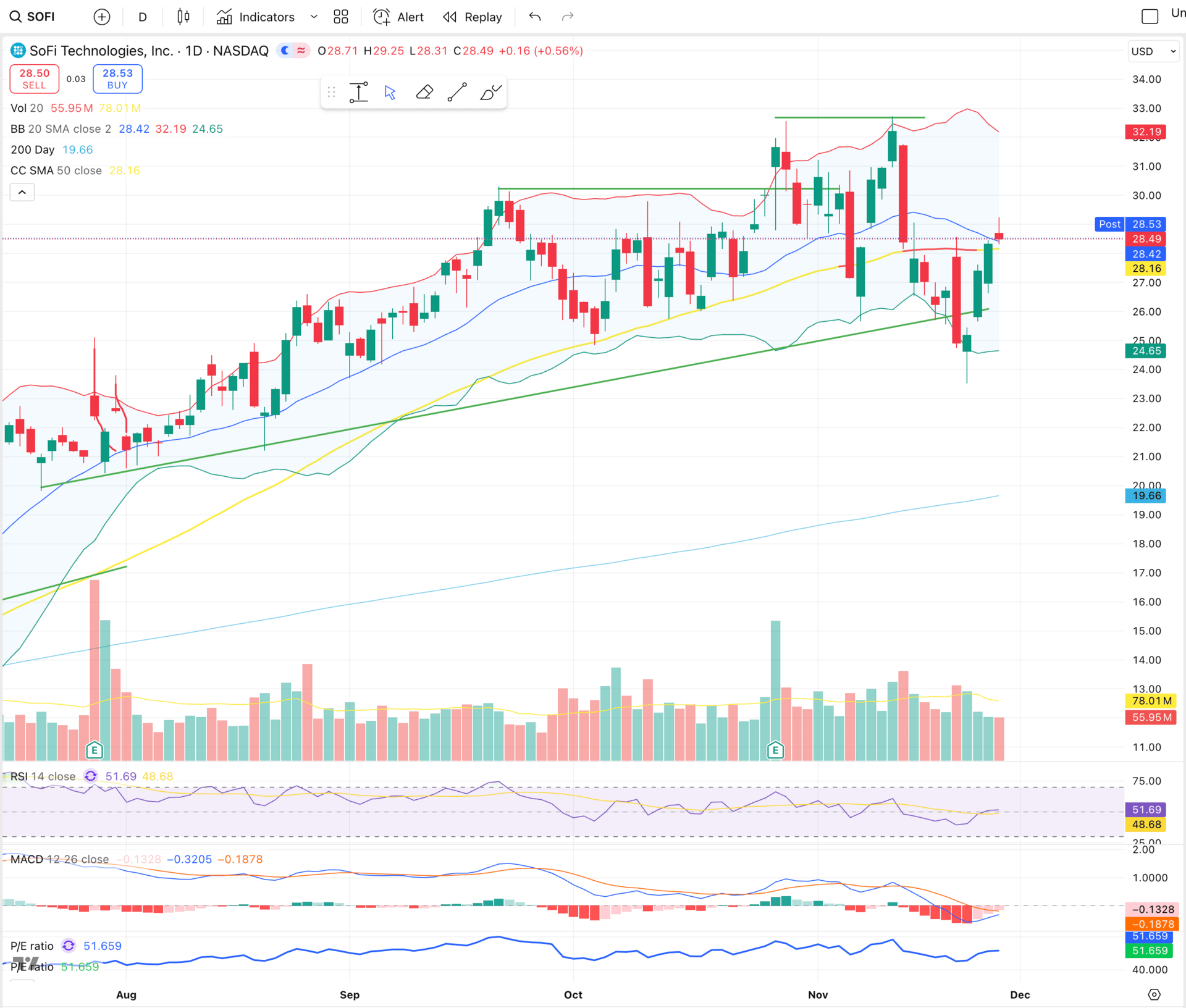

Ticker: $SOFI ( ▲ 3.38% )

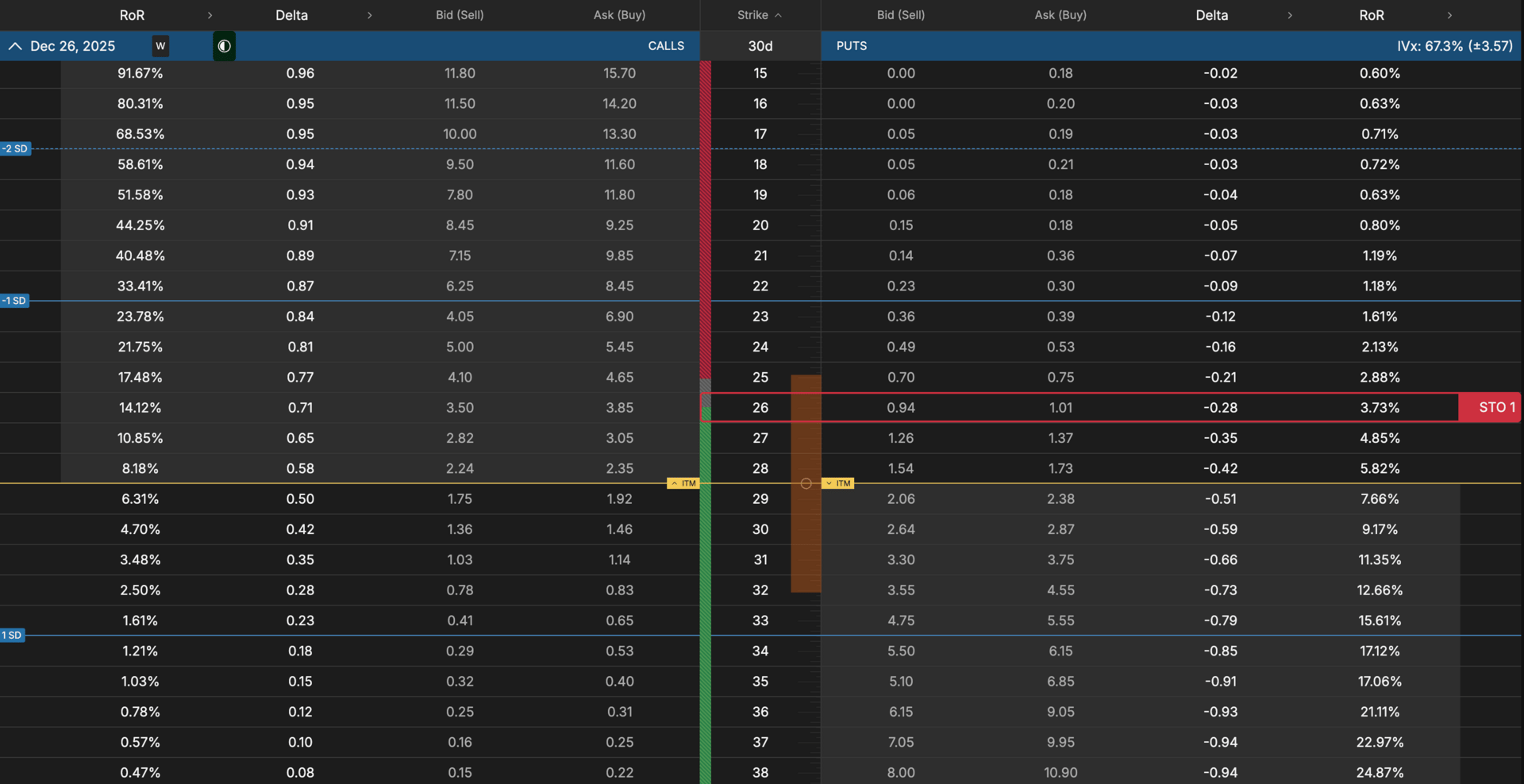

Strategy: Sell the December 26th 26 strike put

Premium Collected: $95

Duration: 30 days

ROI: 3.7 percent

Annualized Return (compounded monthly): 54.6% ROI

Risk: Assignment risk below the 26 level if SOFI sells off into expiration

SOFI is currently sitting right at its mid-Bollinger Band, offering a clean technical level to defend. With rate cut odds high for December and three potential cuts projected for next year, SOFI stands to benefit meaningfully from a lower-rate environment. Even if December does not deliver a cut, the broader trend supports upside for the stock, making this a compelling premium-selling opportunity.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Do red cars cost more to insure?

You may have heard the myth that red cars cost more to insure, often with varying reasons why. The truth is, the color of your car has nothing to do with your premium. Insurance companies are more interested in your vehicle’s make, model, age, safety features, and your driving history. What’s not a myth, though — is that people really can save a ton of money by switching insurers. Check out Money’s car insurance tool to see if you could, too.

Bonus Video

I just uploaded a new YouTube video breaking down the four stocks I’m buying heading into December, along with key QQQ levels to watch. It’s a must-see if you want to stay aligned with where institutional momentum is moving.

Stay focused, stay tactical, and use this week’s volatility to your advantage.

Talk soon,

Ryan