- Options Trading University

- Posts

- NVIDIA Ignites the Market Rally and Reno Clocks an 8.1% ROI Month

NVIDIA Ignites the Market Rally and Reno Clocks an 8.1% ROI Month

Hey Options Trader,

This week brought a major catalyst for the entire market as NVIDIA $NVDA ( ▼ 4.17% ) delivered another blockbuster earnings report. Momentum is shifting quickly, and we’re setting up for what could be a strong rally into year-end. In today’s newsletter, I’ll walk you through my updated market outlook, showcase an inspiring client story, share a brand-new trade idea, and give you a bonus resource to help sharpen your strategy heading into December.

Here’s what we are covering:

Market outlook for the week

Client spotlight

Free Trade of the Week

Bonus resource video

Market Snapshot

I’m very bullish here. NVIDIA reported incredible earnings with 62 percent year-over-year revenue growth and 73 percent net profit margins, sending the stock up over 4 percent after hours and pulling up many AI names with it.

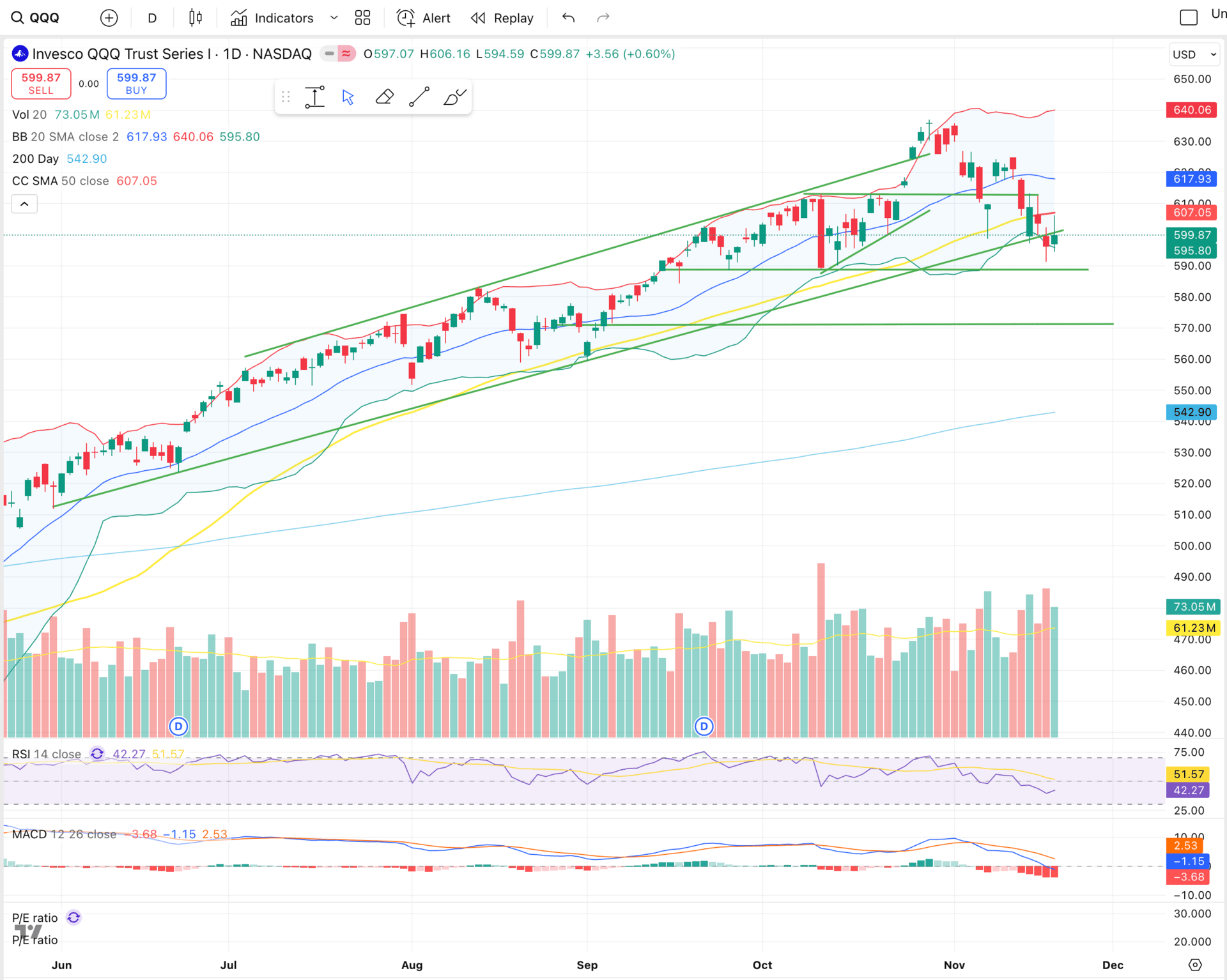

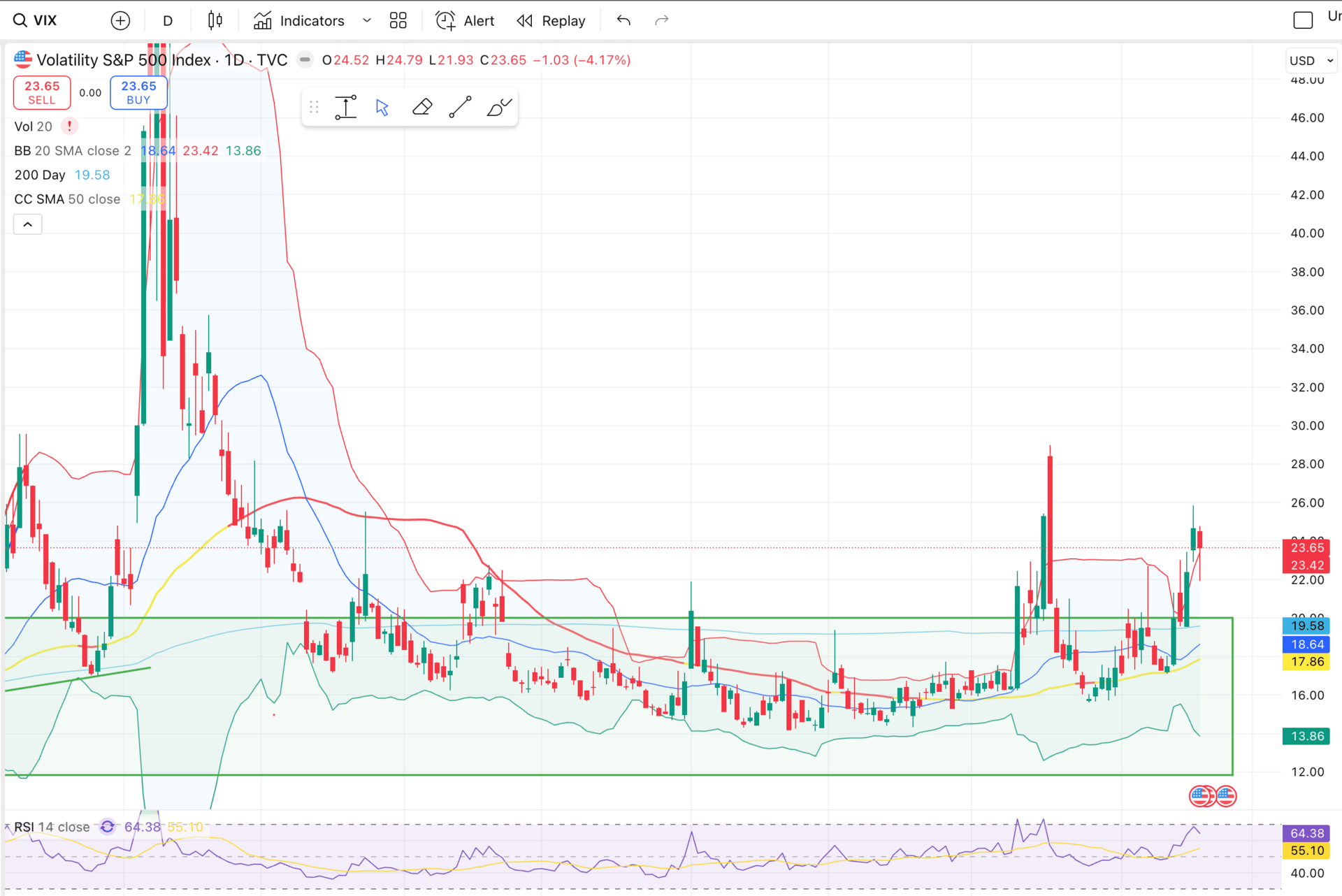

$QQQ ( ▼ 0.32% ) is now set to open around 609 to 610, and while we may see some initial profit taking, the bigger picture points toward a steady bullish rally into Christmas. With the $VIX ( ▲ 6.6% ) likely falling under 20 tomorrow, I’ll be taking profits on select positions to raise my cash from 14 percent back toward 20 percent, bringing me closer to my VIX cash allocation levels. NVIDIA gave us the catalyst we needed, and now we simply wait to see how the non farm payrolls report comes in.

QQQ will confirm the RSI bullish crossover tomorrow

Vix collapse sub 20 tomorrow

Client Spotlight

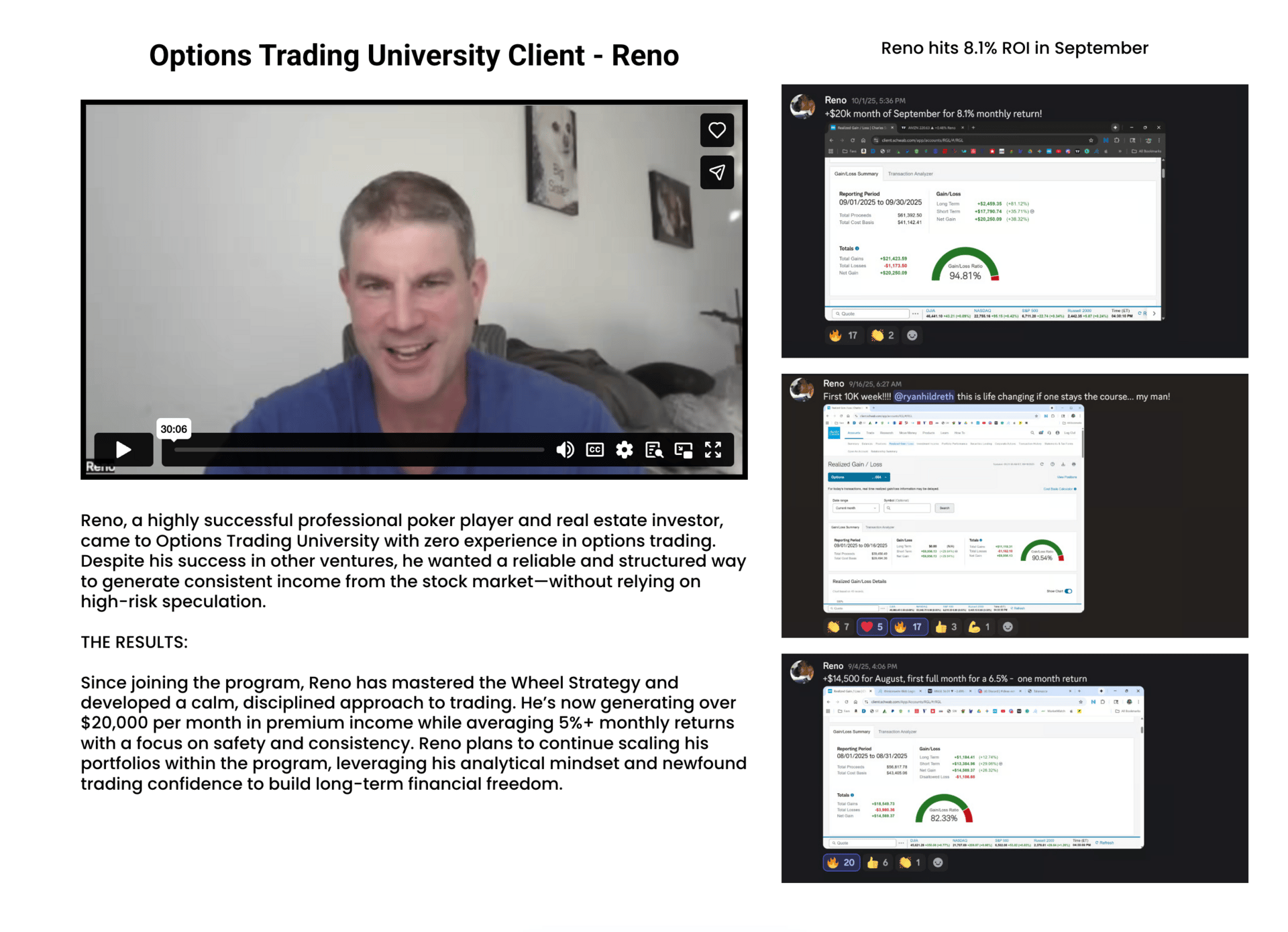

We had the pleasure of interviewing Reno, a highly successful professional poker player and real estate investor. Since joining the program, he’s been consistently generating over $20,000 per month and achieving more than 5 percent monthly returns. In September, he hit a record 8.1 percent month.

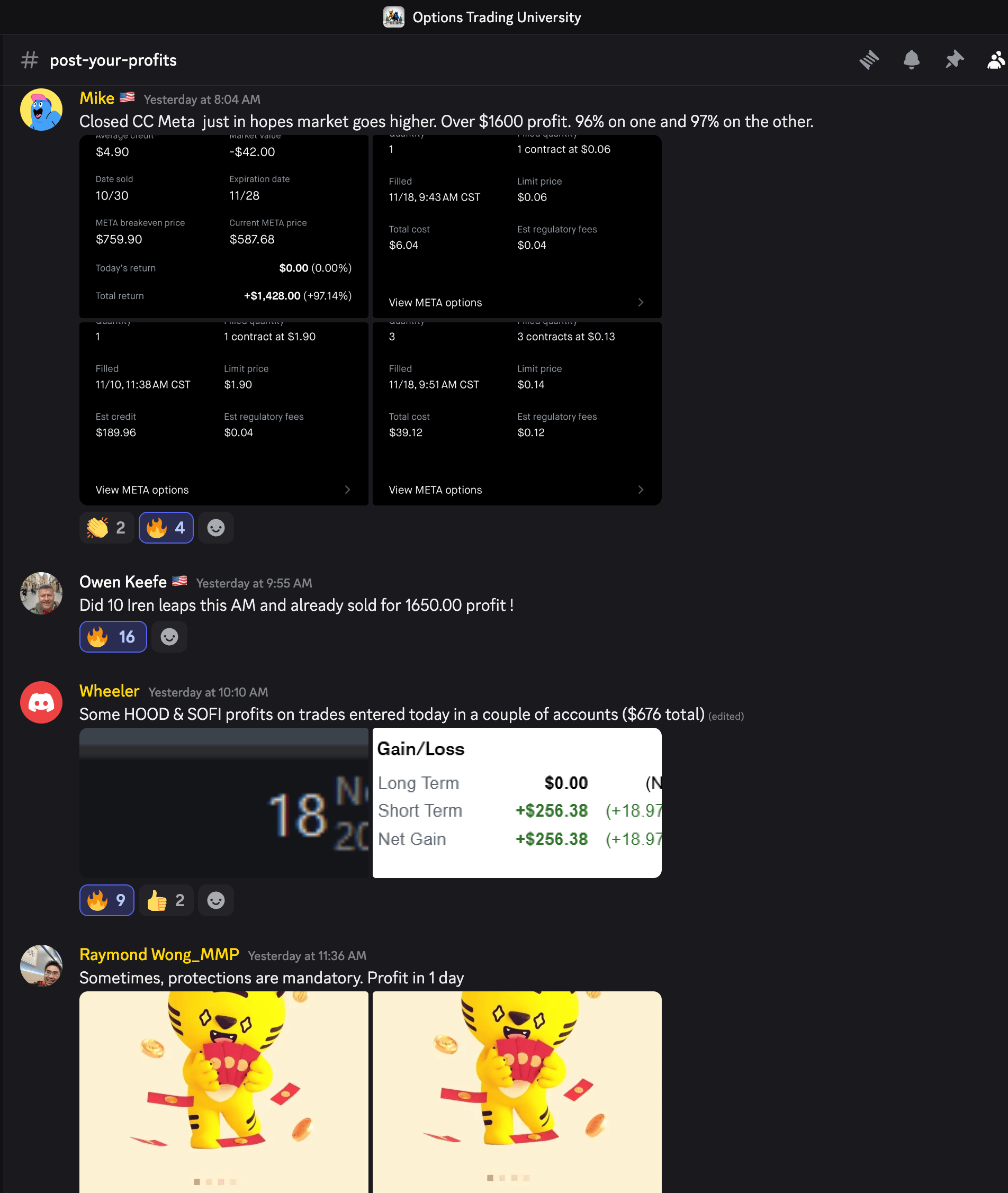

Even today, with the market pulling back earlier, clients continued executing the fundamentals. Mike closed out $1,600 in covered call profits, Owen locked in $1,650 on LEAPS, and several others wrapped up strong LEAPS trades as well.

Free Trade of the Week

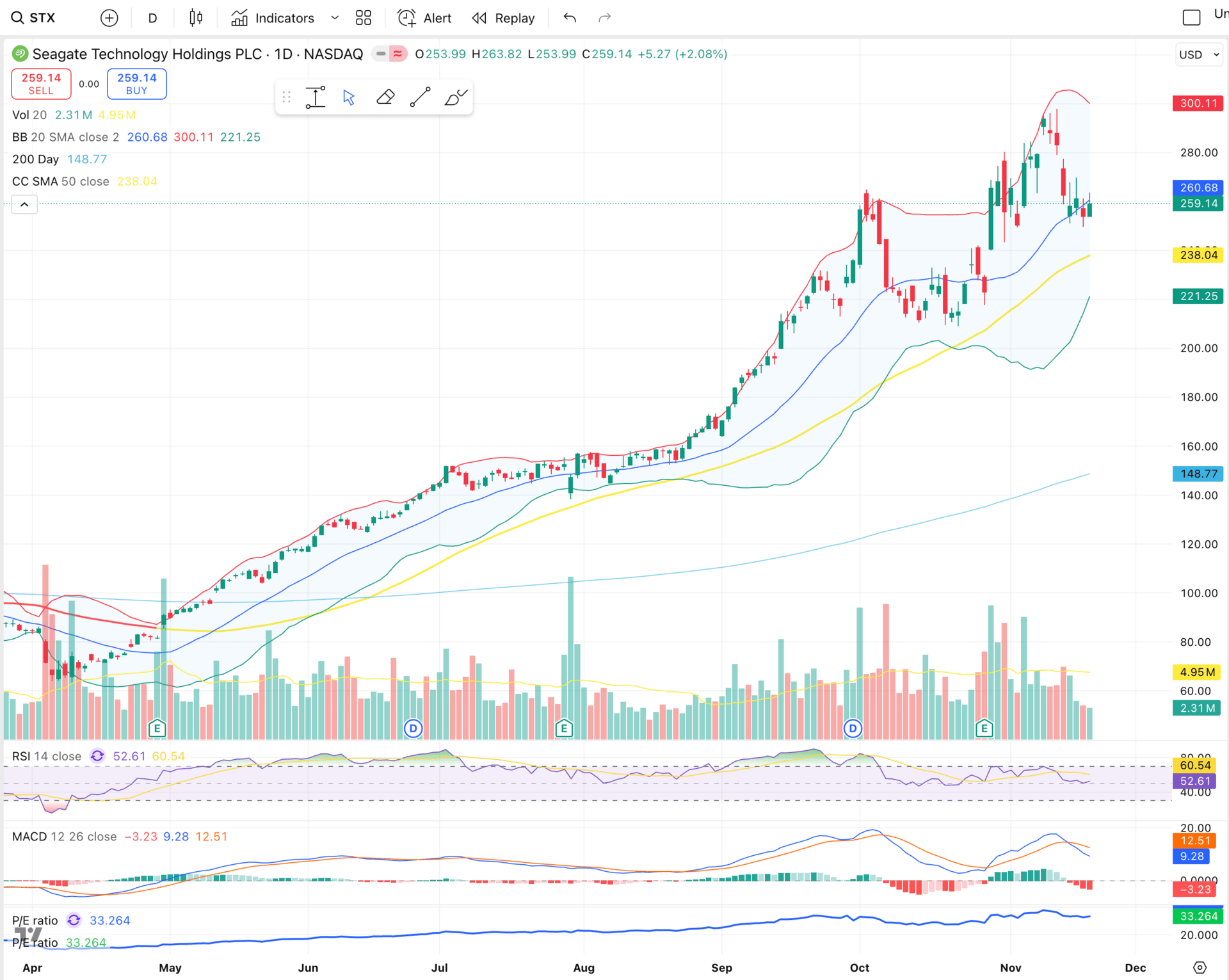

Ticker: $STX ( ▼ 0.45% )

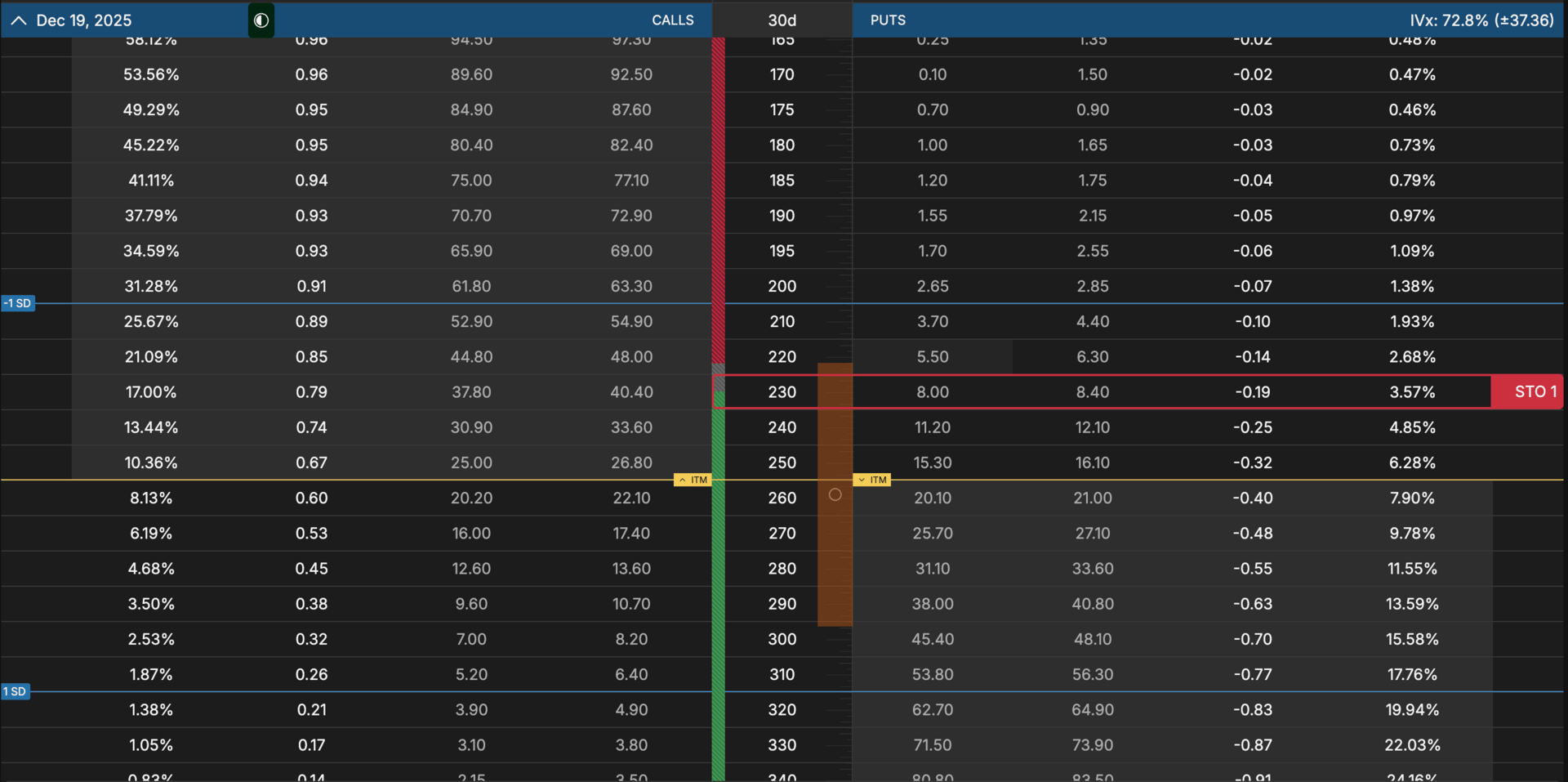

Strategy: Sell the 230 cash-secured put

Premium Collected: Approximately $800

Duration: 30 days

ROI: 3.57 percent

Annualized Return (compounded monthly): 52.86% ROI

Risk: Assignment risk at the 230 level if STX trades below your strike

Seagate Technology is becoming an increasingly important player in the AI hardware ecosystem as data centers require more storage capacity to support massive GPU clusters. With a low P/E of 33 for an AI-adjacent business and a strong long-term trend, STX offers a clean premium setup even after its recent pullback. This is a new addition to the portfolio and a straightforward trade to execute.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Bonus Video

I just released a new YouTube video breaking down NVIDIA’s earnings, what I’m doing with the stock next, and updates on positions like HOOD, TSM, PLTR, and IREN. This is a great one to watch so you can see exactly how I’m navigating the current momentum.

The best opportunities always appear when others hesitate.

Talk soon,

Ryan