- Options Trading University

- Posts

- My $300K Move + Mike’s $295K Win (Full Breakdown Inside)

My $300K Move + Mike’s $295K Win (Full Breakdown Inside)

Hey Options Trader,

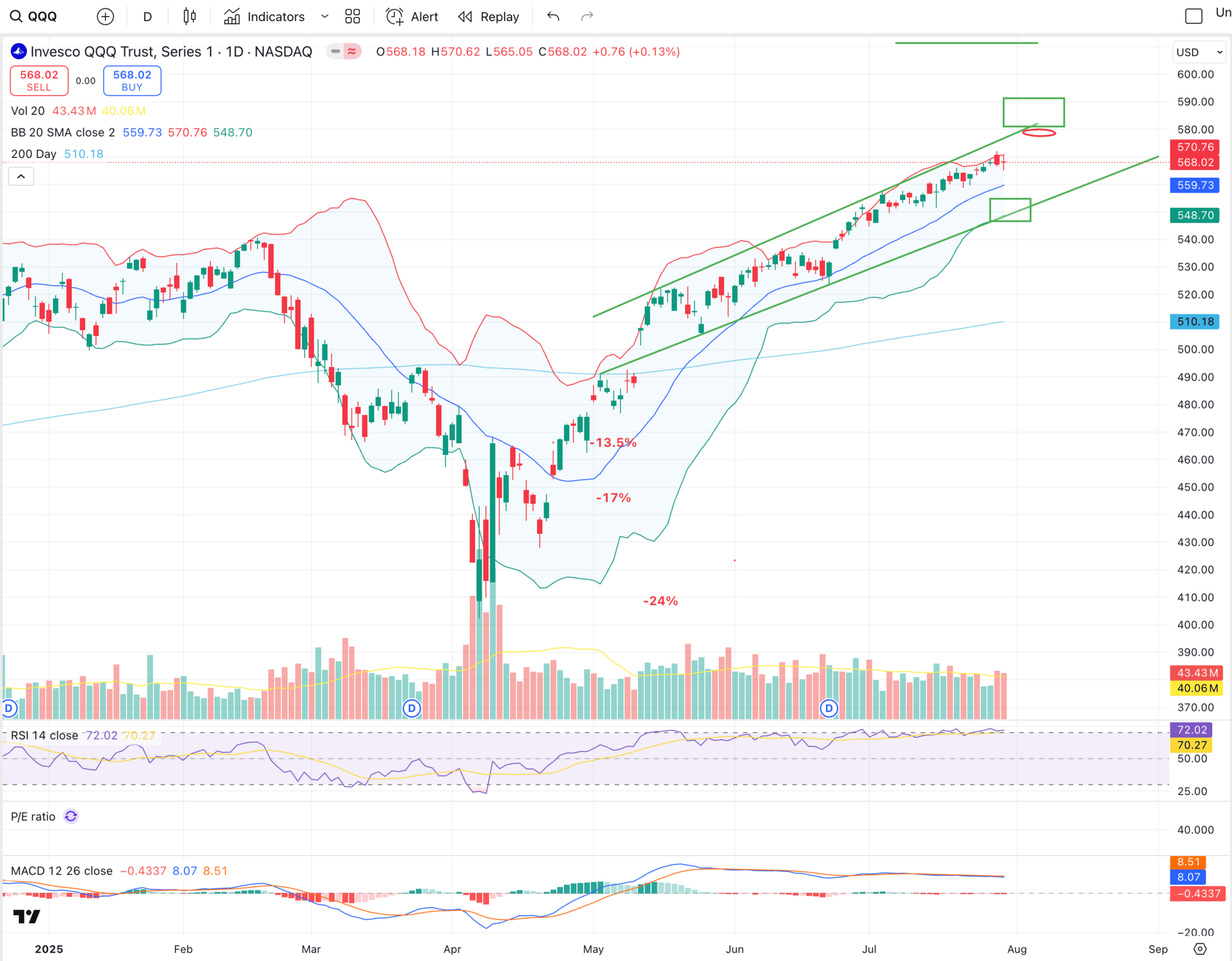

The market has pushed higher post-hours, with $QQQ ( ▲ 0.74% ) now touching 578, almost at my 580–590 price prediction zone. I believe a market pullback is due, as profit taking becomes more likely after strong earnings from Microsoft, Qualcomm, Meta, Robinhood, and others.

Here’s what we are covering:

Market outlook and my updated cash allocation plan

Client wins: $295K year-to-date and $600K lifetime

Free trade of the week: $HOOD ( ▲ 1.03% ) 4% ROI in 30 days

Bonus video: my $300K move into HUD, Meta, and SoFi

Market Snapshot

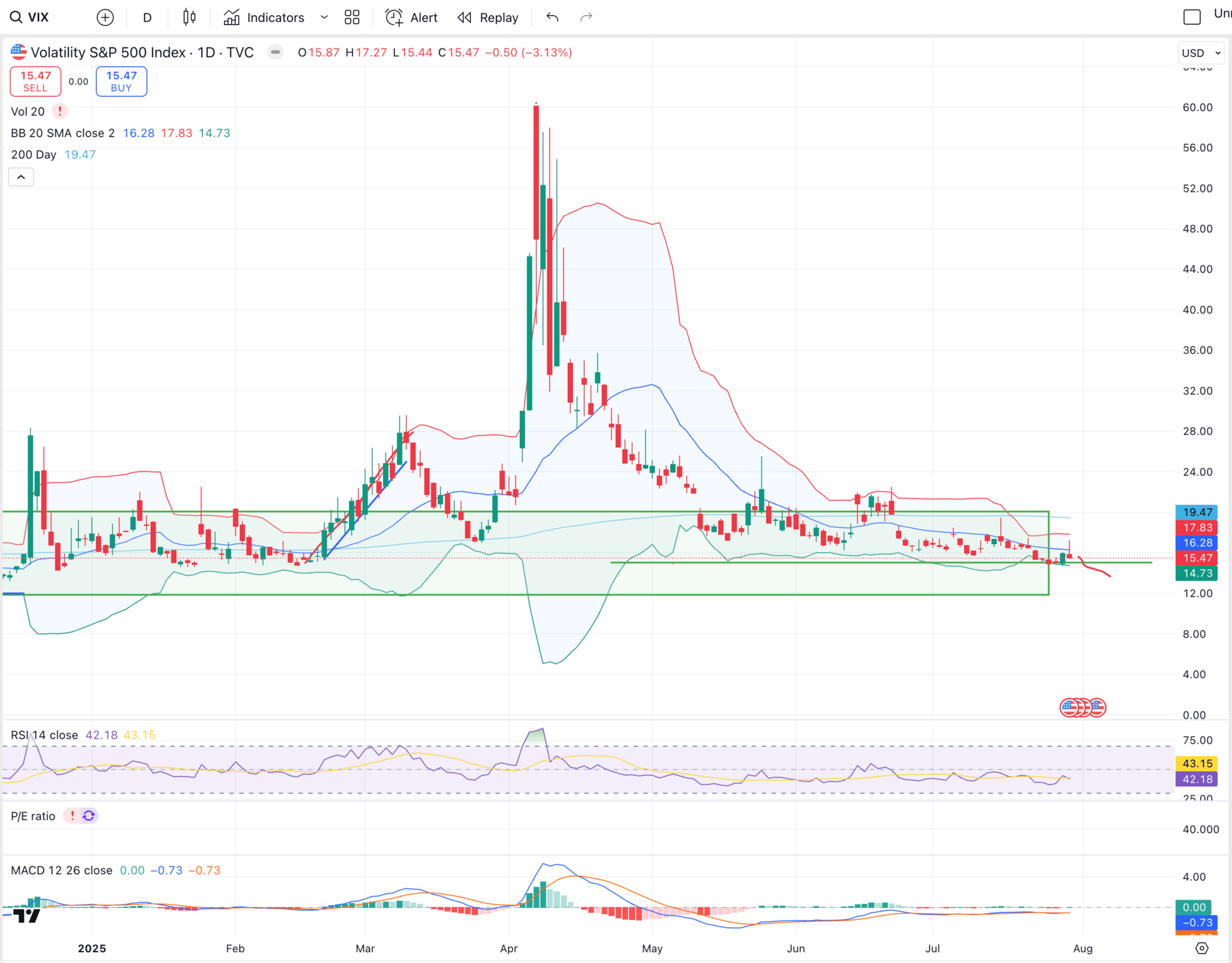

We are in my caution phase. QQQ is almost at the top of my range, and VIX remains low. A short-term rally could still happen, but the risk of a pullback increases at these levels. Any dip will be a good opportunity to buy quality names, but I’m shoring up cash to be ready.

The Federal Reserve did not cut rates, which was already priced in. The CME FedWatch tool still shows over 80 percent odds of a rate cut in October. My current cash levels are 17 percent, as I recently put on a couple new positions. I may increase cash to 20–25 percent, possibly even 30 percent, later in the week.

QQQ touching the $580 range at the open tomorrow

VIX most likely heading much lower, greed commences.

Client Spotlight & Make Multi 6 Figures Trading Options

Our featured interview this week is with Sean. In his first month with us, Sean made $79,000 in profit. Since then, he is up $600,000. This interview is one of our best and remains inspiring to watch.

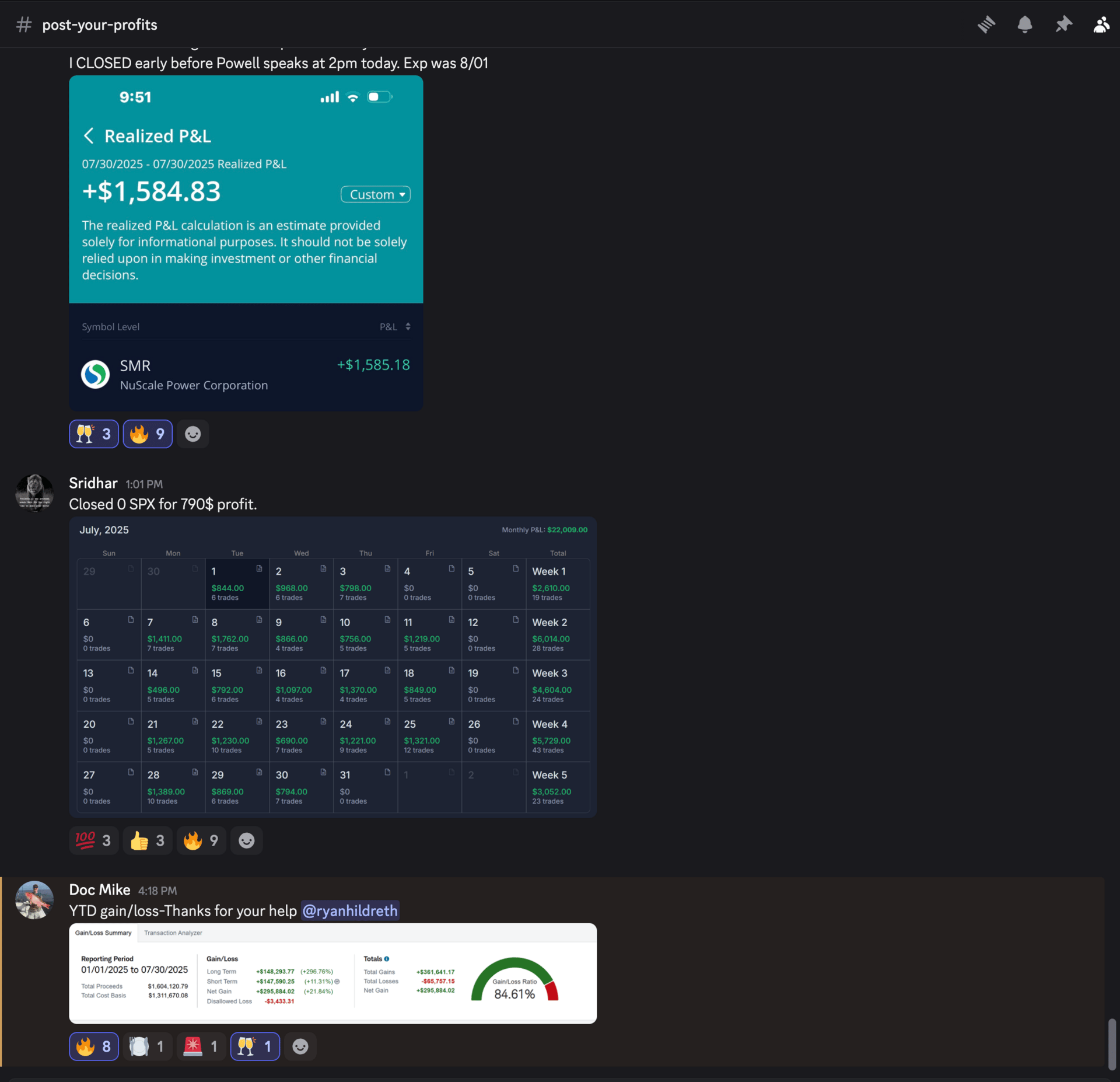

Doc Mike posted his year-to-date gain since joining Options Trading University: $295,884.02. This is a massive achievement, and a clear example of applying our strategy consistently.

Free Trade of the Week

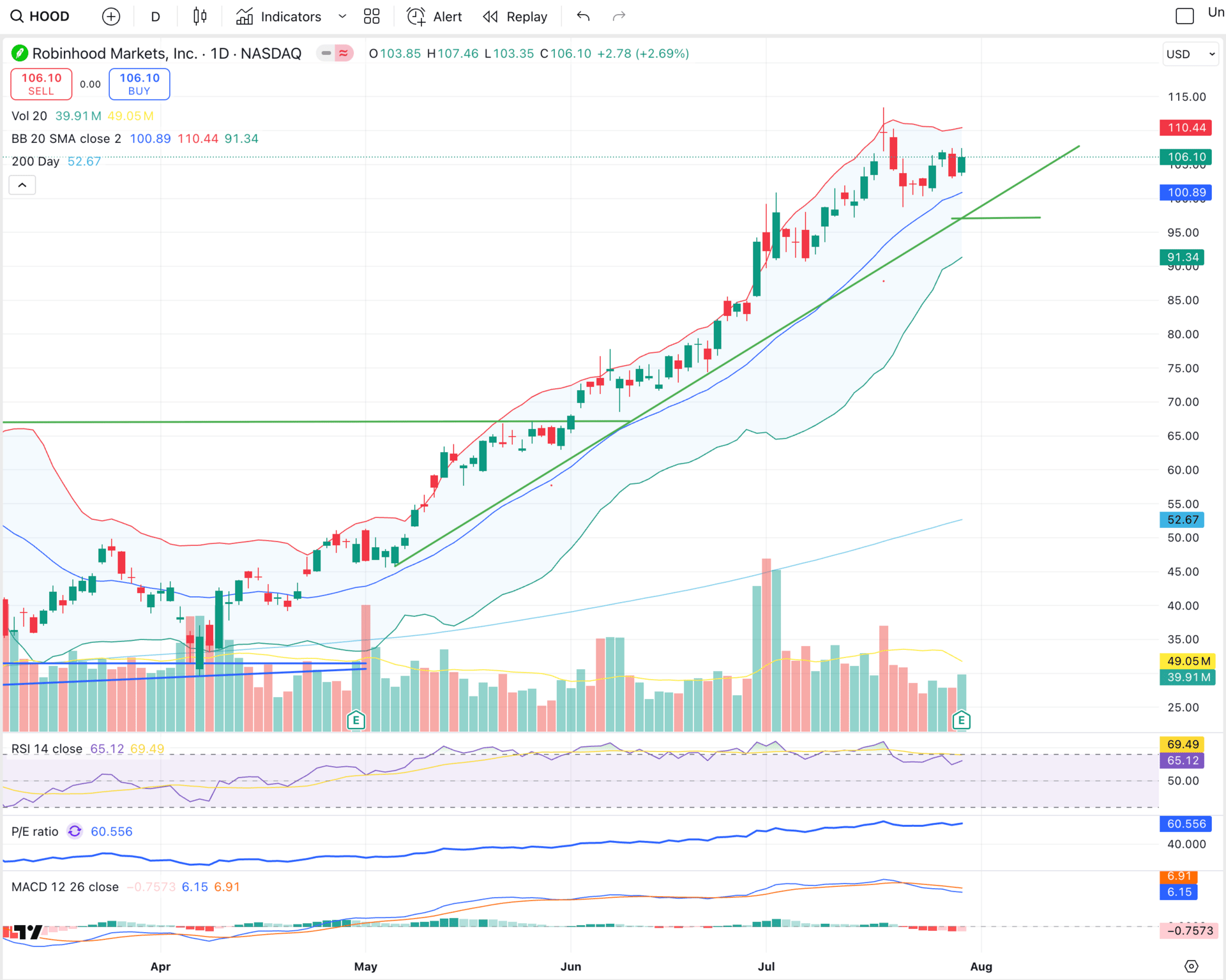

Robinhood $HOOD ( ▲ 1.03% ) is my free trade of the week now that earnings are behind us. I believe HOOD offers strong opportunities for consistent returns going forward.

Trade: Sell August 29th $97 cash-secured put

Premium: 4% ROI in 30 days (annualized ~48.7%)

Robinhood is forming a bull flag pattern and could break out soon if the market pushes higher. Any dips will likely be bought up. Earnings were strong, and fundamentals remain solid.

Hood Forming A Classic Bull Flag

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Bonus Video

In my latest video, I break down my $300K portfolio move, including my positions in HOOD, Meta, and SoFi. I also discuss my earnings strategy and how I’m positioning my portfolio.

Click here to watch the full breakdown.

Stay cautious, stay prepared, and be ready for the next move.

Talk soon,

Ryan

Options Trading University