- Options Trading University

- Posts

- January Volatility Setup, 2025 Portfolio Performance, and a $59,000 Client Breakthrough

January Volatility Setup, 2025 Portfolio Performance, and a $59,000 Client Breakthrough

Hey Options Trader,

The markets are entering a more tactical phase as we head into the heart of January, with volatility starting to creep back into the equation. While the broader trend remains constructive longer term, the short term setup suggests we may see some back and forth as key economic data hits the tape. This week is more about positioning, patience, and preparation than chasing momentum. Staying flexible here allows us to take advantage of higher premiums and better entries if volatility expands.

Here’s what we are covering:

My neutral market outlook heading into key economic data

Client Spotlight on a first month $59,000 win

Free Trade of the Week with a high probability income setup

Bonus resource covering my full 2025 portfolio results

Market Snapshot

My market outlook is neutral heading into next week. We have several key catalysts coming up, including ADP unemployment and the U.S. unemployment rate on Friday, January 9th, which could easily introduce more volatility.

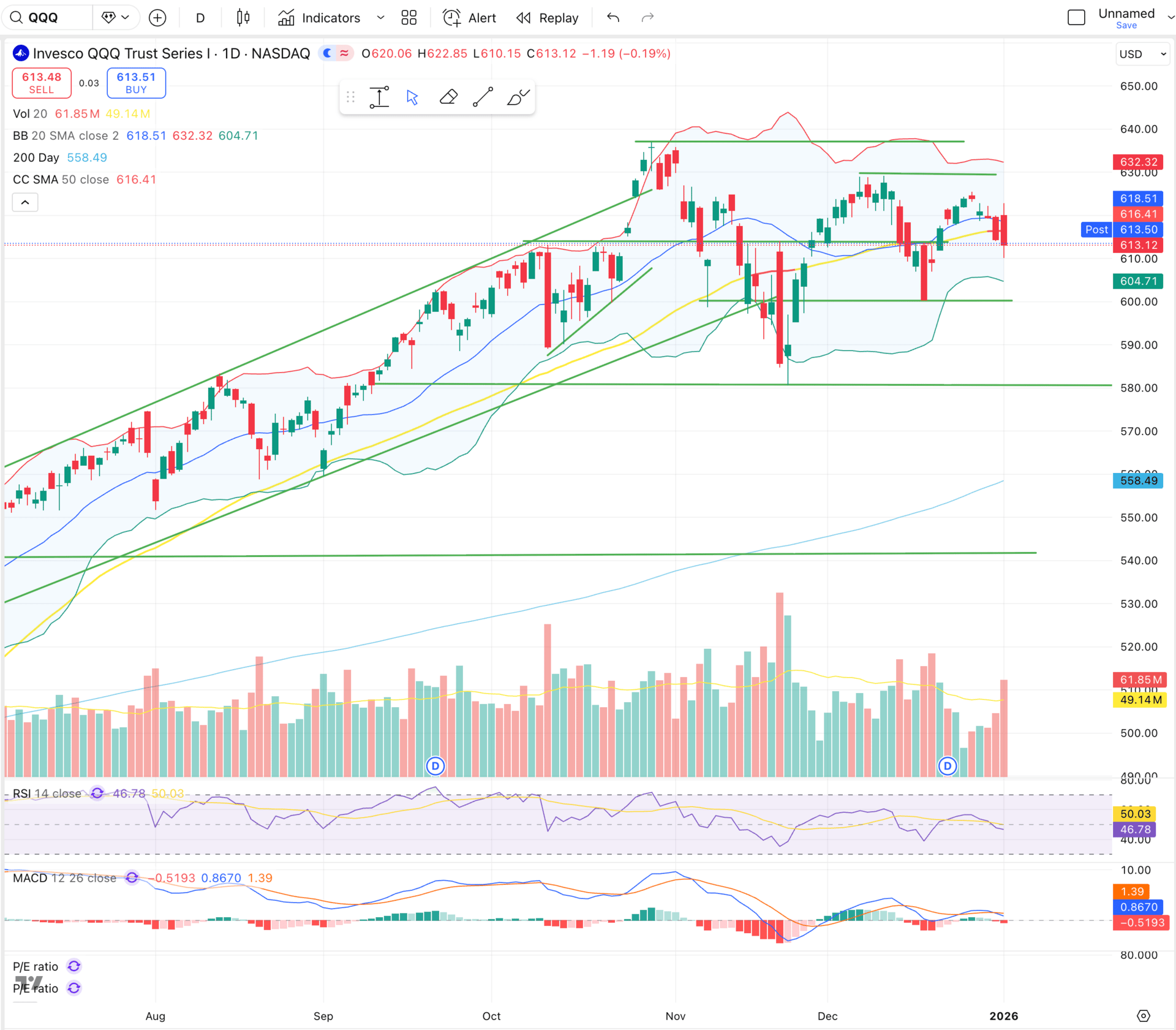

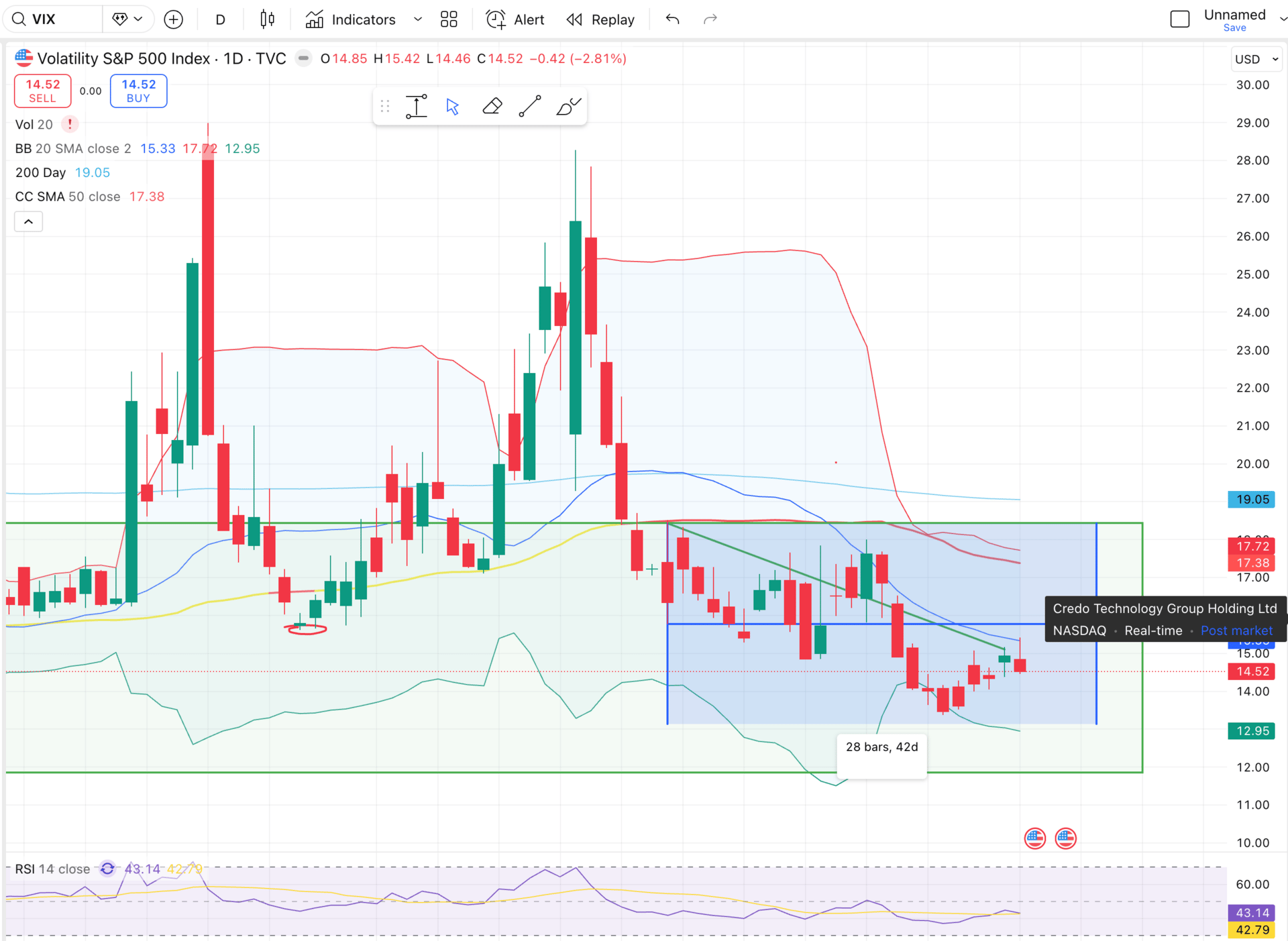

$QQQ ( ▲ 0.89% ) is currently trading around $613, and I think a pullback toward $605 or even $600 is very possible if volatility expands. On the upside, if unemployment data comes in weaker than expected and March rate cut probabilities increase, we could see a retest of the $637 area. The $VIX ( ▼ 5.64% ) is currently sitting in the mid 14s around $14.52, and we are now roughly 35 days into the average 42 day period where the VIX stays below $18.50. As we approach that threshold, the odds of a volatility spike increase, which is why I expect a potential pullback first, followed by a rally higher into earnings season.

QQQ RSI bearish crossover as well as MACD bearish momentum short term

VIX looking like it wants to trend up into next weeks economic data

Client Spotlight

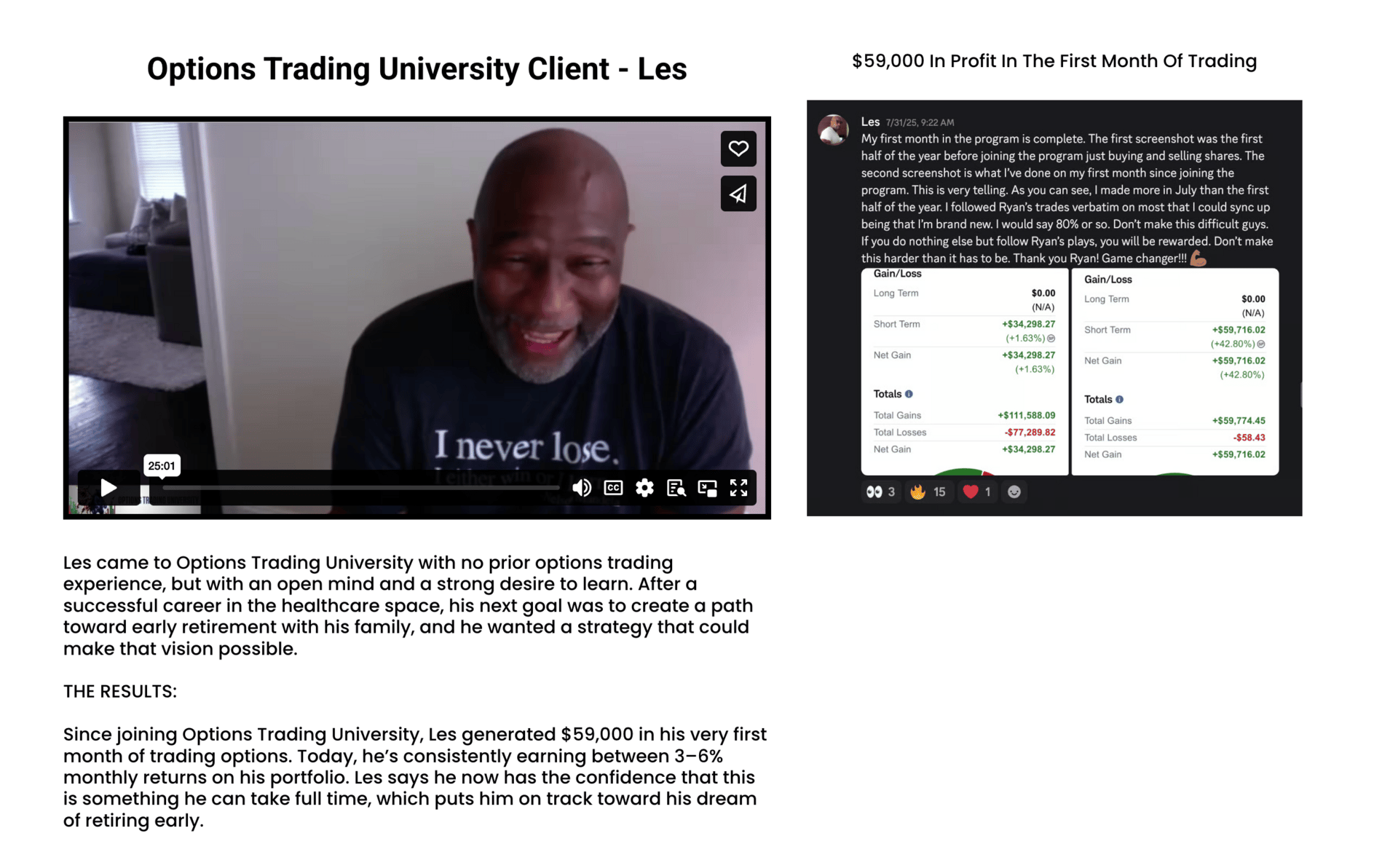

This week’s client spotlight goes to Les. In his very first month trading with Options Trading University, Les generated $59,000 in profit by following our structured approach and risk management principles. Since then, he has gone on to produce six figure months and wrapped up a very successful 2025.

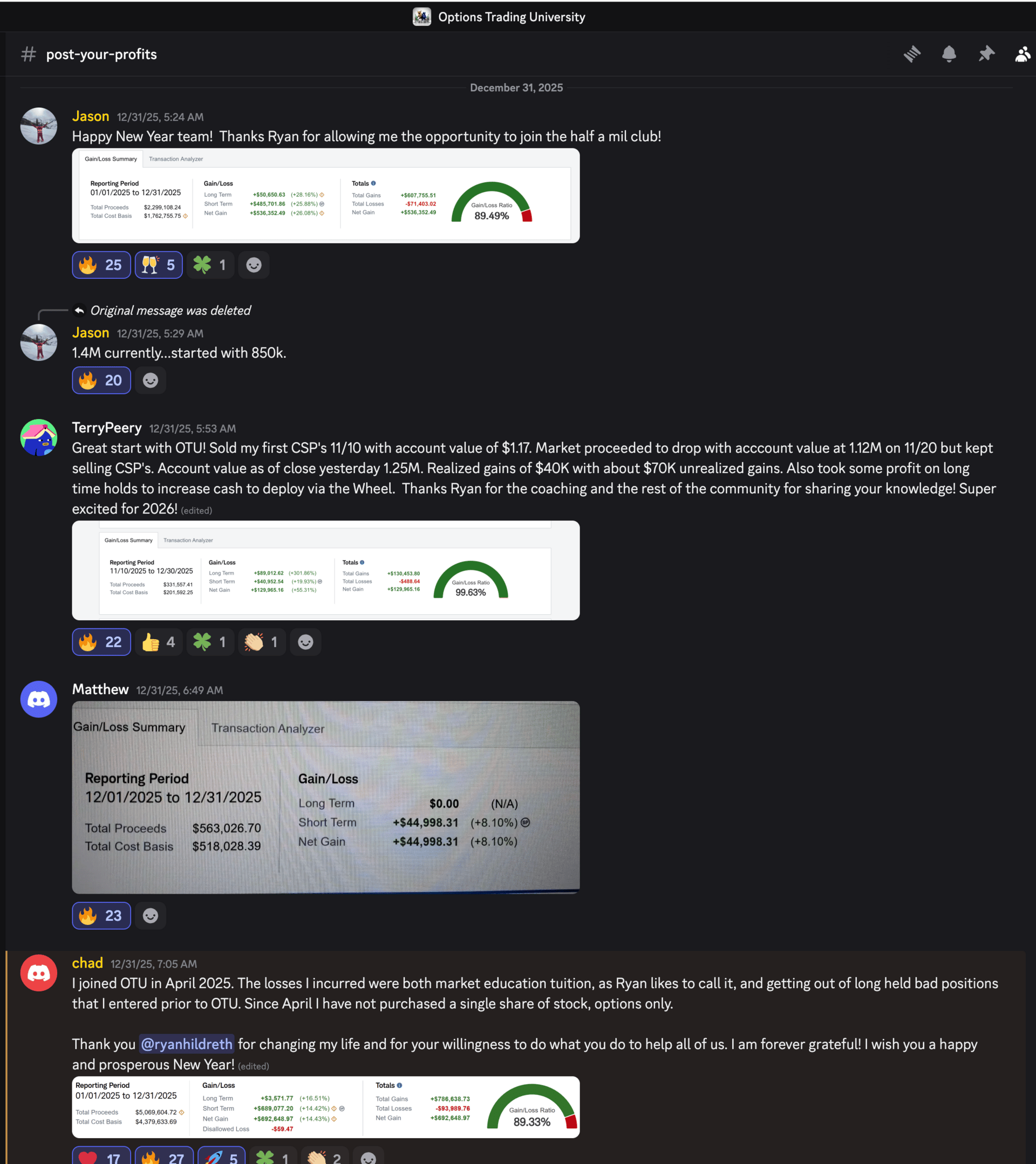

Stories like this are becoming more common inside OTU, with other clients recently sharing results such as Jason reaching $536,000 in profit and Chad reaching $692,000 in profit since joining in 2025.

Free Trade of the Week

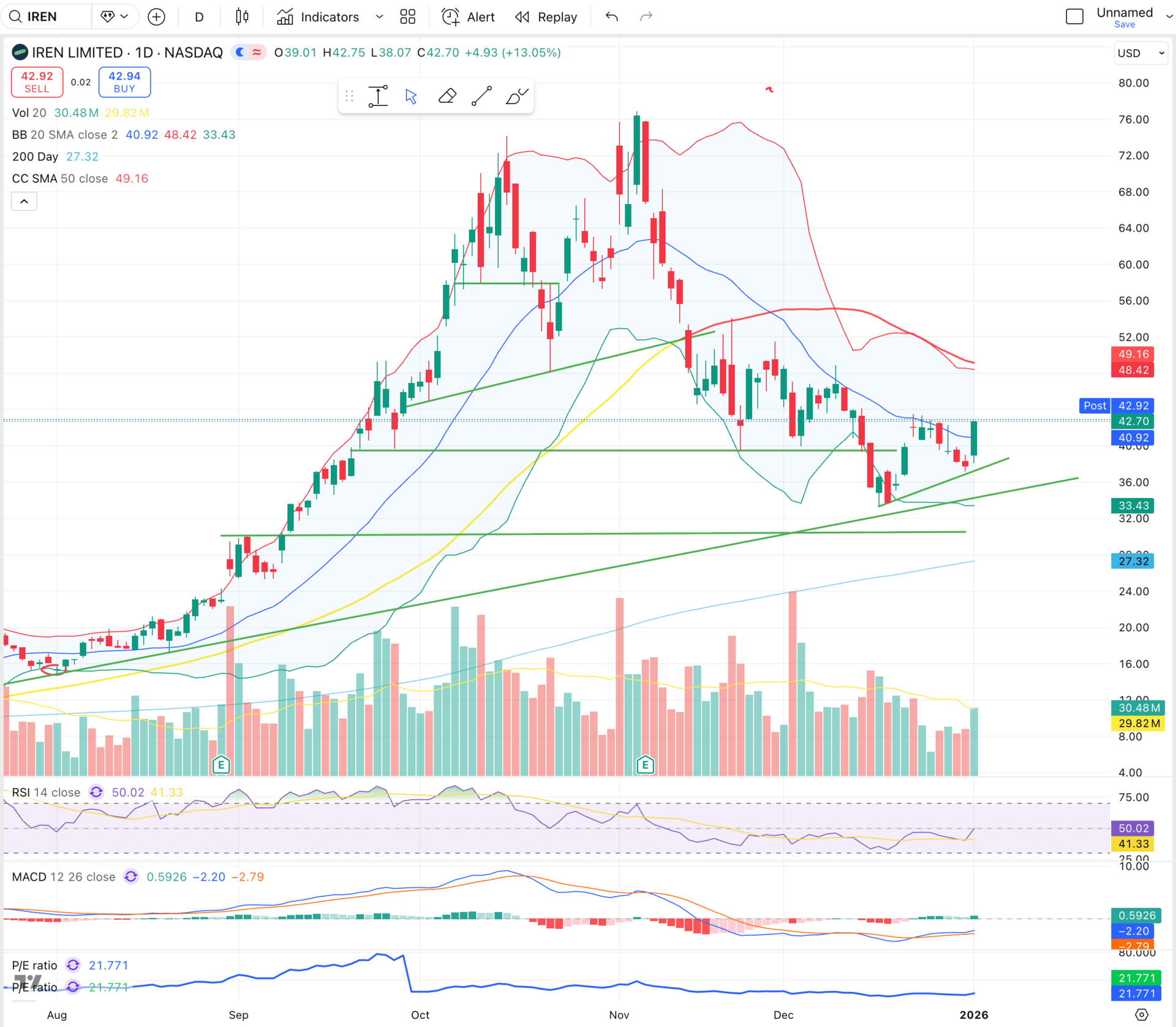

Ticker: $IREN ( ▼ 7.65% )

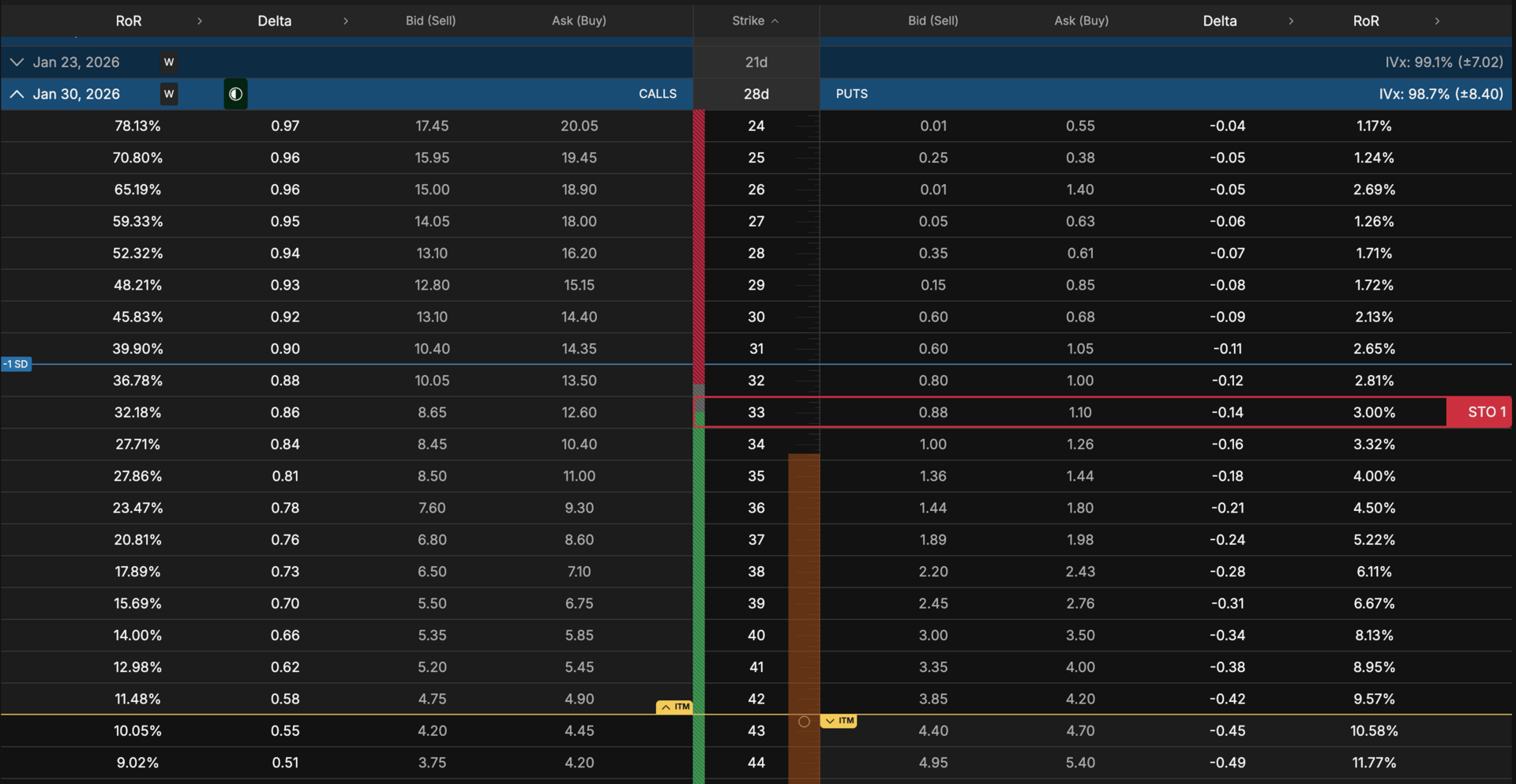

Strategy: Sell the January 30th $33 cash secured put

Premium Collected: $100

Duration: 28 days

ROI: Just over 3%

Annualized Return (compounded monthly): Approximately 42%

Risk: Assignment at $33 per share, a level well below current price and far from all-time highs

IREN saw a strong 13% rebound today, but I believe the move is not over. The stock is still well off its all-time highs, premiums remain elevated, and the company is fundamentally strong. As AI capital rotates back into the sector, IREN stands to benefit significantly due to its low cost electricity contracts in Texas and its ability to efficiently scale data center infrastructure.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

You could be wasting hundreds on car insurance

You could be wasting hundreds every year on overpriced insurance. The experts at FinanceBuzz believe they can help. If your rate went up in the last 12 months, check out this new tool from FinanceBuzz to see if you’re overpaying in just a few clicks! They match drivers with companies reporting savings of $600 or more per year when switching!* Plus, once you use it, you’ll always have access to the lowest rates; best yet, it’s free. Answer a few easy questions to see how much you could be saving.

Bonus Video

I just uploaded a new YouTube video breaking down my full 2025 portfolio returns and walking through my top three cash secured put opportunities for the coming week. This is a great resource if you want to see how everything fits together at the portfolio level.

Discipline in preparation creates confidence in execution.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.