- Options Trading University

- Posts

- How Jason Hit $100K Months (And What I’m Buying Next)

How Jason Hit $100K Months (And What I’m Buying Next)

Hey Options Trader,

What a reversal. After a very sharp selloff, buyers came flooding back in. From mega-caps to high-flyers like $BBAI ( ▲ 5.12% ) , $OKLO ( ▲ 3.12% ) , and $SMR ( ▲ 6.59% ) (some up over 30% in a single session), it’s clear risk is back on. Add Bitcoin and Ethereum bouncing hard, and it’s safe to say confidence has returned to the market.

Here’s what we are covering:

My bullish outlook after the shakeout

Client Spotlight: Jason’s $100K months + Richard $91k In A Day

Free Trade of the Week: CLS earnings setup

Bonus Resource: 3 stocks I’m buying now for November

Market Snapshot

The market had every chance to roll over and it didn’t. People took profits, rotated capital, and then jumped right back in. That kind of price action shows real strength underneath.

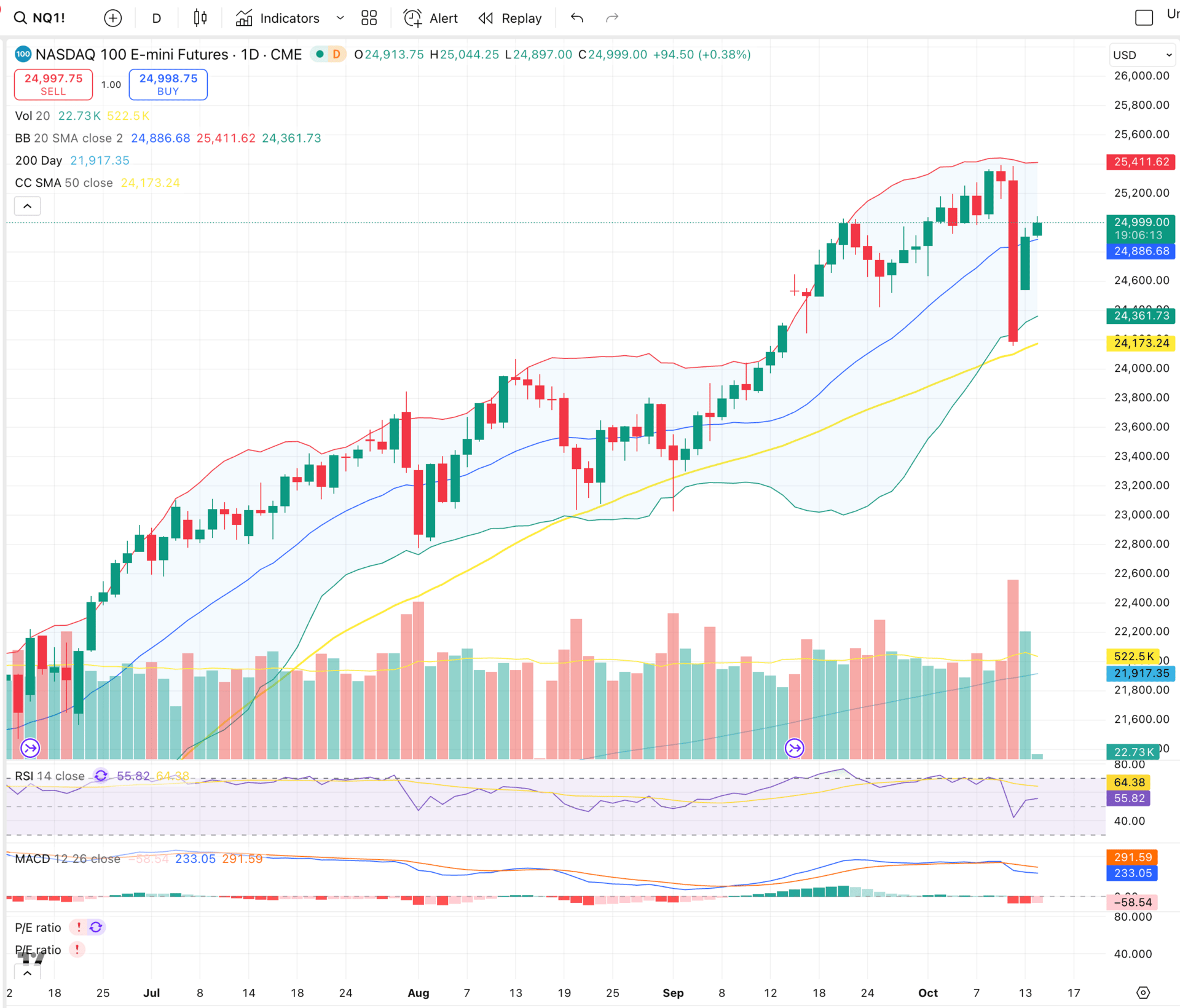

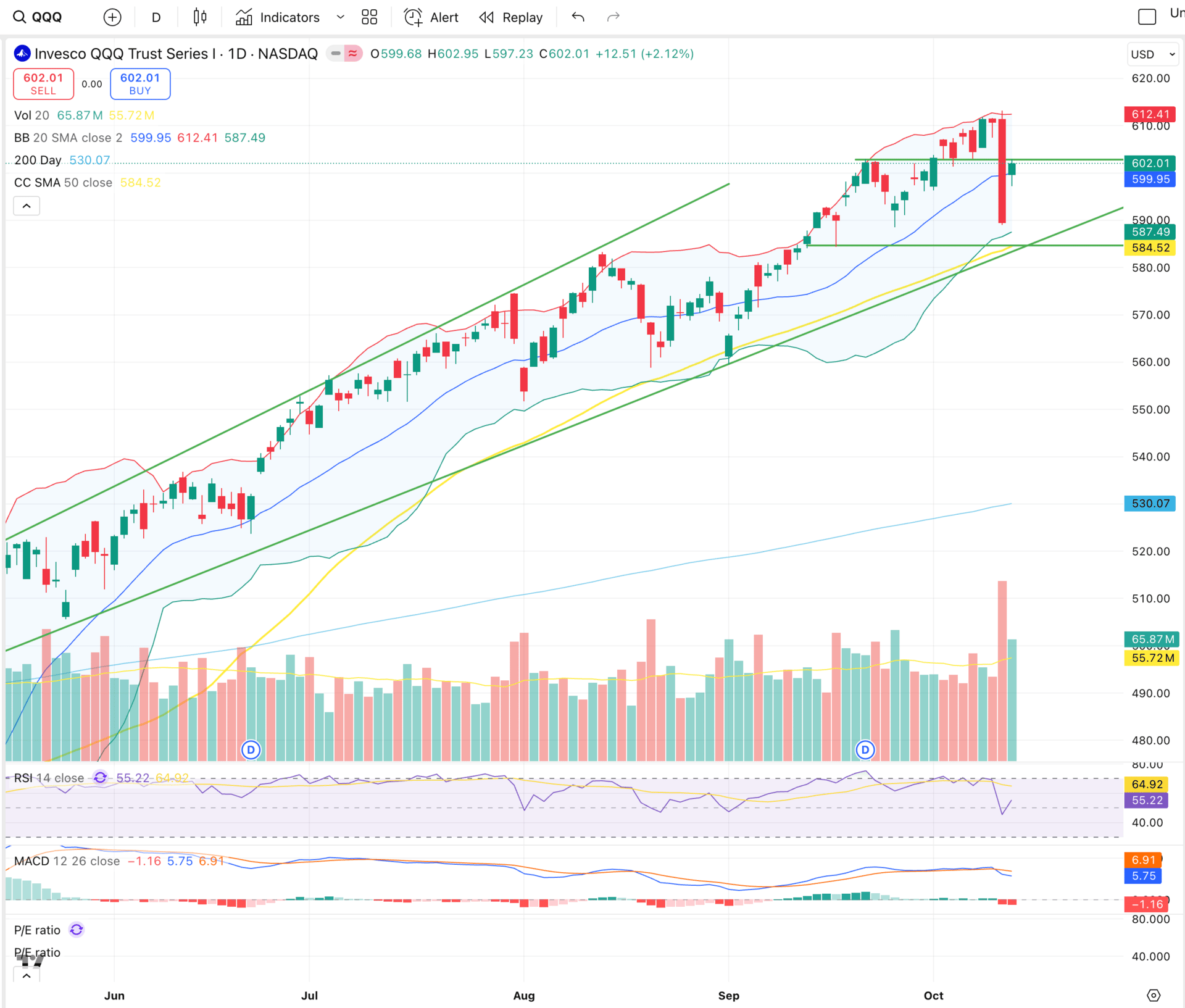

NASDAQ futures are green as of tonight, and $QQQ ( ▲ 1.07% ) is sitting just under the 603 area. If we break and hold above that level, expect a steady grind higher and a potential bullish crossover on both the RSI and MACD daily charts.

Nasdaq Futures already retracing the move

QQQ had a lot of bullish volume today. Bullish crossover ready to commence.

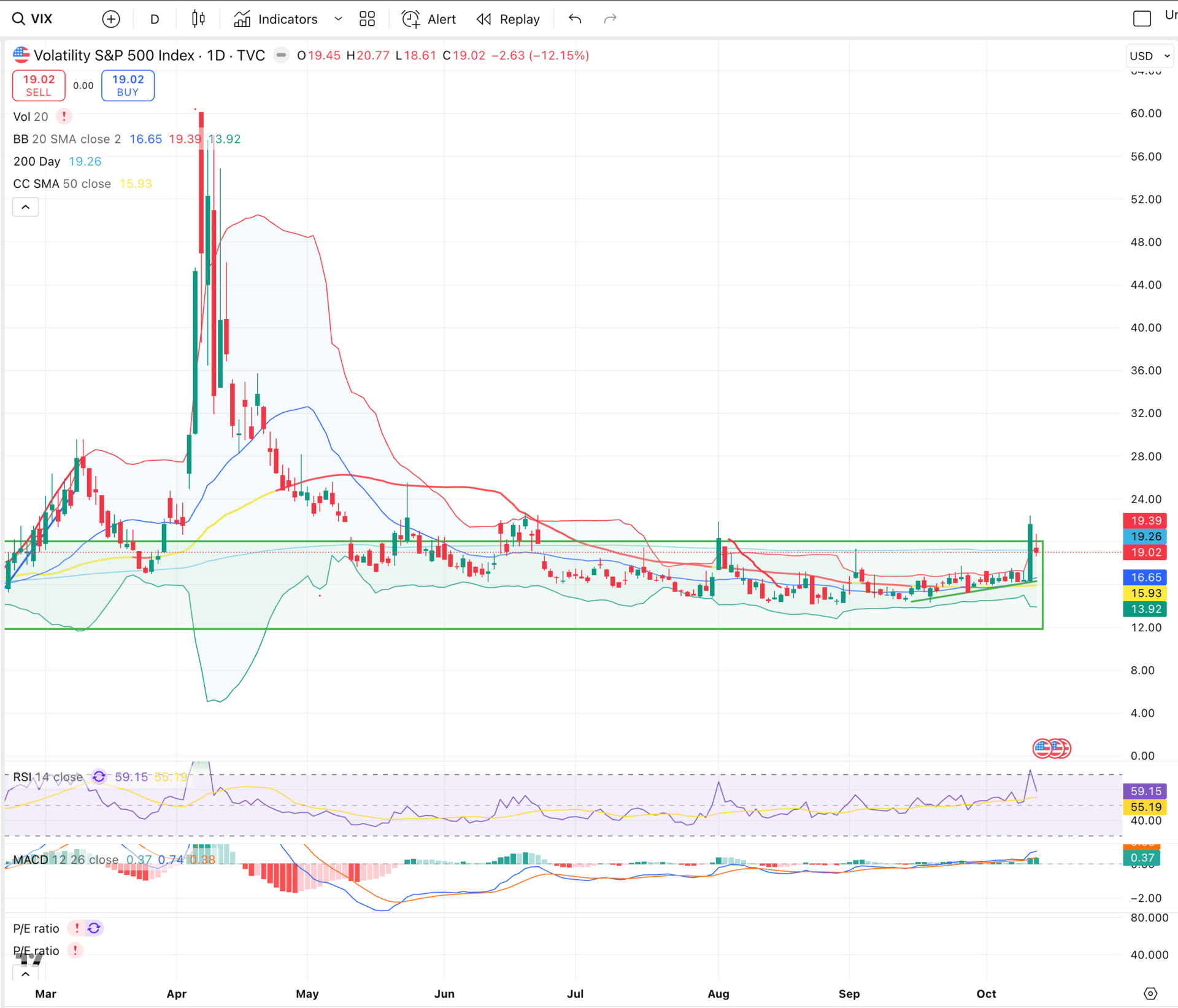

$VIX ( ▼ 6.95% ) collapsed from a high of 22.4 down to 19 by the close, signaling fear is fading fast. I expect it to trend lower into the 17–16 range over the next few sessions as confidence returns.

Current Cash Allocation

I’m sitting at 12% cash, very aggressive right now. I put a lot of capital to work while VIX was still above 20 earlier in the day. My plan is to slowly raise that cash level back up later this week and next as we move into earnings season.

Client Spotlight

This week we’re highlighting our client Jason. When Jason joined Options Trading University, he had zero experience trading options. Now he’s hitting $80K to $100K months consistently using the same framework we teach inside the program.

We even had another member post a $91,000 profit day today, proof that discipline and process beat luck every single time.

Free Trade of the Week

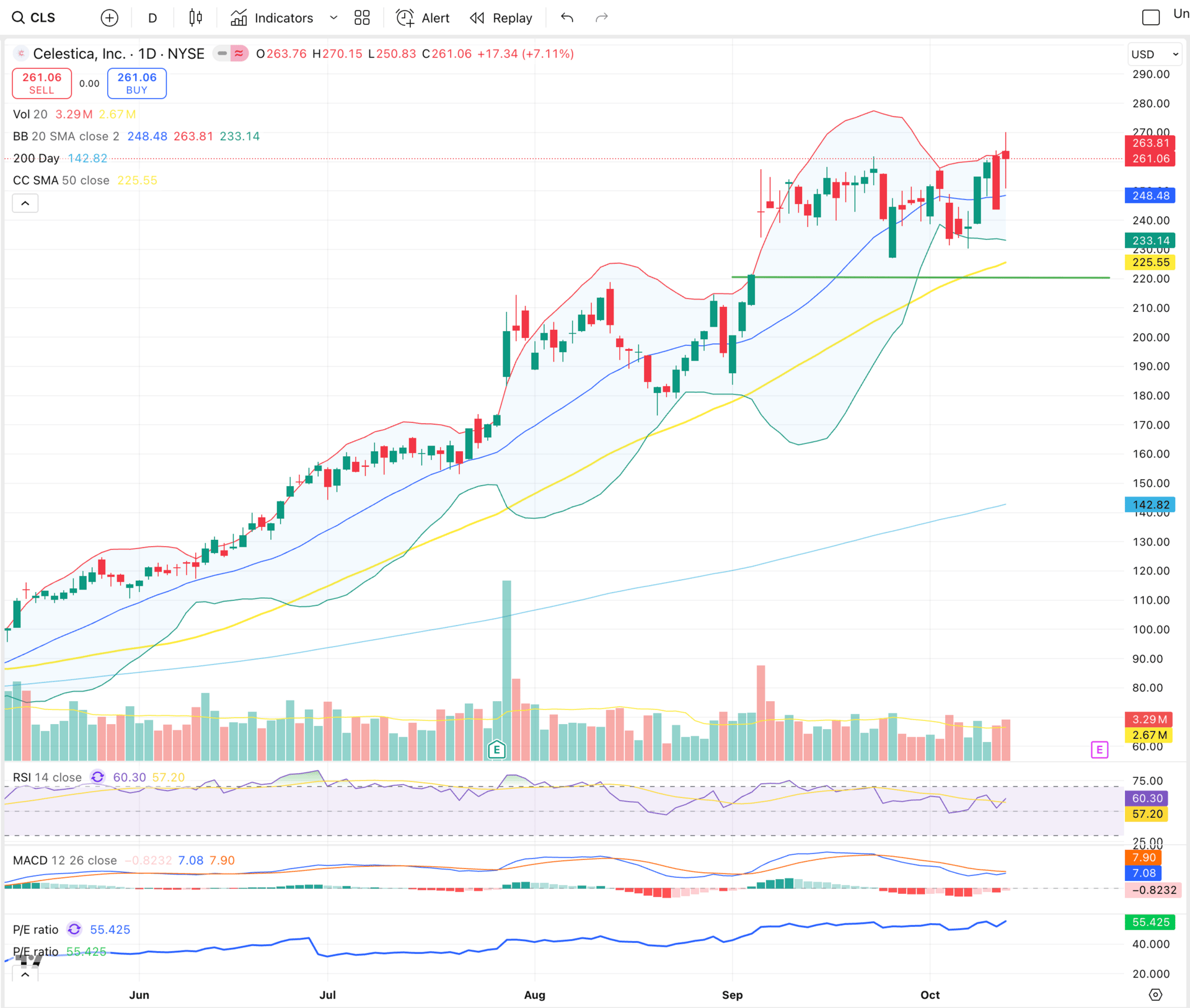

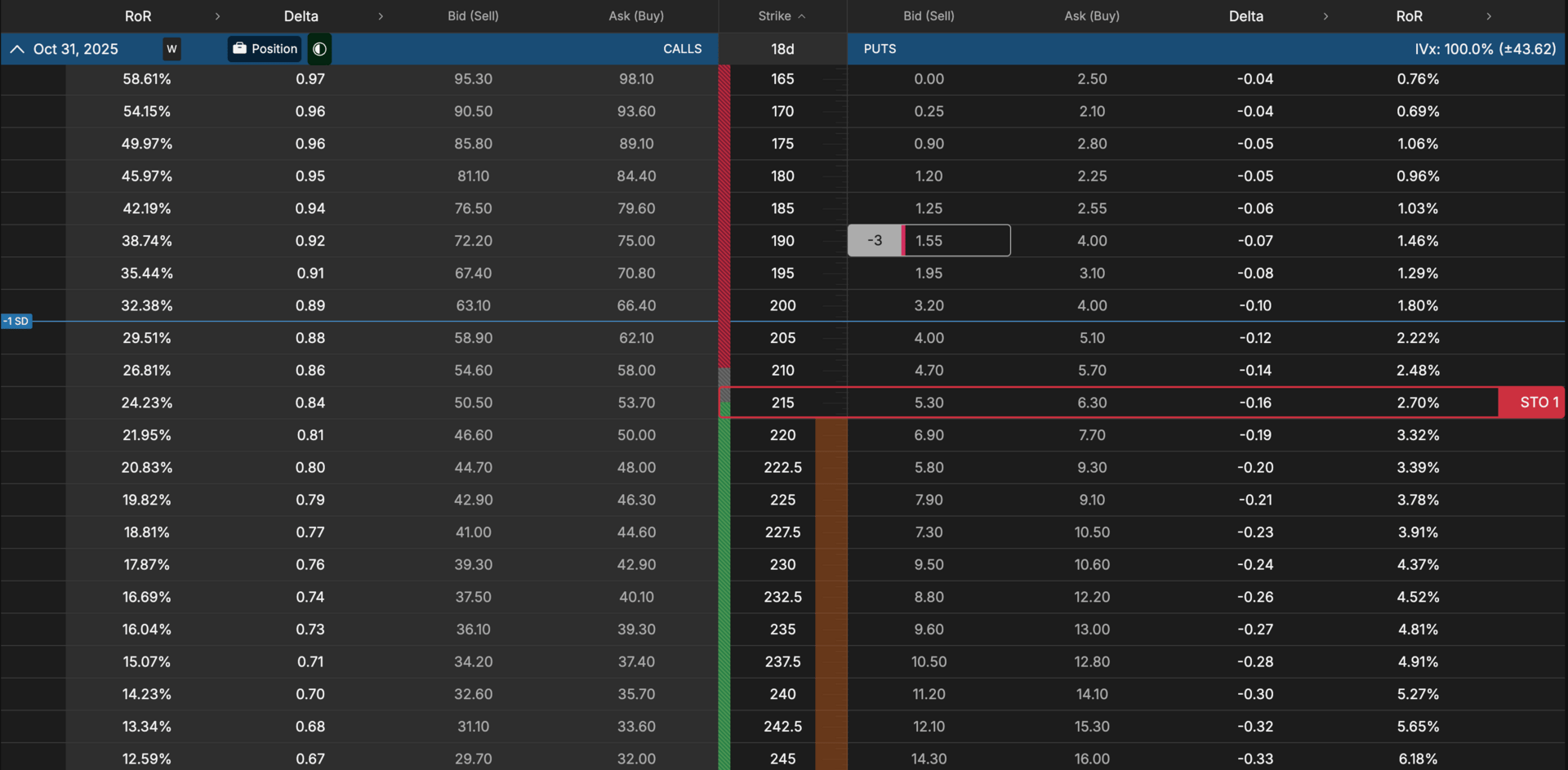

Ticker: $CLS ( ▼ 0.11% ) (Celestica)

Strategy: Sell To Open Cash-Secured Put

Expiration: October 31st (18 days out)

Strike: 215

Premium Collected: $530

ROI: 2.7% in 18 days (~54.8% annualized linear, ~71.6% compounded)

Why I like it: Celestica just released two new high-performance switches designed for AI data centers, opening new revenue streams and positioning them perfectly for the current AI infrastructure boom. I’m bullish going into earnings and like the 215 level for a safe entry.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Bank Boldly. Climb Higher.

Peak Bank offers an all-digital banking experience, providing all the tools and tips you need to make your way to the top. Take advantage of competitive rates on our high-yield savings account and get access to a suite of smart money management tools. Apply online and start your journey today.

Member FDIC

Bonus Video

In my latest YouTube video, I break down three stocks I’m buying heavily in October to set up for November. I also share exactly where I think the market’s headed next and how I’m positioning my portfolio in this new bullish environment.

Success is built in the quiet moments when others hesitate to act.

Talk soon,

Ryan