- Options Trading University

- Posts

- Fed Cut Odds at 89 Percent and Sridhar’s $67K Month

Fed Cut Odds at 89 Percent and Sridhar’s $67K Month

Hey Options Trader,

With the market gaining strength ahead of the December 10th Fed meeting, this week is shaping up to be one of the most pivotal of the month. In today’s newsletter, we’ll break down why bullish momentum is accelerating, the key catalysts to watch, and how to position with discipline despite the excitement. You’ll also see a new client spotlight featuring a strong early win, plus a high-probability Palantir trade that fits perfectly with current market conditions. I’ve also included a new video covering the top five stocks I’m buying into 2026.

Here’s what we are covering:

My market outlook for the week

Client Spotlight

Free Trade of the Week

Bonus Resource video and updates

Market Snapshot

Momentum is very bullish heading into the December 10 rate cut meeting. Rate cut odds surged to 89 percent after ADP payrolls came in at negative 32,000 jobs, signaling significant weakness in the labor market and creating more pressure for the Fed to cut.

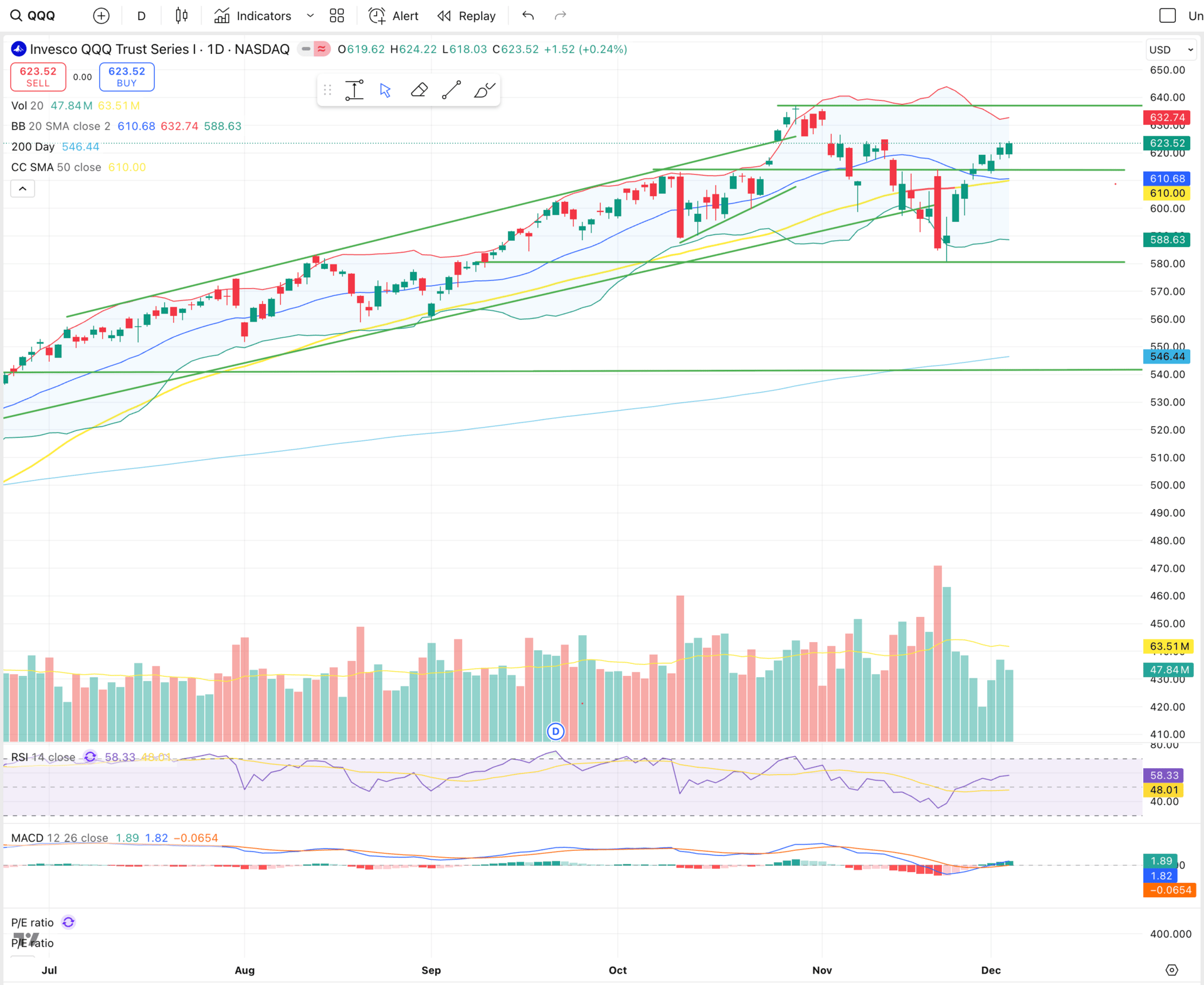

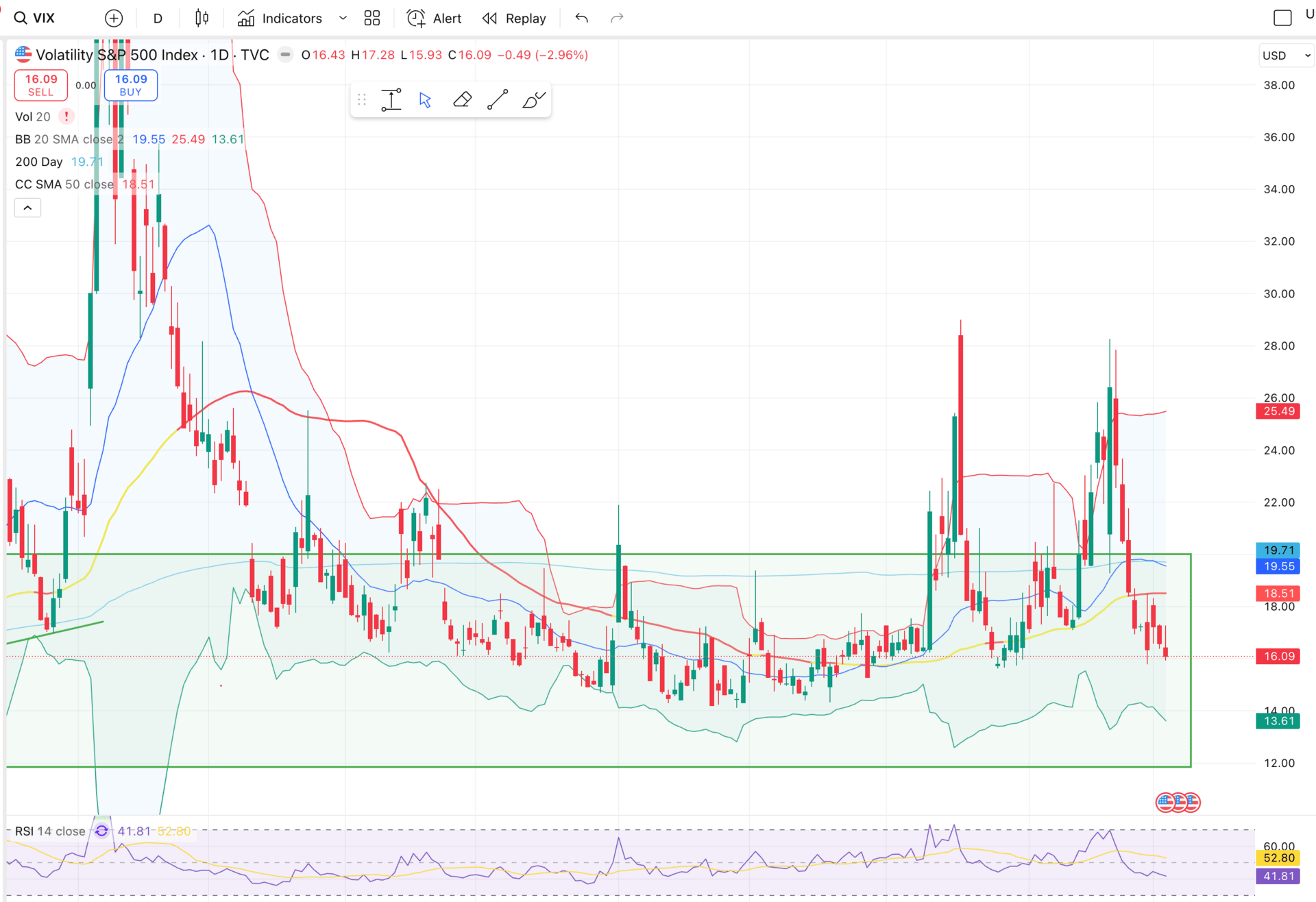

$QQQ ( ▲ 1.45% ) continues to grind higher with a bullish MACD crossover and looks ready to reclaim its previous all-time highs around 637. Volume remains light, $VIX ( ▼ 8.29% ) is sitting at 16, and it looks ready to break into the 15s or even sub-15 as we move closer to the announcement. I’m holding around 20 percent cash in case we see a volatility spike into the meeting or if the Fed surprises markets by holding rates steady. Core PCE data on Friday could also trigger short-term volatility, but overall momentum remains strong.

QQQ continuing bullish crossover on MACD heading towards upper bollinger band

Fear subsiding. VIX heading towards $15 tomorrow.

Client Spotlight

This week we’re highlighting our client Sridhar, who joined us a few months ago and made $67,000 in his first month following the principles.

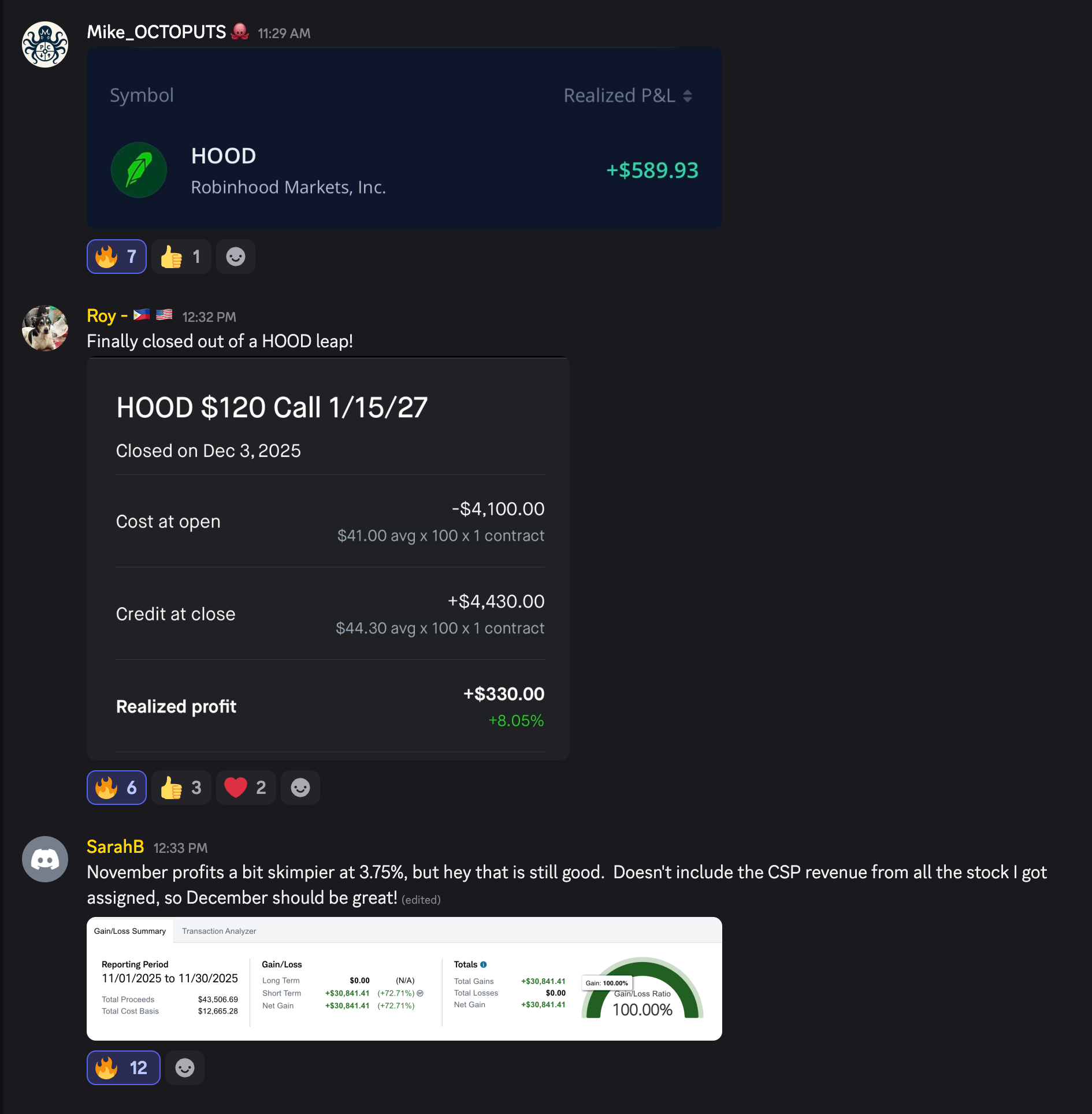

We also had Mike close out a $589 win today and Sarah finish her November with a $30,000 profit, which equated to a 3.75 percent ROI in her portfolio.

Free Trade of the Week

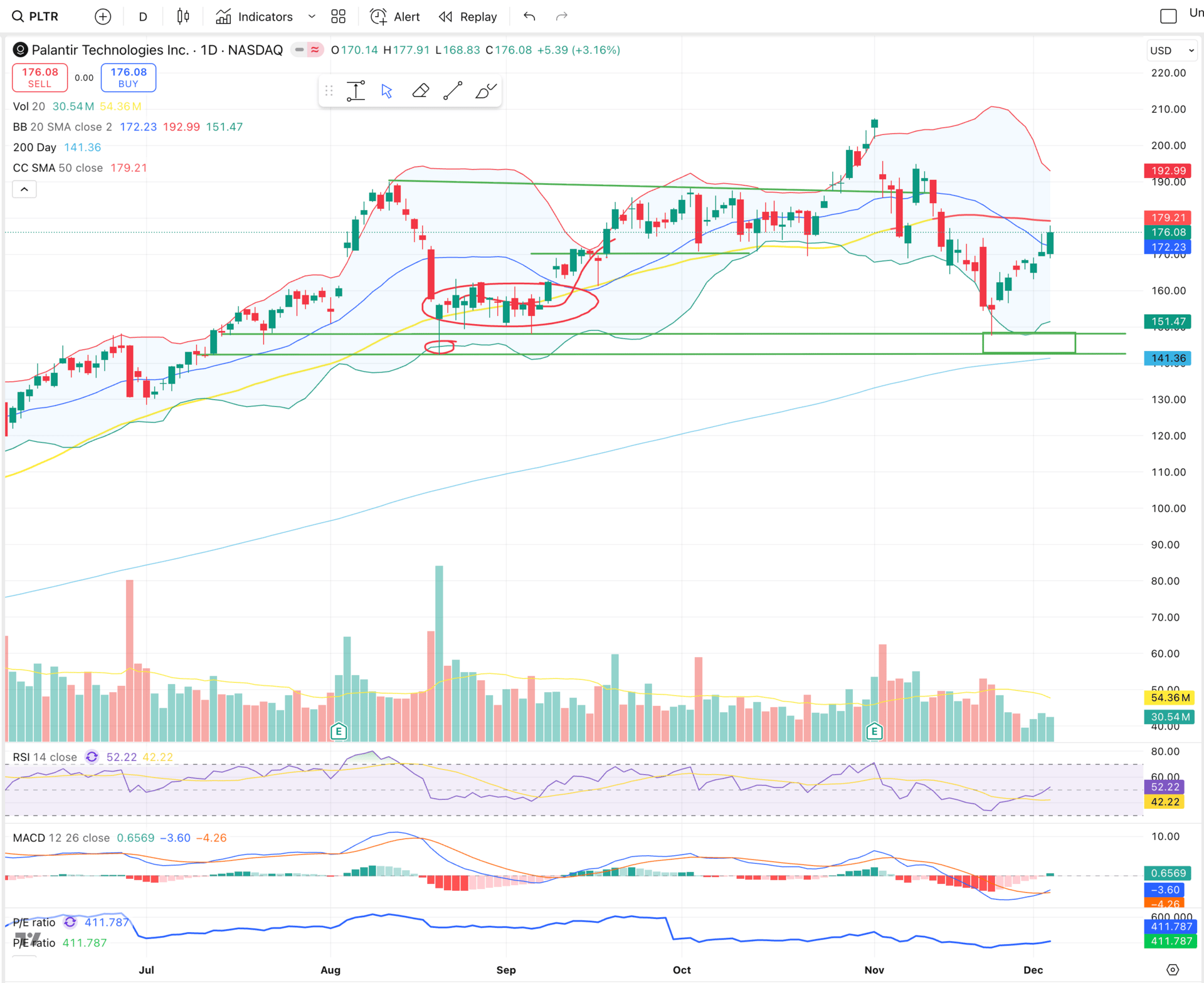

Ticker: $PLTR ( ▲ 4.15% )

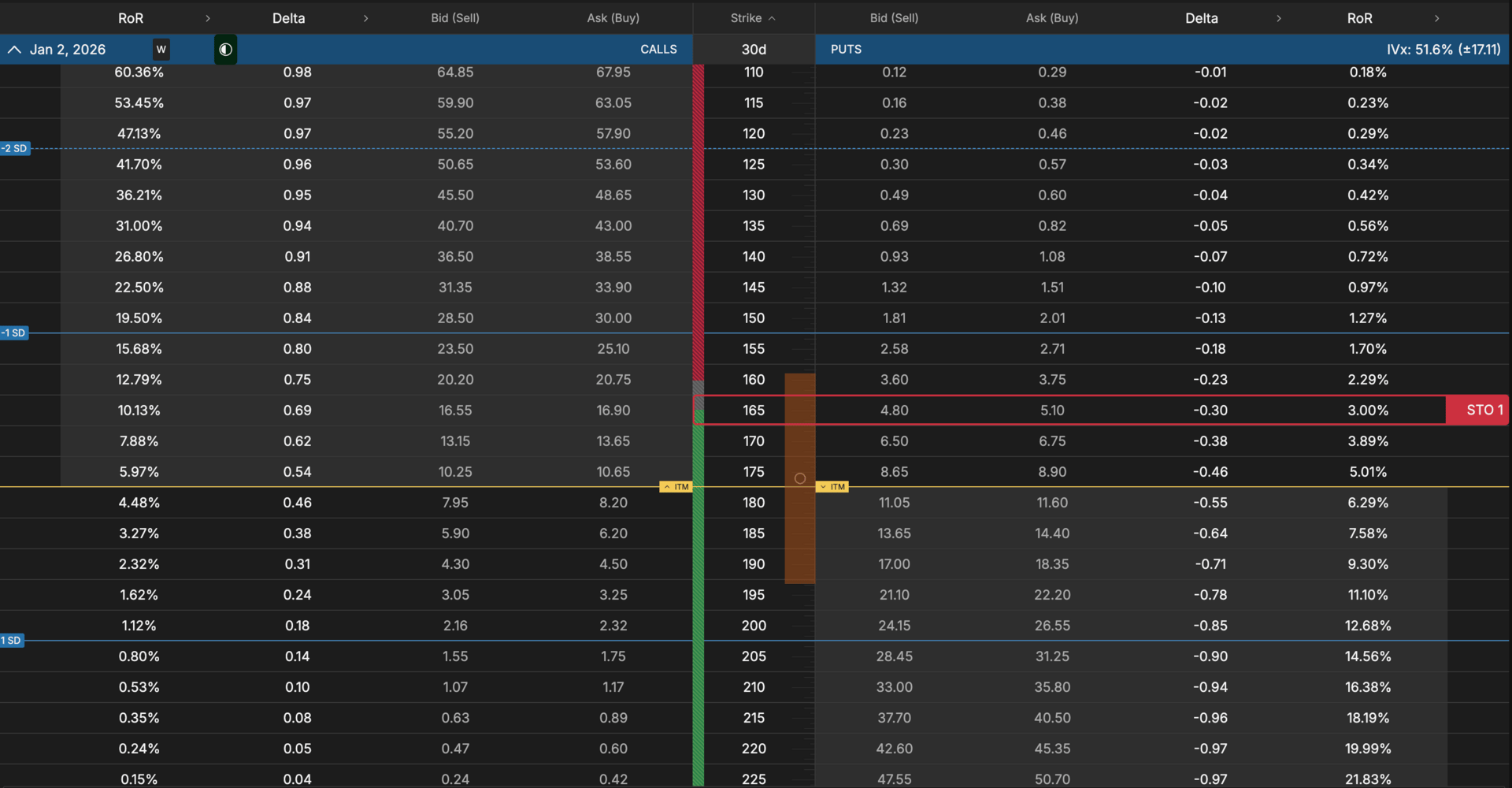

Strategy: Sell the January 2nd 165 strike put

Premium Collected: $480

Duration: 30 days

ROI: 3 percent

Annualized Return (compounded monthly): 42.58% ROI

Risk: Assignment risk below 165 if PLTR pulls back into expiration

Palantir is setting up beautifully here with a fresh bullish MACD crossover and price action that looks ready to push higher. The stock has been quiet for the past month, with little news, and it only needs one solid catalyst to make a strong move toward its previous highs in the 200s. Selling cash-secured puts remains the safest and most consistent way to generate premium on a fundamentally strong name like PLTR.

bullish crossover started today on MACD

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Tackle your credit card debt by paying 0% intro APR until 2027

Did you know some credit cards can actually help you get out of debt faster? Yes, it sounds crazy. But it’s true.

The secret: Find a card with a “0% intro APR" period for balance transfers or purchases. This could help you fund a large purchase or transfer your debt balance and pay it down as much as possible during the intro period. No interest means you could pay off the debt faster.

Bonus Video

I just released a new YouTube video covering the five stocks I’m buying into 2026, including one position sized at $217,000. If you want to see how I’m allocating for the long term, don’t miss this one.

Stay focused, stay tactical, and use this week’s volatility to your advantage.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.