- Options Trading University

- Posts

- DoorDash, Robinhood, And What I Sold $60K Of

DoorDash, Robinhood, And What I Sold $60K Of

Hey Options Trader,

The market’s giving us a mix of fear and strength right now, exactly the kind of setup where the biggest opportunities are hiding in plain sight. While most traders are waiting for “confirmation,” we’re seeing momentum quietly building underneath the surface.

Here’s what we are covering:

My neutral-to-bullish outlook heading into next week

Client Spotlight: Reno’s consistent 6–8% months

A safe SoFi setup paying 3.4% in 30 days

Bonus Resource: My latest update on HOOD and DASH earnings

Market Snapshot

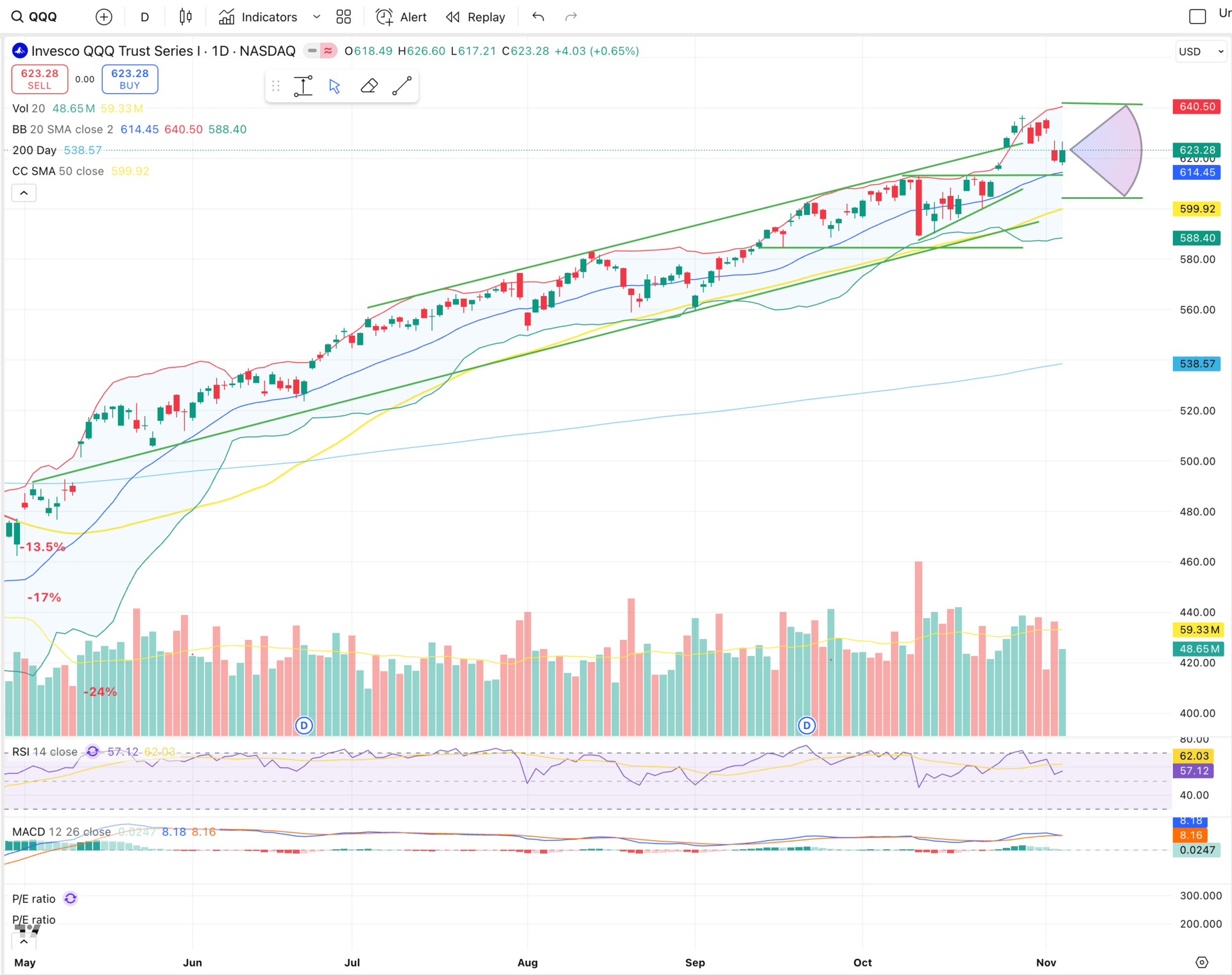

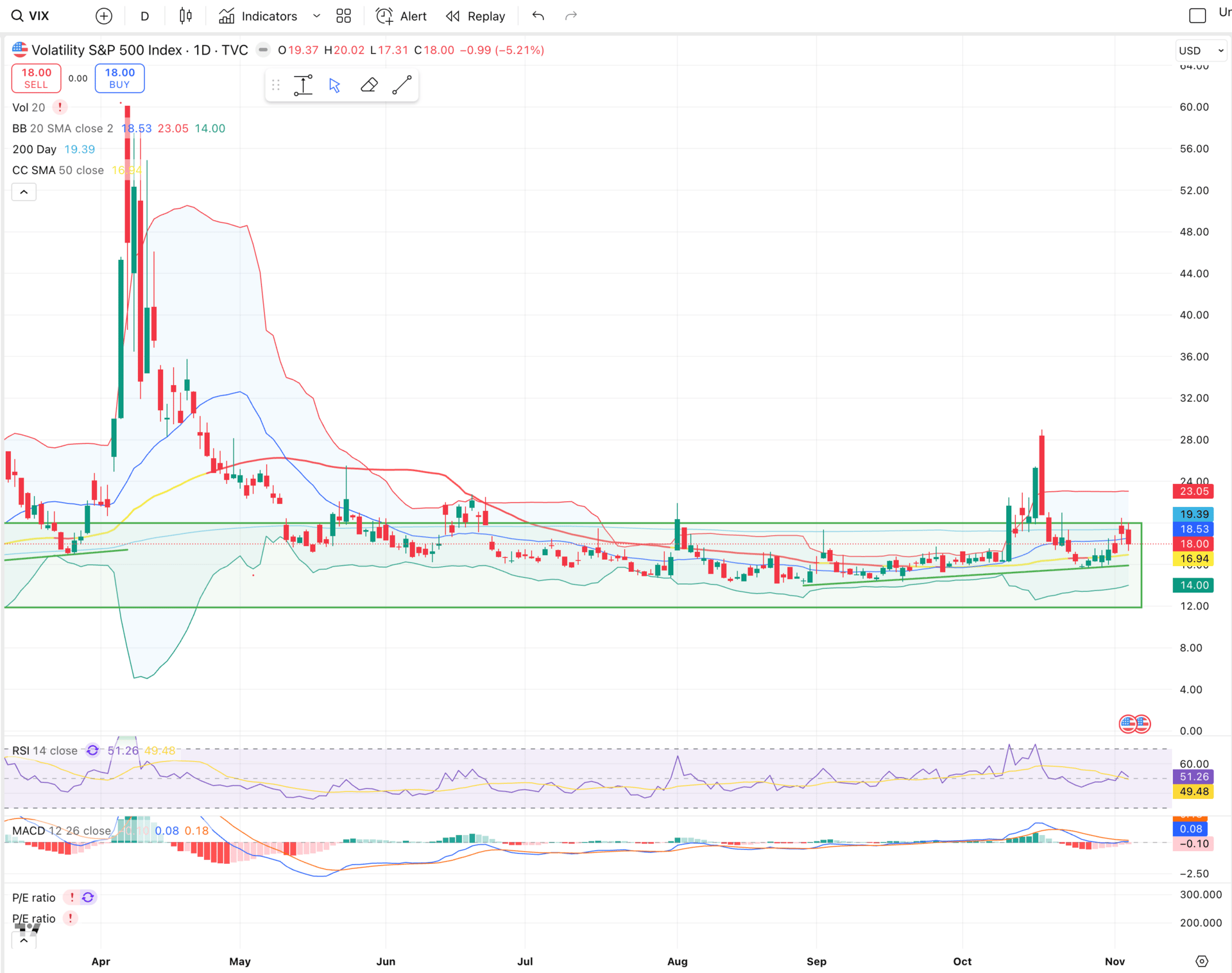

The bulls stepped in to defend the market today. $QQQ ( ▲ 1.34% ) looked like it might drop to the 613 area, but buyers quickly reversed the move and pushed prices higher. $VIX ( ▼ 5.83% ) briefly spiked near 20 but settled back down to 18 by the close, a sign of stability returning.

At this point, I’m neutral to bullish. The expected move on QQQ for the next two weeks is about 20 points in either direction, which means we could see a range between 600 and 640. That’s a wide window, but it gives us opportunity both ways.

We’re coming off a big earnings stretch with DoorDash $DASH ( ▲ 6.36% ) and Robinhood $HOOD ( ▲ 5.11% ) moving sharply after reports, and we’ve got Core CPI data on deck next Thursday. That could influence whether the Fed decides to cut rates in December or waits until January. Odds for a December cut sit around 62.5%, so any surprise to the upside on inflation could shift sentiment fast.

QQQ in the middle of the range, indecisive, but bulls stepped in on todays drop

VIX slightly elevated here

Client Spotlight

We recently interviewed our client Reno, who’s been quietly and consistently generating results every month. In September, he had his best performance yet. An 8.1% return, totaling $20,000 in profit. Reno’s consistency is the perfect example of what happens when structure meets execution. Watch his interview below.

Free Trade of the Week

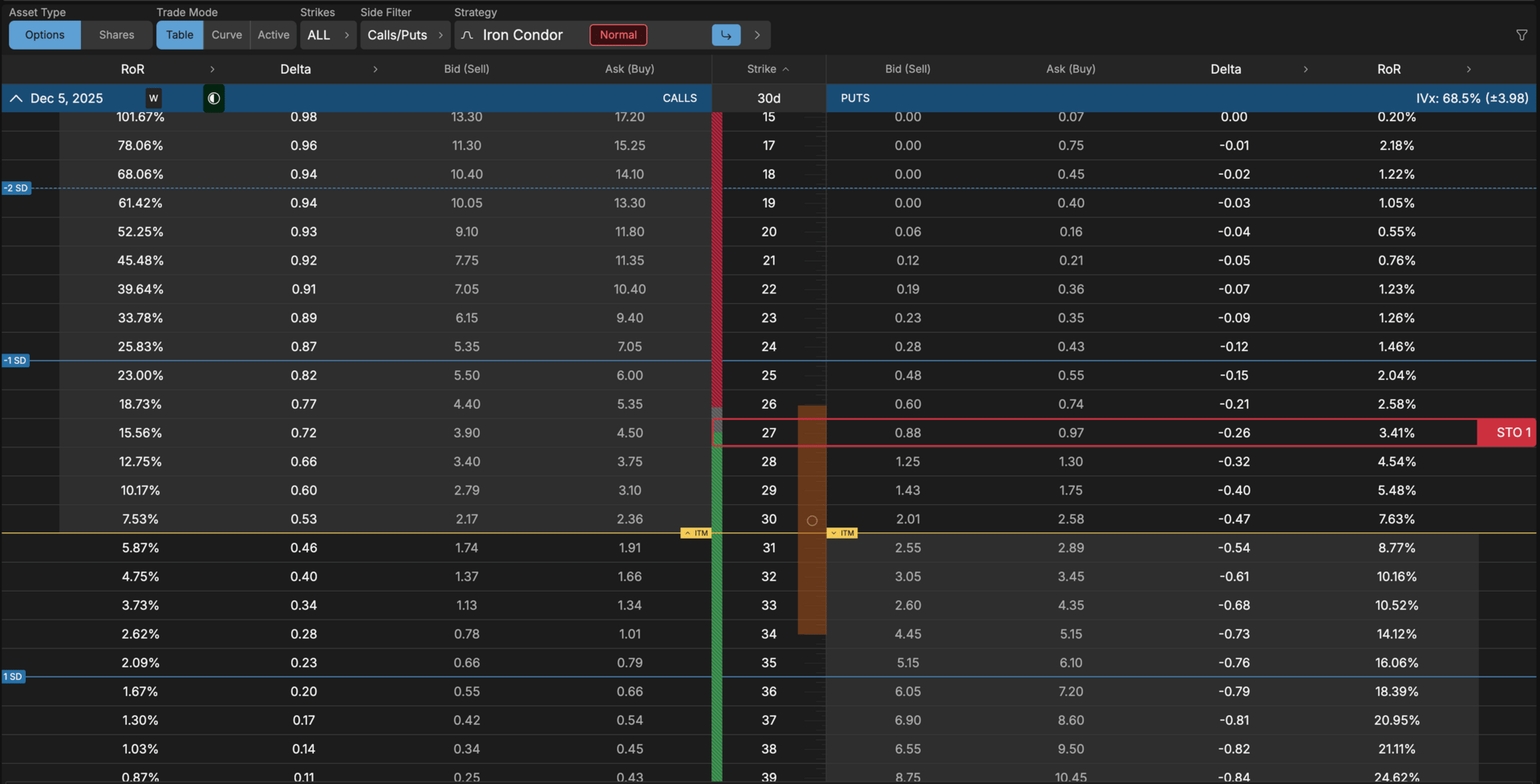

Ticker: $SOFI ( ▲ 4.48% )

Strategy: Sell Cash-Secured Put

Expiration: December 5 (30 days)

Strike: 27

Premium Collected: $90

ROI: 3.4% in 30 days

SoFi continues to be one of the easiest, most consistent trades in the portfolio. Trading around $30, it’s at a discount relative to its growth trajectory. If SoFi secures the $1.6 trillion in student loan refinancing from the government, this stock could explode higher.

Selling the 27-strike cash secured put pays 3.4% for the month, and getting assigned at that level would be a gift.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

Bonus Video

In my latest video, I break down the full story behind Robinhood and DoorDash’s earnings including why both stocks moved the way they did. I also go over a $60K position I exited this week due to a potential catalyst hitting tomorrow.

Stay focused, stay tactical, and use this week’s volatility to your advantage.

Talk soon,

Ryan