- Options Trading University

- Posts

- CPI Tomorrow, QQQ Resilience, and How Richard Turned OTU Into $800,000+

CPI Tomorrow, QQQ Resilience, and How Richard Turned OTU Into $800,000+

Hey Options Trader,

This week’s market action gave us a great real-time look at how resilient equities are becoming, even in the face of unexpected headlines. With CPI data coming in tomorrow and volatility briefly waking up, there’s a lot to unpack beneath the surface. I’ll walk you through what the market is telling us right now, where key levels are on QQQ, and how I’m thinking about positioning. I’ll also highlight a massive client milestone, share a high-probability income trade, and point you to a brand-new video breaking down a long-term position I’ve never publicly discussed before.

Here’s what we are covering:

My neutral-to-bullish market outlook heading into CPI

Client Spotlight featuring a $800,000+ trading journey

Free Trade of the Week

Bonus video covering a $55,000 LEAPS position and top stocks of the week

Market Snapshot

My outlook this week is neutral to bullish as we head into tomorrow’s CPI data. My base case is inflation coming in in line with expectations or slightly cooler, which would be supportive for equities. There is always a small probability of a hotter-than-expected print, especially following the holiday season, but overall the market appears well positioned.

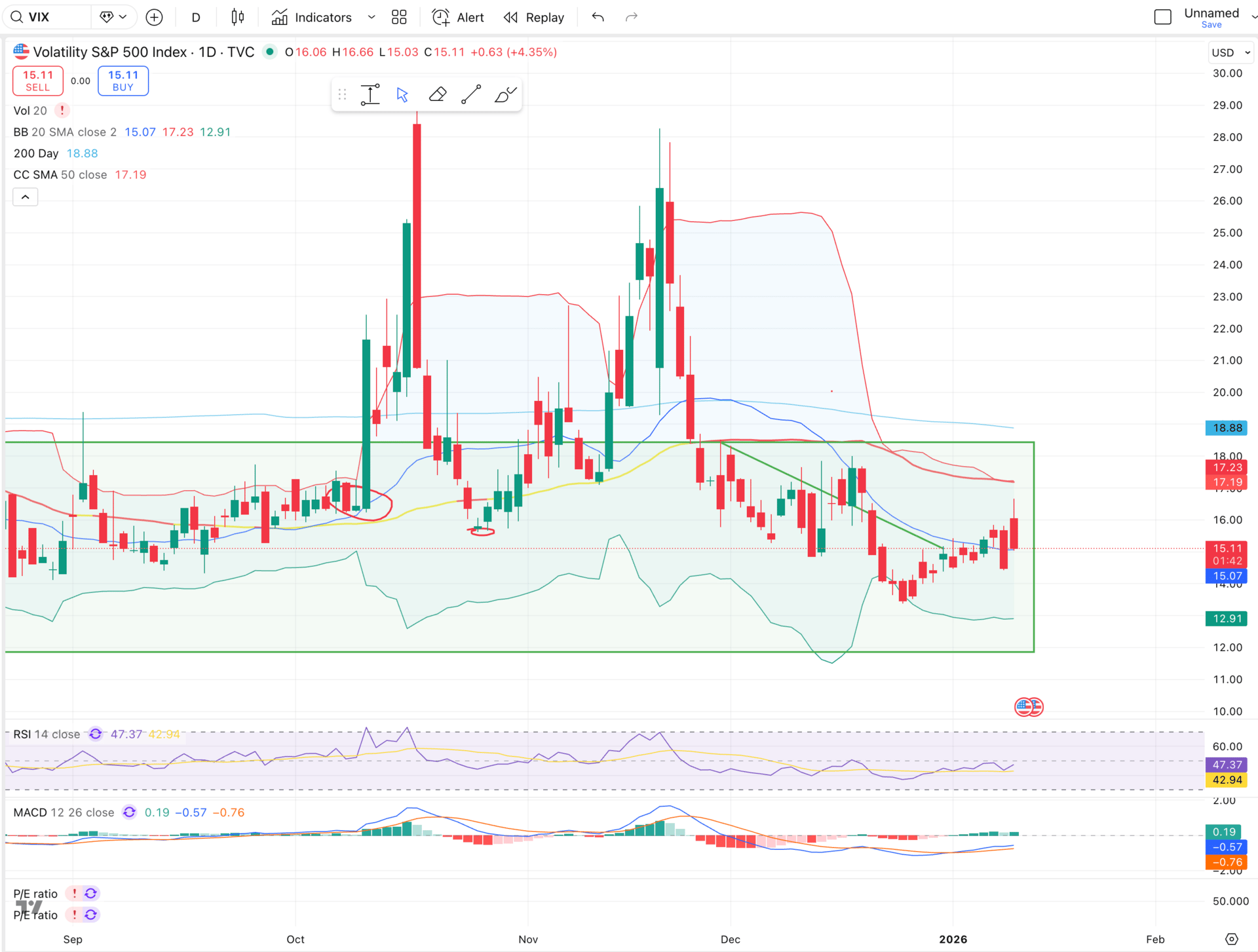

$QQQ ( ▲ 1.45% ) showed notable strength today after opening lower on headlines surrounding a criminal investigation into Jerome Powell, which briefly pushed the $VIX ( ▼ 8.29% ) above 16 for the first time in a while. Despite that, QQQ finished green and the VIX settled back into the low 15s, signaling resilience. If this same news had hit months ago, the reaction likely would have been much more severe. On the upside, the 637 level is the key area I’m watching on QQQ, while 610 remains a potential downside extreme.

QQQ bullish momentum after todays volatility

VIX spike above $16 for a brief moment today

Client Spotlight

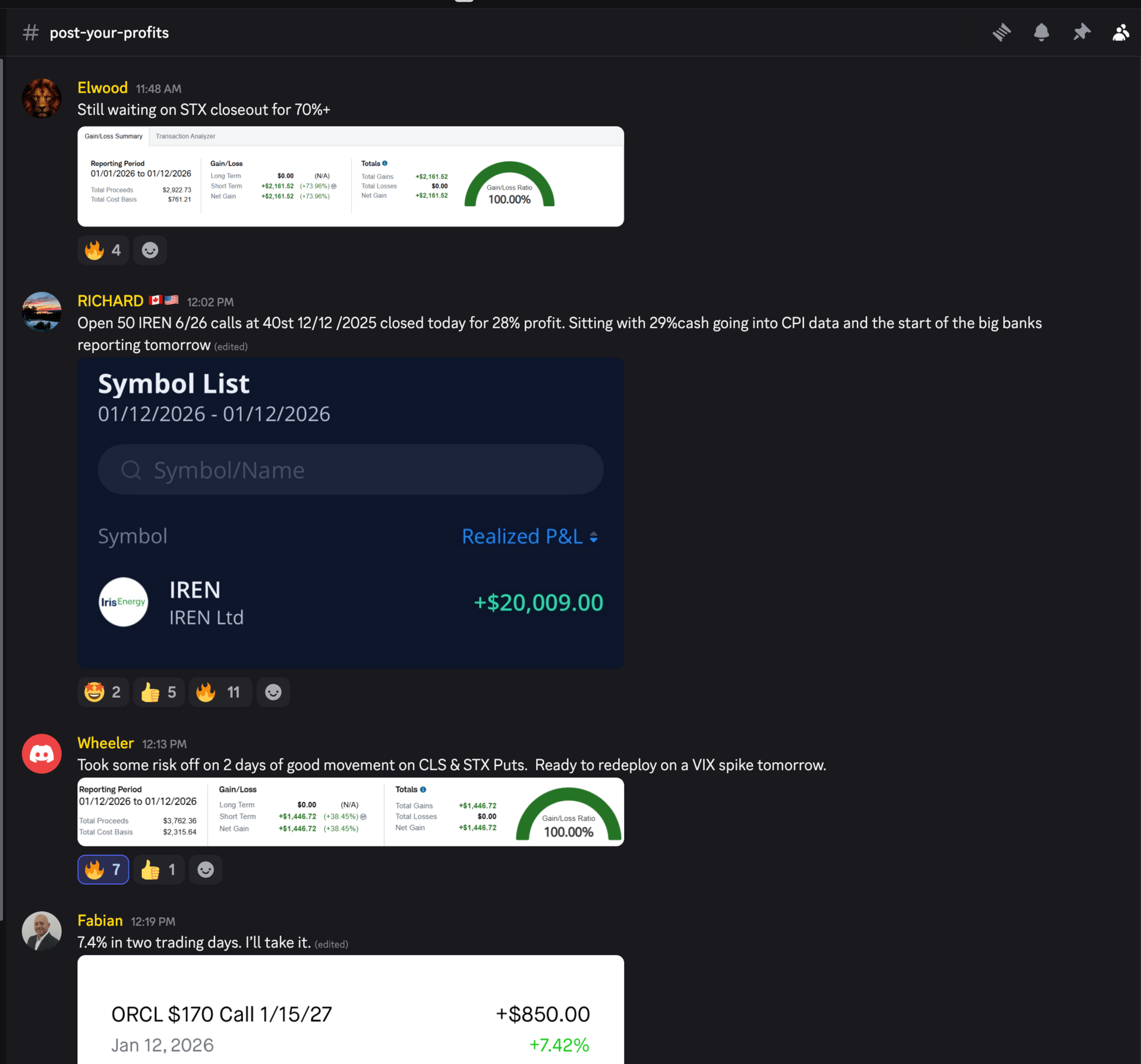

We recently had the pleasure of interviewing our client Richard, and his results speak for themselves. In his first three months inside Options Trading University, Richard generated $371,000 in profit, and by year-end he surpassed $800,000 total since joining the program.

Even this week, he logged another $20,000 day, while another member closed over $2,000 in profits on cash-secured puts. These are strong examples of disciplined execution and consistency over time.

Free Trade of the Week

Ticker: $IREN ( ▼ 3.12% )

Strategy: Sell the February 6th $42 put

Premium Collected: ~$200

Duration: ~25 days

ROI: 4.8%

Annualized Return (compounded monthly): ~97%

Risk: Assignment risk below $42, a key mid-Bollinger Band support level

IREN continues to show relative strength compared to much of the market, trading near the upper Bollinger Band without being overbought on RSI. There is strong bullish momentum, and rumors of another potential partnership announcement add to the upside narrative. The $42 strike sits near the mid-Bollinger Band and a clear support area, making this a level I’m comfortable defending or owning at a discount if assigned.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Fuel your business brain. No caffeine needed.

Consider this your wake-up call.

Morning Brew}} is the free daily newsletter that powers you up with business news you’ll actually enjoy reading. It’s already trusted by over 4 million people who like their news with a bit more personality, pizazz — and a few games thrown in. Some even come for the crosswords and quizzes, but leave knowing more about the business world than they expected.

Quick, witty, and delivered first thing in the morning, Morning Brew takes less time to read than brewing your coffee — and gives your business brain the boost it needs to stay sharp and in the know.

Bonus Video

I just released a brand-new video where I break down a $55,000 long-term core LEAPS position that I’ve never publicly discussed before. I also walk through my top four stocks of the week and how I’m thinking about positioning them within the current market environment.

Discipline compounds faster than motivation ever will.

Talk soon,

Ryan

Disclaimer: This newsletter is for educational purposes only and is not a recommendation to buy or sell any financial instruments. Trading involves risk, and you are responsible for your own investment decisions.