- Options Trading University

- Posts

- Could QQQ Run to 620? $134K Record Client Profit in September

Could QQQ Run to 620? $134K Record Client Profit in September

Hey Options Trader,

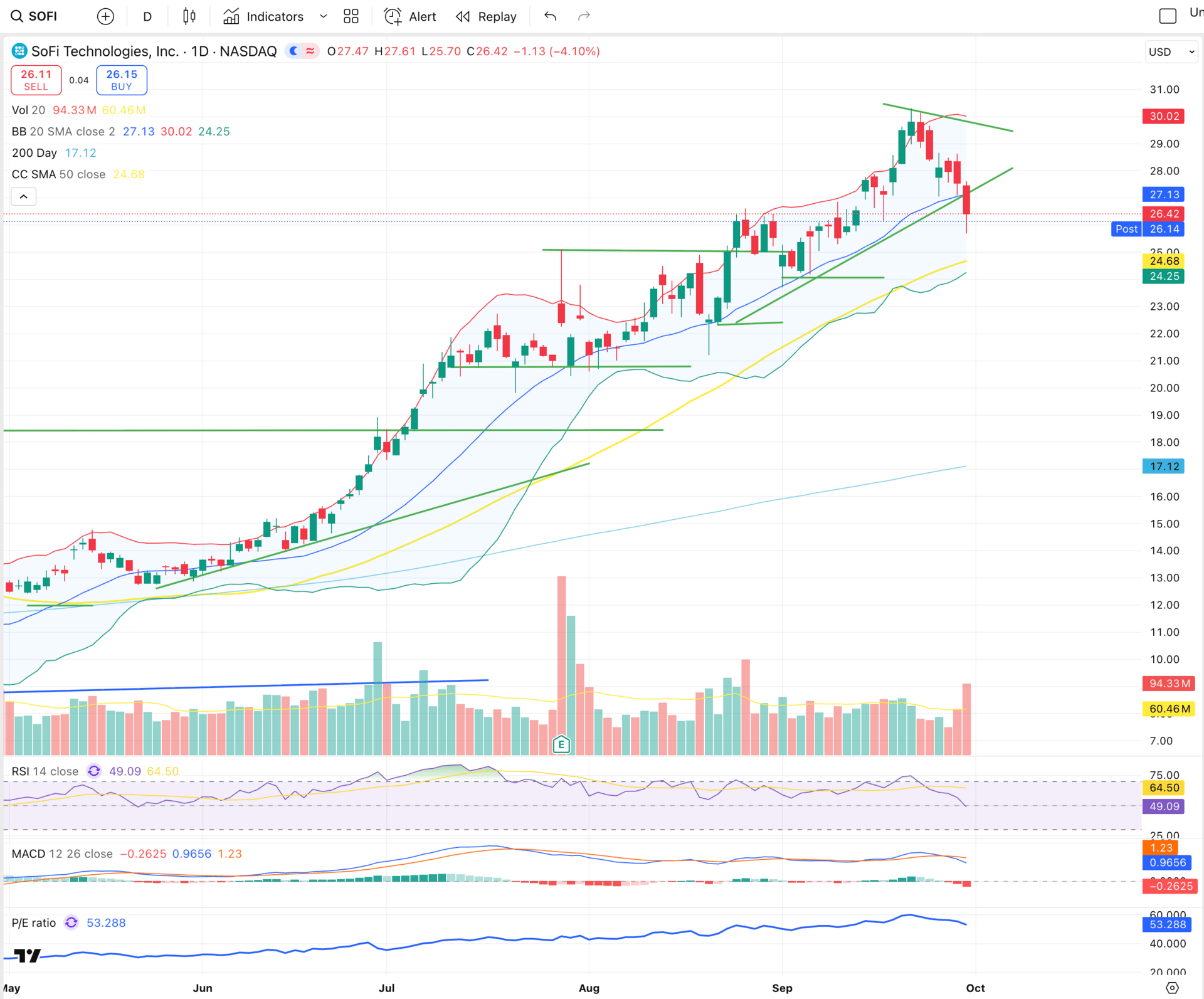

Right now the market is giving us a range-bound chop, but that’s creating opportunities on individual names. I’ve been eyeing stocks like SoFi and HIMS, both offering strong setups even in this neutral market.

Here’s what we are covering:

Market snapshot: Neutral, key levels on QQQ, VIX, and government shutdown potential

Free trade of the week: Safe SoFi earnings setup paying 4.26% in 38 days

Client spotlight: Ahmad’s 7% September and 6 clients hitting six figures last month

Bonus resource: My latest video breaking down Palantir & SoFi trade opportunities

Market Snapshot

I am neutral right now, playing it cautious and spotting opportunities in individual names. $SOFI ( ▲ 2.42% ) fi dipped today, $HIMS ( ▼ 0.32% ) is another I like here, but overall I’m sitting with 20% cash to stay aligned with my VIX cash allocation levels.

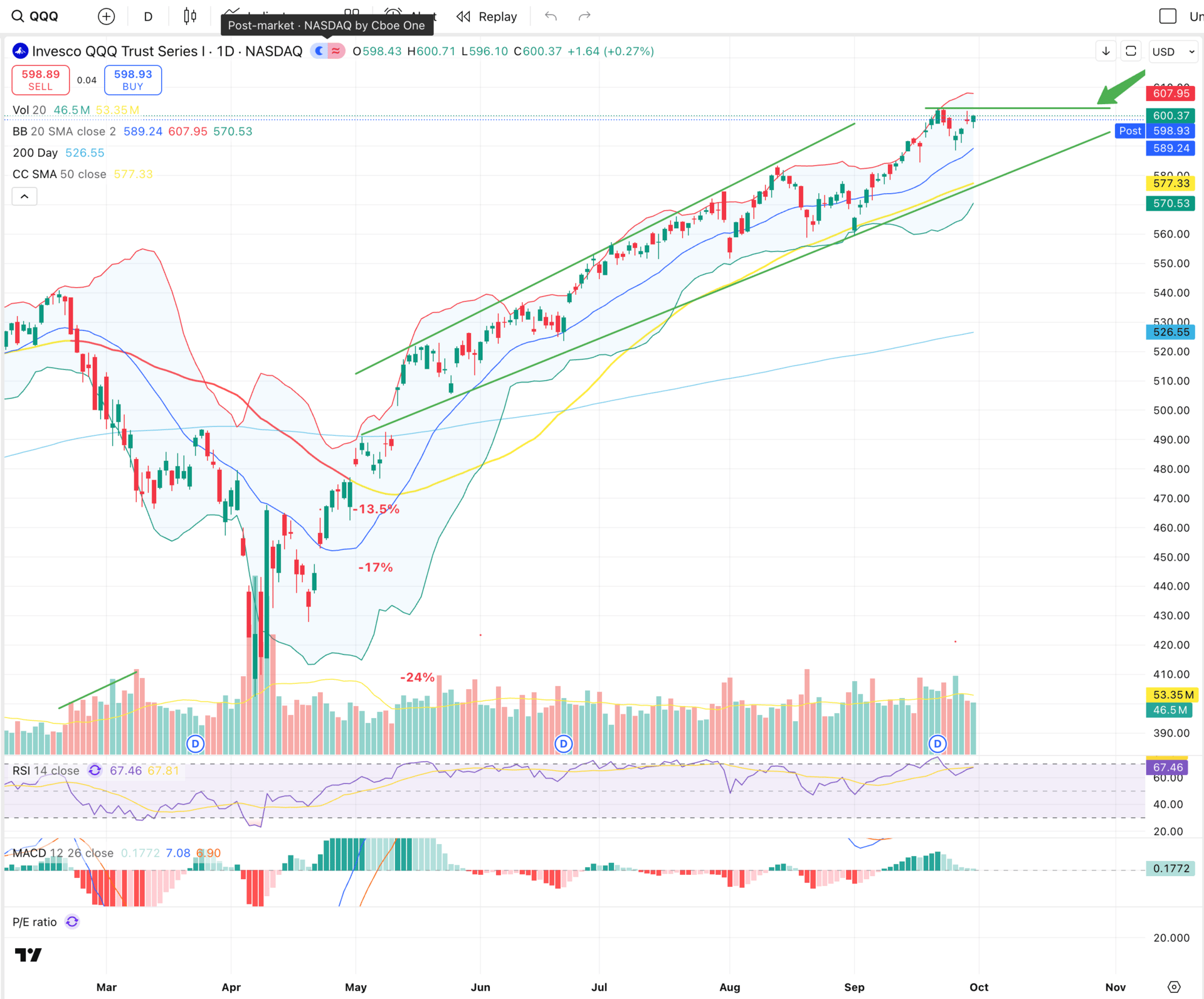

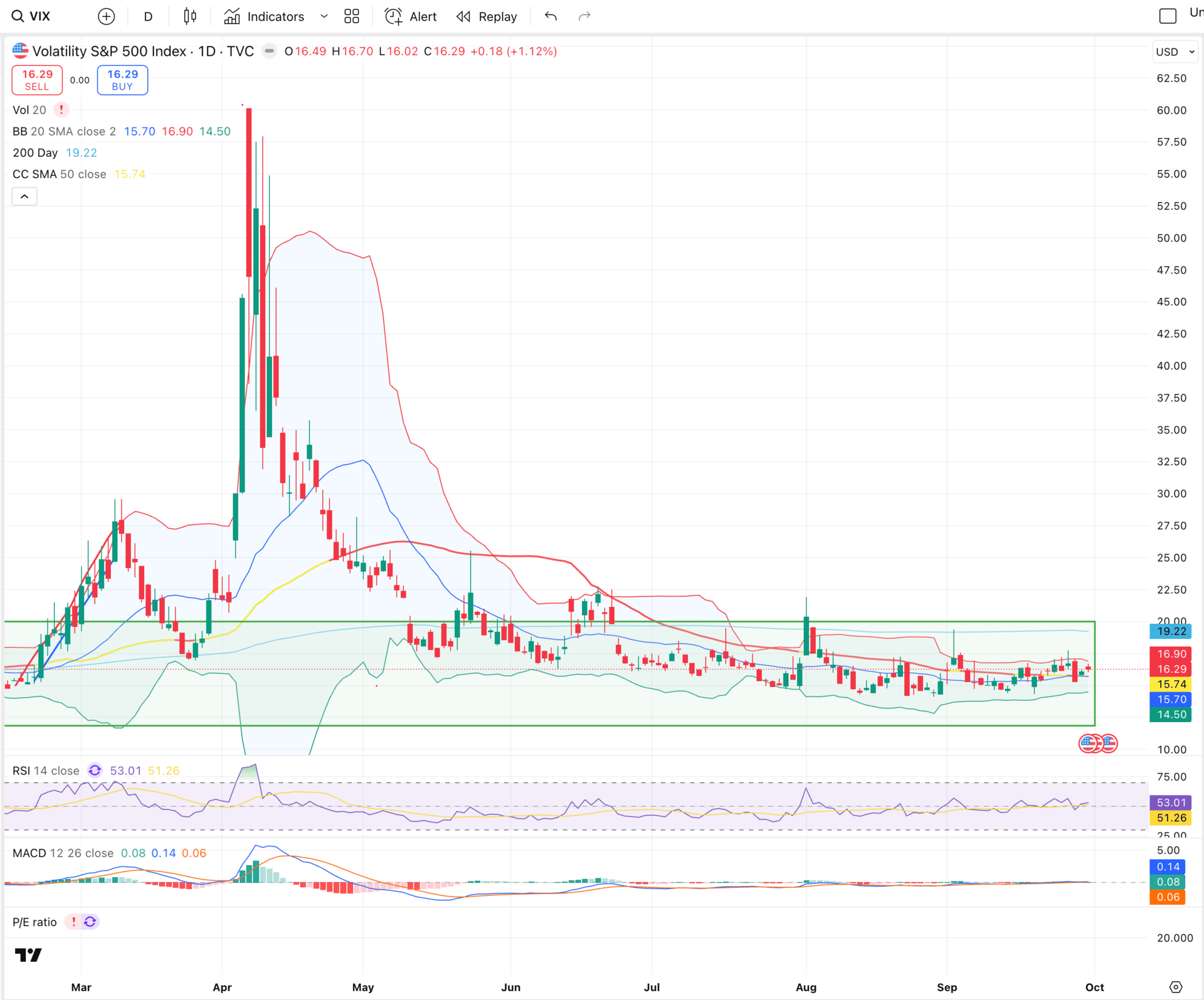

$QQQ ( ▲ 1.07% ) is trading within range, bouncing off the $600 level. If consolidation continues, we could break out to new all-time highs at 610–620. $VIX ( ▼ 6.95% ) is at 16.90, so the market is sitting at a crossroads, potential pullback or the next leg up.

Two catalysts this week:

Unemployment data Friday: A bad report could trigger volatility.

Government shutdown risk: Last shutdown (2018–2019) lasted 35 days, but the S&P 500 rallied 10.3% during that period. Could history repeat? Possibly.

For now, I’m neutral, cautious with cash, and prepared to buy dips on quality names.

Consolidation around $600 level

VIX calmly sitting around $16

Client Spotlight

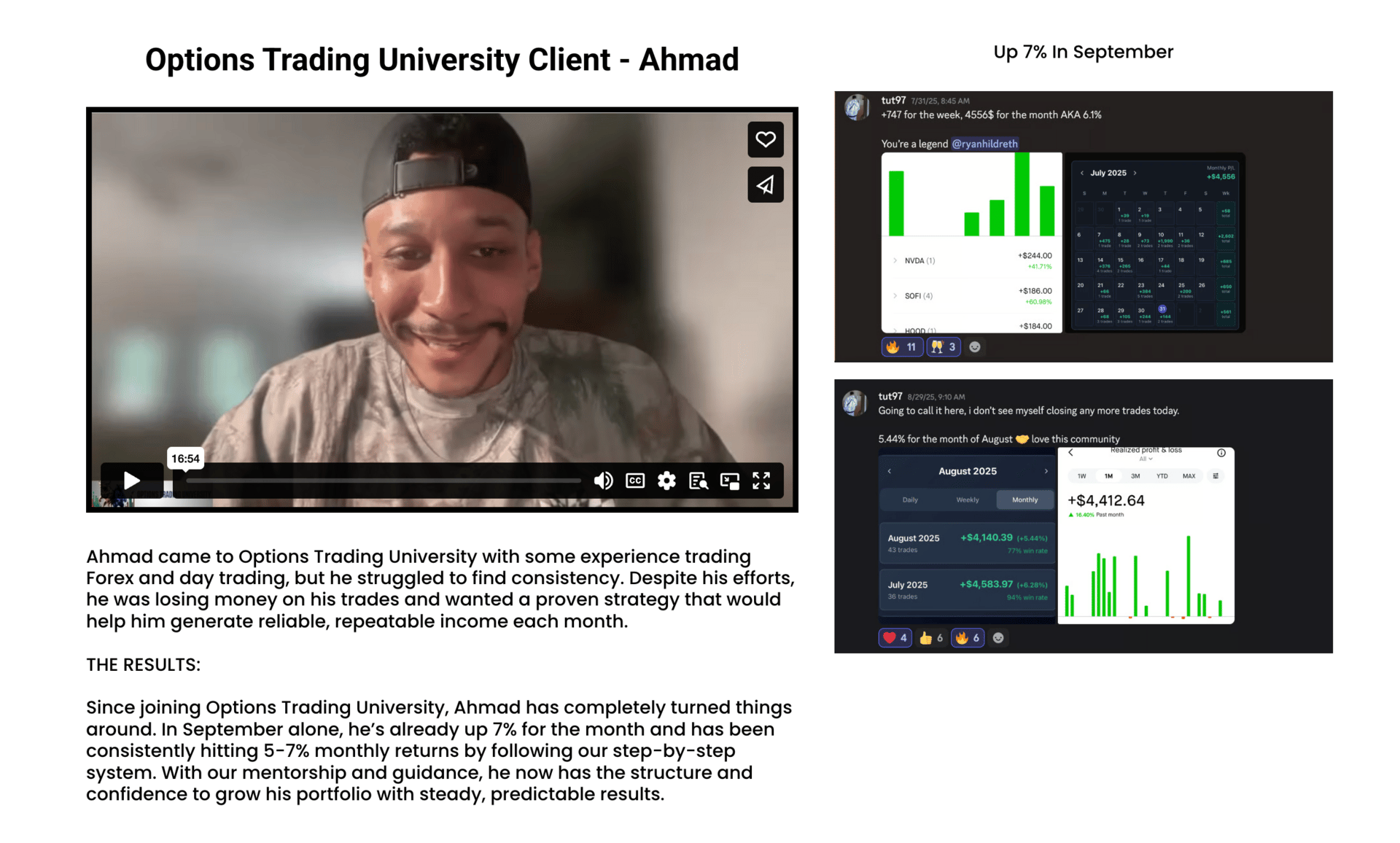

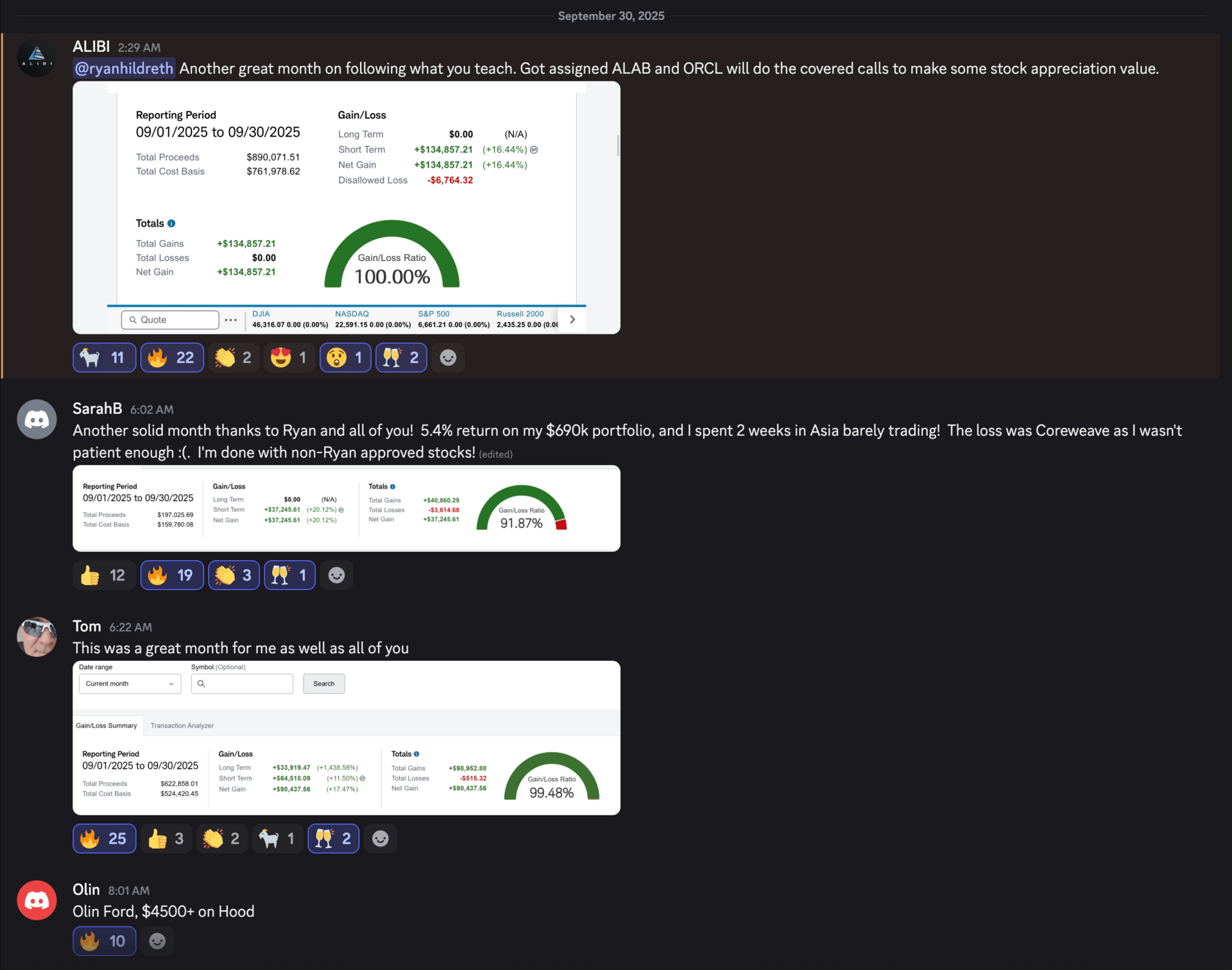

We had the pleasure of interviewing Ahmad last week, a real estate investor turned trader who’s been consistently hitting 5–7% monthly returns. For September, he locked in over 7% on his portfolio.

On top of that, six clients posted profits over $100,000 in September inside OTU. Our record so far: Shawn’s $134,000 in a single month. Huge congrats to everyone crushing it.

Free Trade of the Week

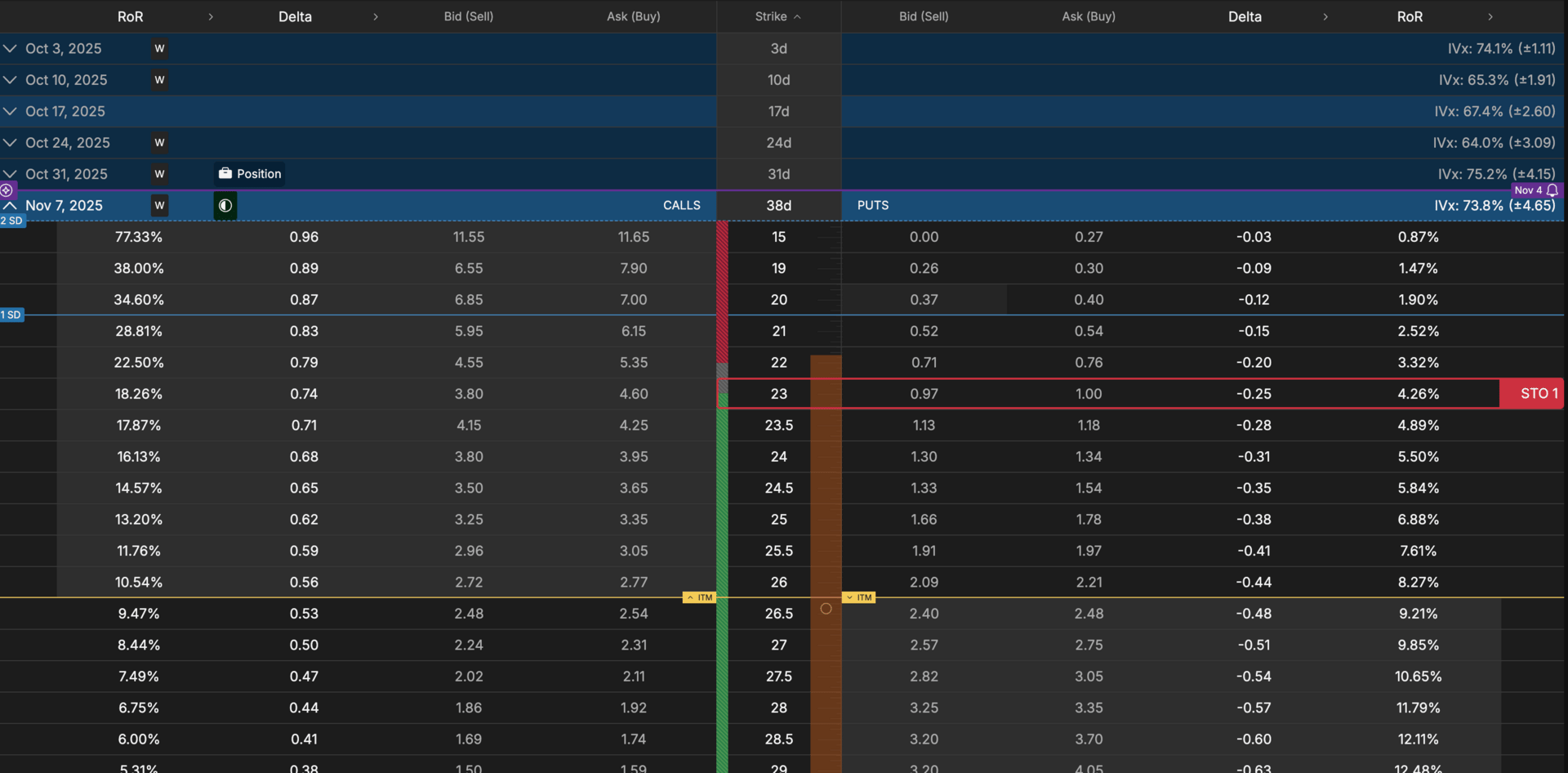

Ticker: SOFI Technologies $SOFI ( ▲ 2.42% )

Strategy: Cash-secured put, earnings play

Expiration: November 7th (38 days out)

Strike: $23

Premium: $97

ROI: 4.26% in 38 days (annualized compounded ROI: 45.7%)

Delta: 25

Why I like it: The 23 strike is a safe entry if assigned, and if not, the premium alone provides strong cash flow. With upcoming earnings, it’s a balanced way to generate income while positioning for a potential move higher.

Headed towards lower bollinger band for a nice snap back

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

Bonus Video

If you missed my latest video, I covered why Palantir and SoFi are two of the strongest opportunities right now. I break down the charts, levels, and setups I’m personally watching. Be sure to check it out.

Stay focused, stay tactical, and use this week’s volatility to your advantage.

Talk soon,

Ryan