- Options Trading University

- Posts

- Chad’s $8,637 Win On SoFi + My NVDA Trade Setup

Chad’s $8,637 Win On SoFi + My NVDA Trade Setup

Hey Options Trader,

The market is moving into a sideways phase with light volume and cautious positioning. September tends to be volatile, but I see strength building for the next push higher once this consolidation finishes.

Here’s what we are covering:

Neutral to bullish outlook with QQQ levels to watch

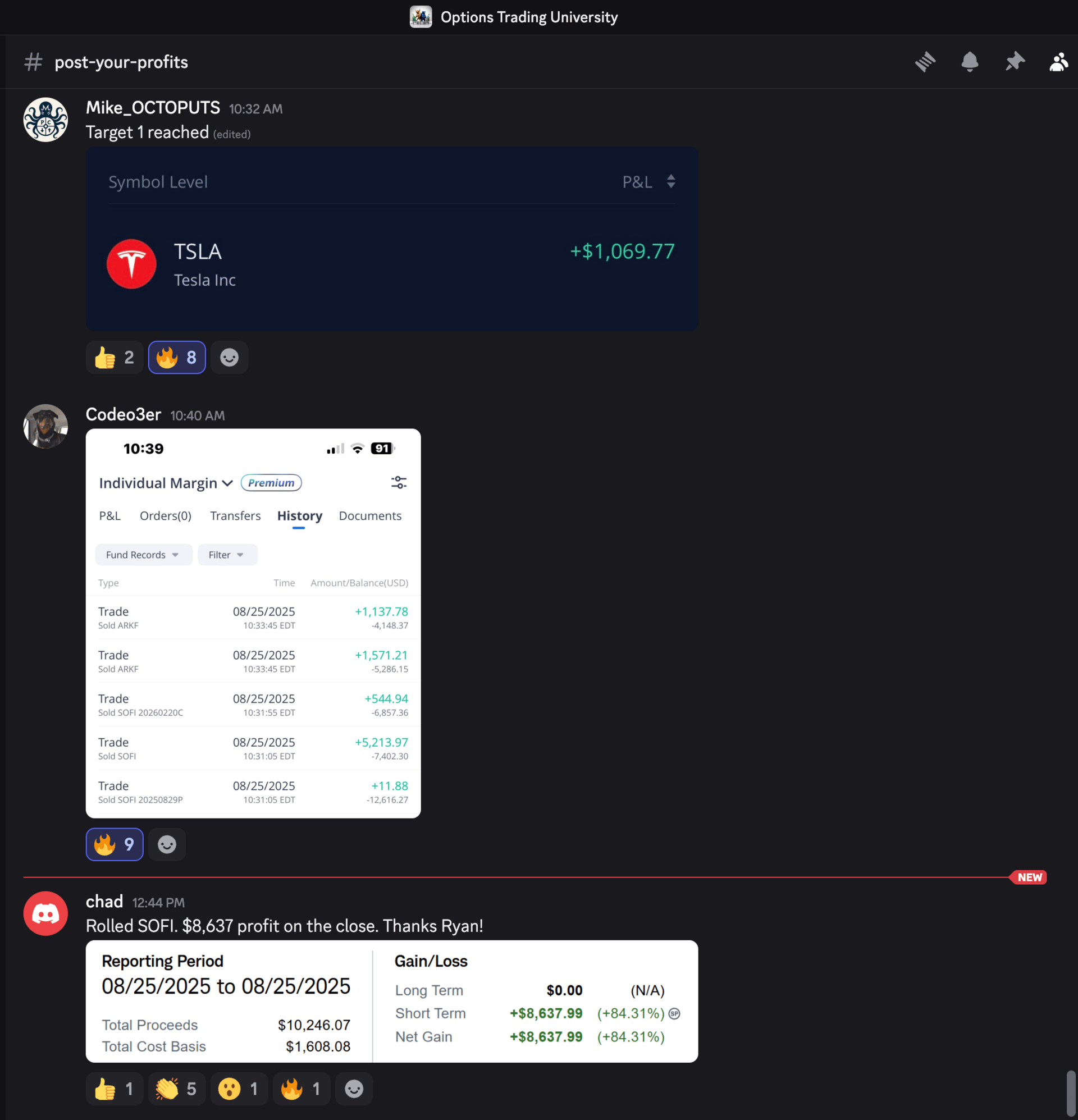

Client spotlight: Chad’s $8,637 SoFi win

My free trade of the week on NVDA with 2.18% ROI in 18 days

Bonus video: my positions on NVDA, HIMS, and SoFi

Market Snapshot

I’m neutral to bullish right now. $QQQ ( ▲ 0.89% ) touched 577 and I think we’ll consolidate sideways for the next week or two. Light volume and vacations have kept the market quiet, which is typical for late August.

If QQQ consolidates here and then breaks higher, I see a run to 590 in the near term. At that point, $VIX ( ▼ 5.64% ) could fall into the 13s or even the 12s. That’s when I’ll look to start adding some bearish trades in a very small portion of the portfolio, since I think a larger pullback would be healthy.

For now, I’m keeping 15% in cash and expect that to rise to about 25% by the end of the week as positions close. September is historically a negative-return month, so I want to stay cautious while keeping bullish exposure.

$QQQ on low volume trading sideways

VIX getting in very low territory

Client Spotlight

Chad has become one of our most consistent performers. After posting multiple $80K–$90K months, today he closed out a SoFi CSP position for an $8,637 profit. This is his fifth month in the program, and he’s showing the kind of repeatability we aim for with the strategy.

If you want access to all my trades, including these setups, make sure to click the link below.

Free Trade of the Week

Trade: Sell September 12th $170 cash-secured put

Premium: $370

ROI: 2.18% in 18 days (annualized ~44.1%)

Delta: 28

NVIDIA has an expected move of $12 going into earnings. Worst case, the stock dips to around 167, which lines up well with this strike. I believe NVIDIA heads higher from here, making this a safe play with solid income potential. If assigned, you’d be getting the stock at a discount.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Thousands are flocking to 2025’s “It Card”

This leading card now offers 0% interest on balance transfers and purchases until nearly 2027. That’s almost two years to pay off your balance, sans interest. So the only question is, what are you waiting for?

Bonus Video

In my latest video, I go deeper into my NVIDIA position ahead of earnings, compare the last earnings report to my expectations for this one, and break down what I’m doing with HIMS and SoFi. It’s a must-watch if you’re preparing for volatility in September.

Small, consistent wins compound into life-changing results.

To smart trading,

Ryan