- Options Trading University

- Posts

- Big Friday Catalyst: 3 LEAPS Opportunities If We Pull Back

Big Friday Catalyst: 3 LEAPS Opportunities If We Pull Back

Hey Options Trader,

The market is sitting in wait mode ahead of Friday’s unemployment report. This will be a major catalyst for rate cut expectations and could determine whether we get a dip-buying opportunity or simply grind higher.

Here’s what we are covering:

Key levels to watch on QQQ and VIX

Client spotlight: Erin’s consistency + new client wins

Three LEAPS buying opportunities if we dip

Bonus video: portfolio update and HIMS stock breakdown

Market Snapshot

I’m neutral into Friday’s unemployment report, but bullish long term. $QQQ ( ▼ 0.01% ) is currently at 570, and I think tomorrow will be an inside day. The real action comes Friday.

If unemployment numbers disappoint badly, QQQ could flush to 545. That would be a golden buying opportunity. A weak jobs report all but guarantees aggressive rate cuts ahead maybe not just 25 basis points, but 50 basis points in October or December. September’s cut is already priced in at 97%.

If unemployment numbers come in line with expectations, I expect a grind higher rather than a gap up, with $VIX ( ▼ 3.11% ) trending down into the high 14s. On bad data, though, VIX could spike above 20. I’m holding 17.3% cash steady into Friday, ready to deploy heavily if we get that dip.

Client Spotlight

Erin joined us with prior trading experience but lacked consistency. Since starting, she’s been hitting her goals of 3–5% per month and even posted a $2,000 profit in a single day.

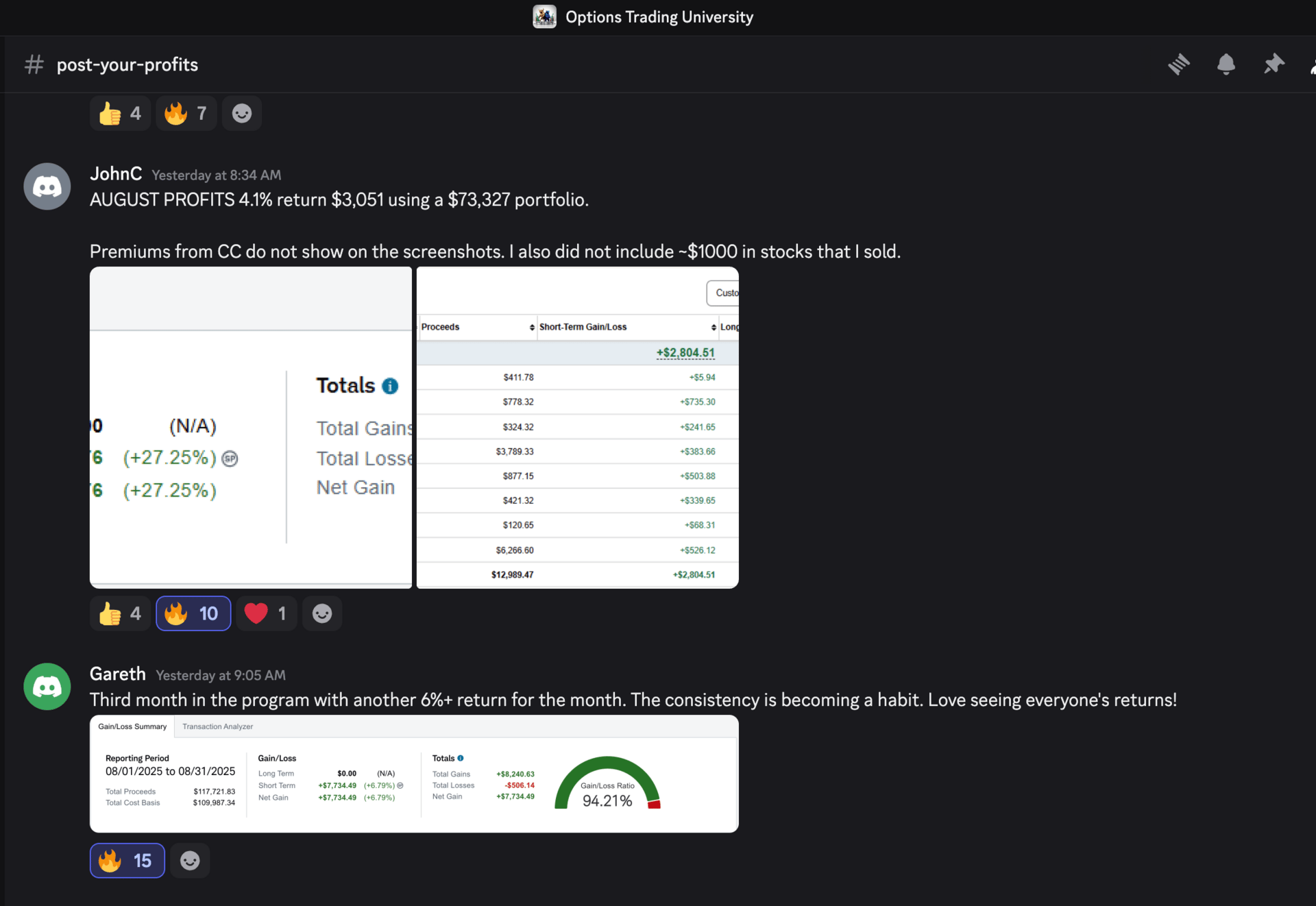

We also saw newer members share their August results: John returned 4.1% in his portfolio, and Gareth posted a 6% return. Amazing progress for first-month clients.

Free Trade of the Week: 3 LEAPS Opportunities

Instead of a single trade this week, I’m sharing three LEAPS call option setups that I’ll be looking at if Friday gives us a dip.

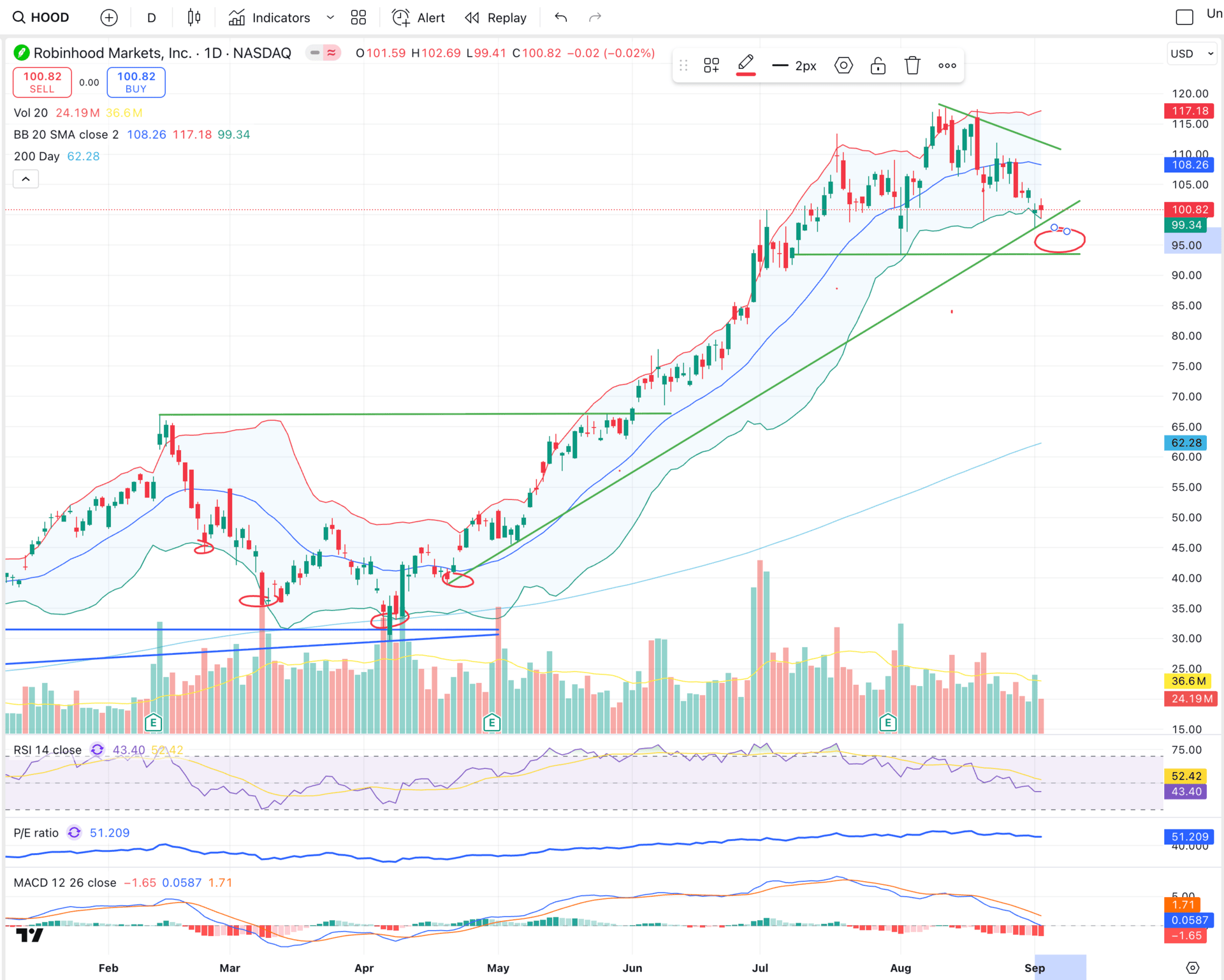

Robinhood ($HOOD ( ▲ 0.08% ) ): Extreme buy if it dips near 95. I’d go out to January 2027 for LEAPS calls.

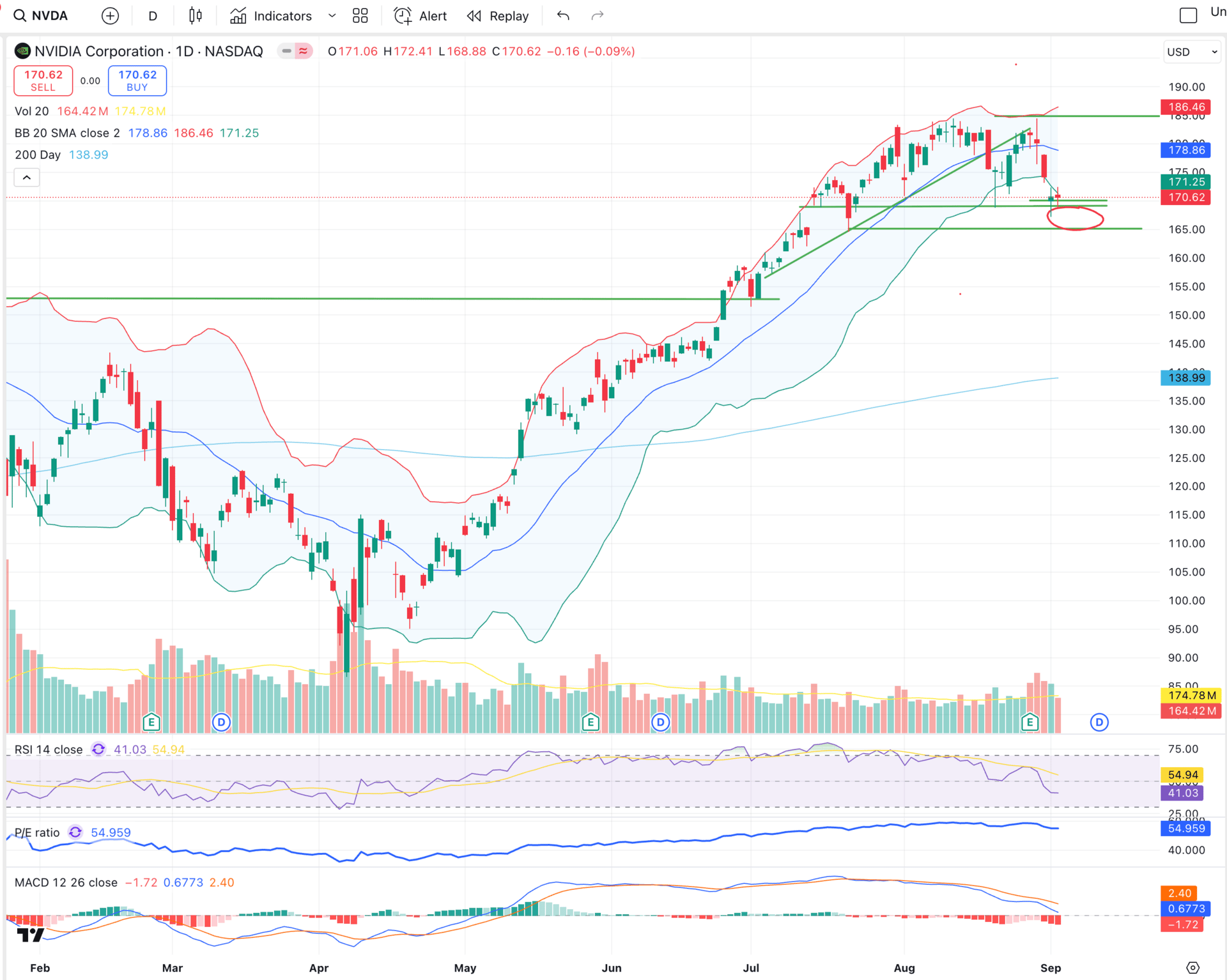

NVIDIA ($NVDA ( ▲ 1.75% ) ): Attractive buy zone around 165 or slightly above. Long-term LEAPS entry.

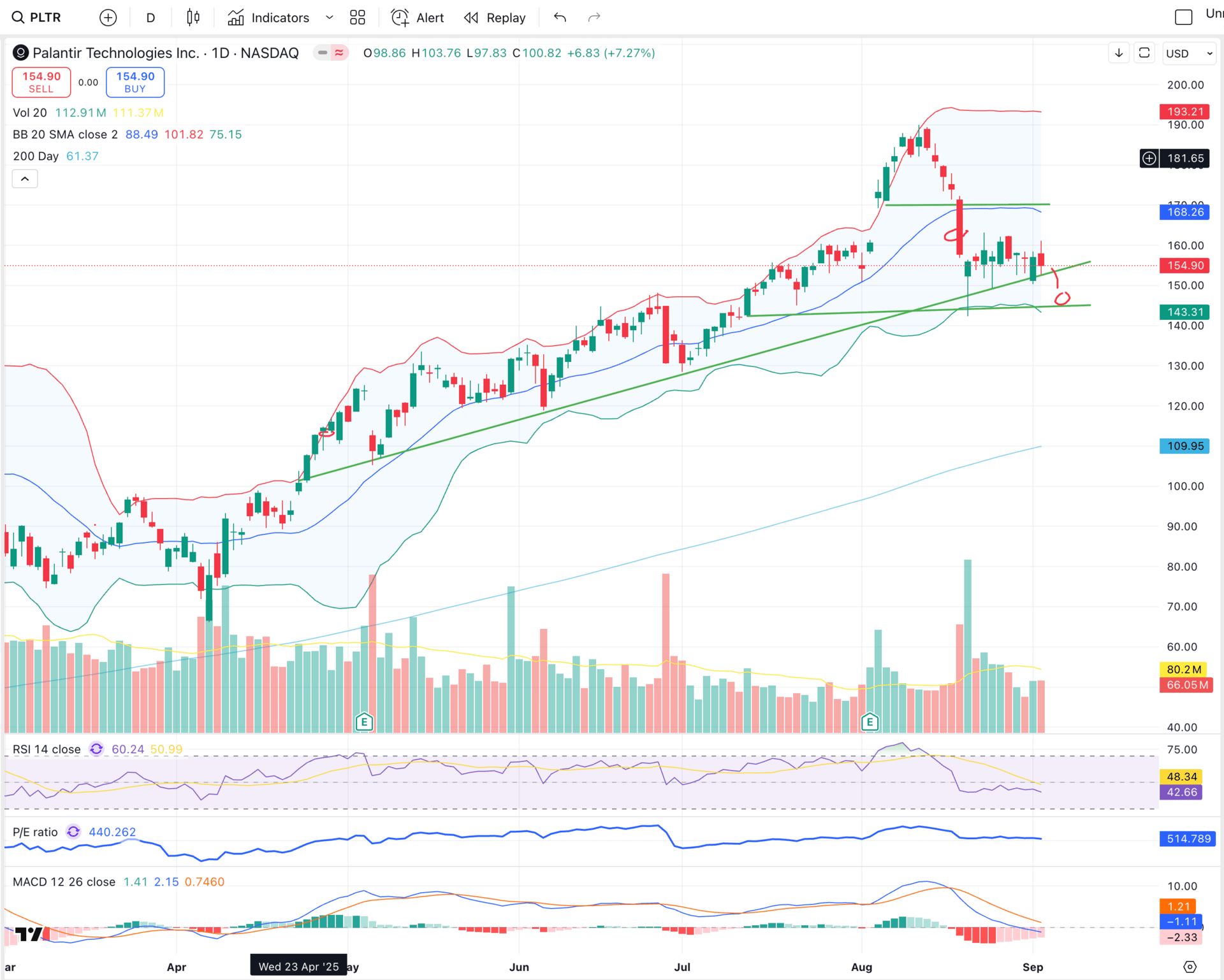

Palantir ($PLTR ( ▲ 1.59% ) ): Buy zone between 143–153. Great long-term LEAPS setup.

All three represent core positions I want to build on weakness.

Get Exclusive Access To My Mastermind + Make Multi 6 Figures Trading Options

Are you looking to consistently make multi 6 figures options trading even through crashes, while getting:

Direct access and mentorship from a 7 figure options trader

Exclusive membership to a private mastermind group

A 45 module system to become consistently profitable (45%+ Year over Year returns)

1 on 1 coaching calls

Live trade alerts

Then click the button below.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Bonus Video

In my latest video, I break down exactly what I’m doing with the portfolio going into Friday, plus a major update on HIMS stock and how I’m managing that position. Watch here to get the full breakdown.

Stay focused, stay tactical, and use this week’s volatility to your advantage.

Talk soon,

Ryan