- Options Trading University

- Posts

- $5900 For S&P 500, Here's Why I'm All In

$5900 For S&P 500, Here's Why I'm All In

Trump remained victorious in this election which was a close race

Hey Options Trader,

President Donald Trump managed to secure a close victory and the markets loved it! $SPX, $QQQ, $NVDA, $MSTR, and Bitcoin made new all time highs. This has confirmed by stance on being 100% invested (No cash).

Thank you for the feedback on the last newsletter on adding $MSTR to the newsletter.

Here’s what what we are covering:

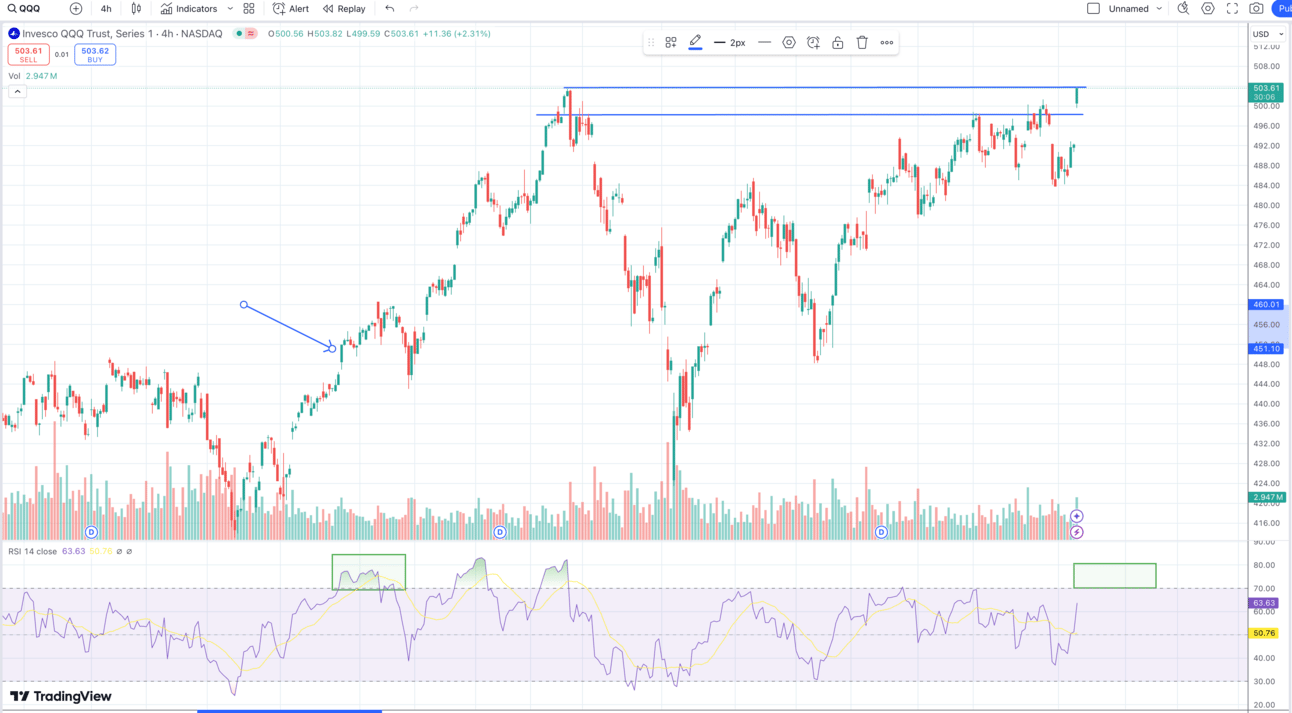

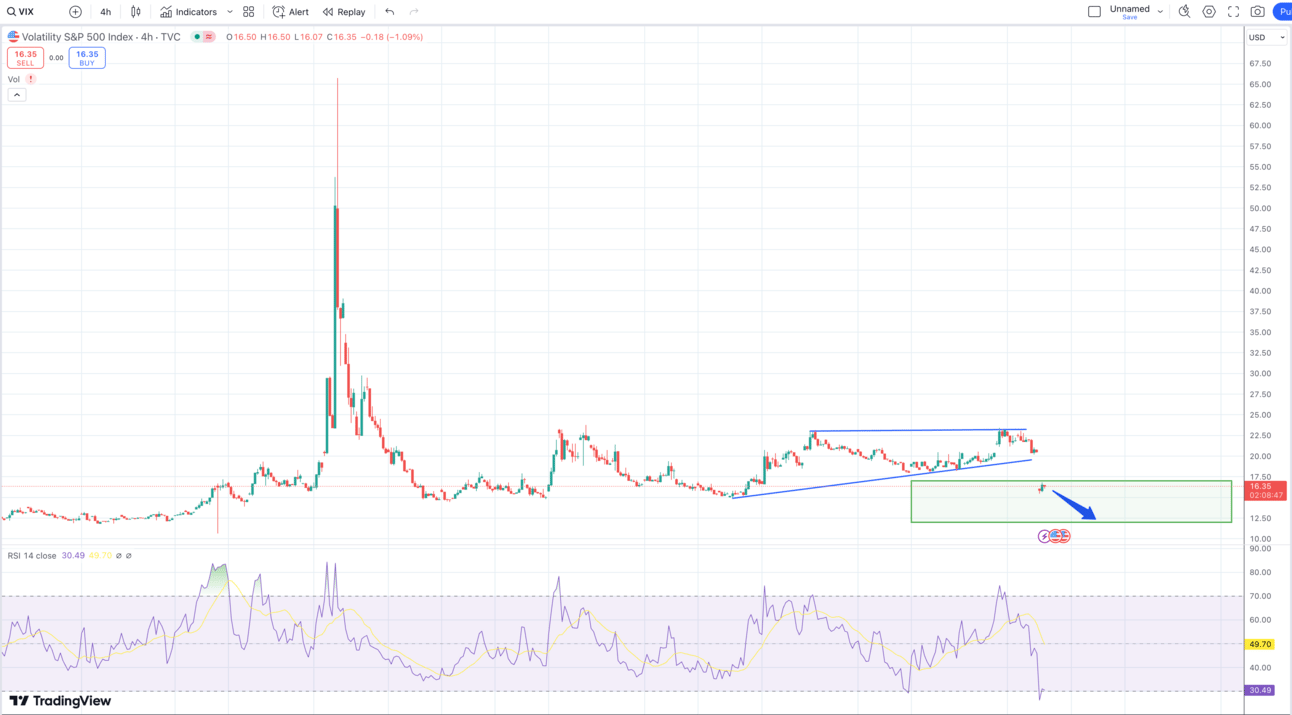

$QQQ and $VIX

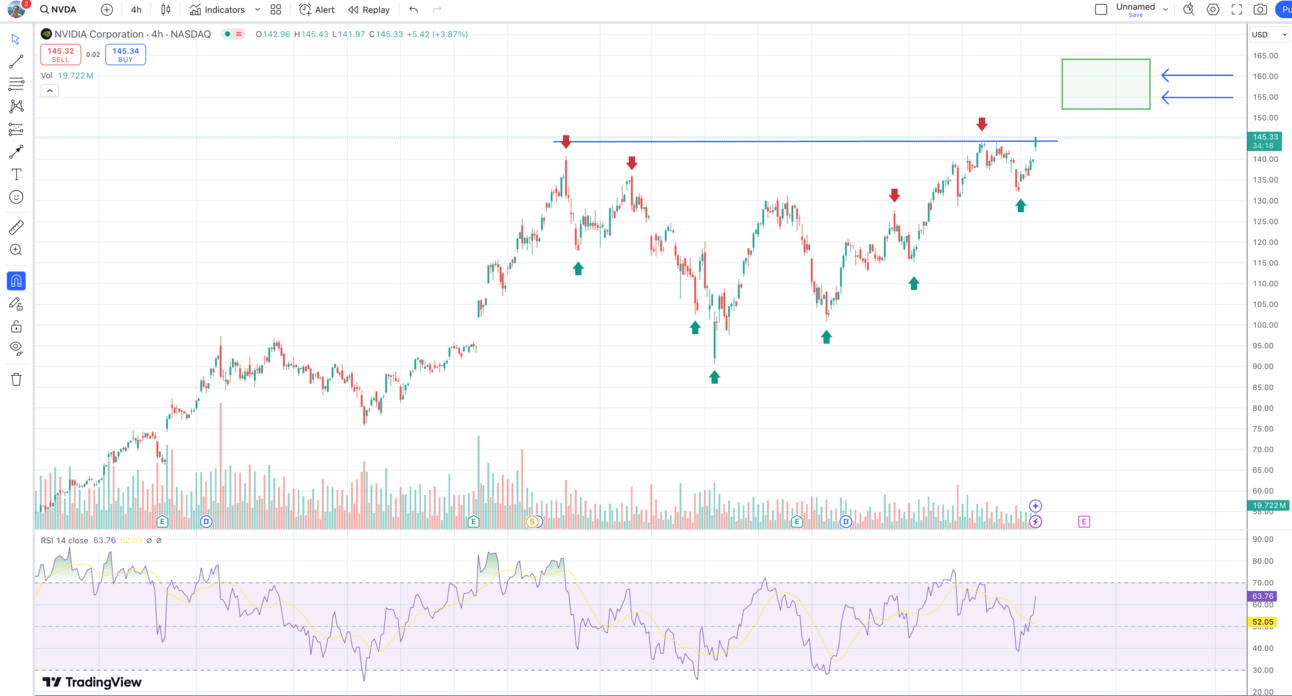

$NVDA - why I bought 200 shares today instead of selling puts

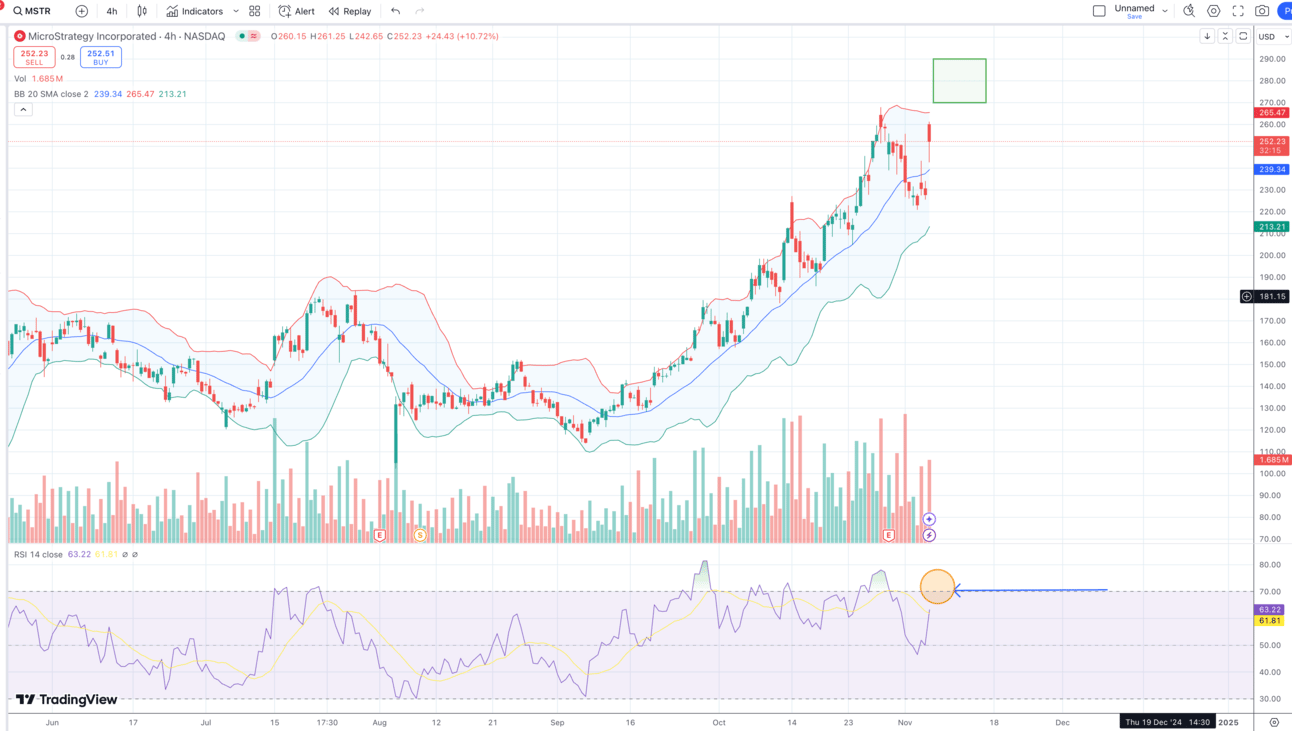

$MSTR - how to play bitcoin with Microstrategy stock

New Wheel Strategy Youtube Video Went Live

QQQ, VIX, and where the markets are headed

Well, it looks like the markets approved Donald Trump’s win! His policies seem to favor the overall markets and tech. Vix also had a drop from $20+ down to $16, so fear is subsiding and I believe we are going to see a $12 VIX by end of year, which is a very bullish signal. We may have some speed-bumps along the way but this confirms my conviction of a Christmas Rally!

I will however be shoring up cash in the next two months to take advantage of any pullbacks early next year.

$QQQ testing all time highs, primed to breakout. RSI is still not above 70. We have a ways to go.

VIX has broken down significantly! I expect continuation downwards.

3 Strong Trades Recommended by A.I. Today

There are thousands of good trade opportunities happening right now as you read this.

Attend today’s free live class because you’ll learn the top three trades our artificial intelligence is recommending.

Prepare to be amazed as we forecast the best trades in real-time.

I officially have over 6 figures in NVDA shares, puts, and covered call positions. Today I decided to buy 200 shares to get more exposure as I believe on good earnings we will see $155 to $160. Selling more puts would give me less exposure and less risk, but I want to be full risk in this environment.

To collect income, I sold the 155 & 160 Covered Calls expiring the week of earnings. If Nvidia hits those targets, i’m fine selling my shares at a huge profit and selling puts to get back in lower.

Right now my position is more of a Covered Strangle (Short puts, shares, and covered calls).

RSI is still not above 70. Perfect setup for bullish breakout into earnings.

$MSTR - Microstrategy, the darling for Bitcoin maxi’s

I wanted to cover Microstrategy as I am a Bitcoin believer as well. I had a multi 6 figure altcoin position that I entered in early 2023 and I sold in May of 2024 so i am currently out of my crypto holdings. However, if I were to put on a Crypto position as of today, I would use MSTR as a bitcoin proxy to play options on. (For those who don’t know, Microstrategy is a company that owns billions in Bitcoin and other companies and investors buy their stock as a proxy to buying bitcoin outright).

I do believe we have have room to run upwards. For me the risk is not worth the reward as I already exited crypto, but for someone who wants to play the upside, here’s what I would do.

Safe Strategy: Sell Cash Secured Puts at strike prices between 220 and 240 or buy 100 shares here and sell covered calls at 290.

Extreme Bull: Buy 6 month out Call options deep in the money 80-90 delta and exit with 25-50% profit. (Extremely risky as time works against you)

Once RSI hits 70 or above on the 4 hour chart, I would be out of all my positions. Risk is not worth reward at that point.

Once we are out of your position at profit, we wait until Bitcoin plummets back down below $40k to start building another long term position.

How did we do today? |

-Ryan