- Options Trading University

- Posts

- $34,884 in 3 Weeks?! What’s Actually Working Right Now (Free Trade Setup Inside)

$34,884 in 3 Weeks?! What’s Actually Working Right Now (Free Trade Setup Inside)

Hey Options Trader,

This week’s newsletter is packed with opportunity. I’ll walk you through a clean consolidation setup on QQQ, my current strategy for elevated VIX, and a brand-new free trade on DoorDash yielding nearly 2.8% in just 25 days. I’m also sharing one of the most powerful client transformations to date, Sean went from never having sold an option before to banking $79K in his first month.

Plus, I’ve got a new video breakdown on Palantir, NVIDIA, and Robinhood, three names I’m adjusting ahead of earnings.

Here’s what we are covering:

QQQ + VIX – CPI Setup, Key Levels & Premium Strategy

$34,884 Profit Since June – More Member Results

Free Trade of the Week – 2.78% ROI on DASH (25 Days)

Palantir, NVIDIA, HOOD – Earnings Adjustments + Trades

Market Snapshot – Why I’m Bullish Right Now

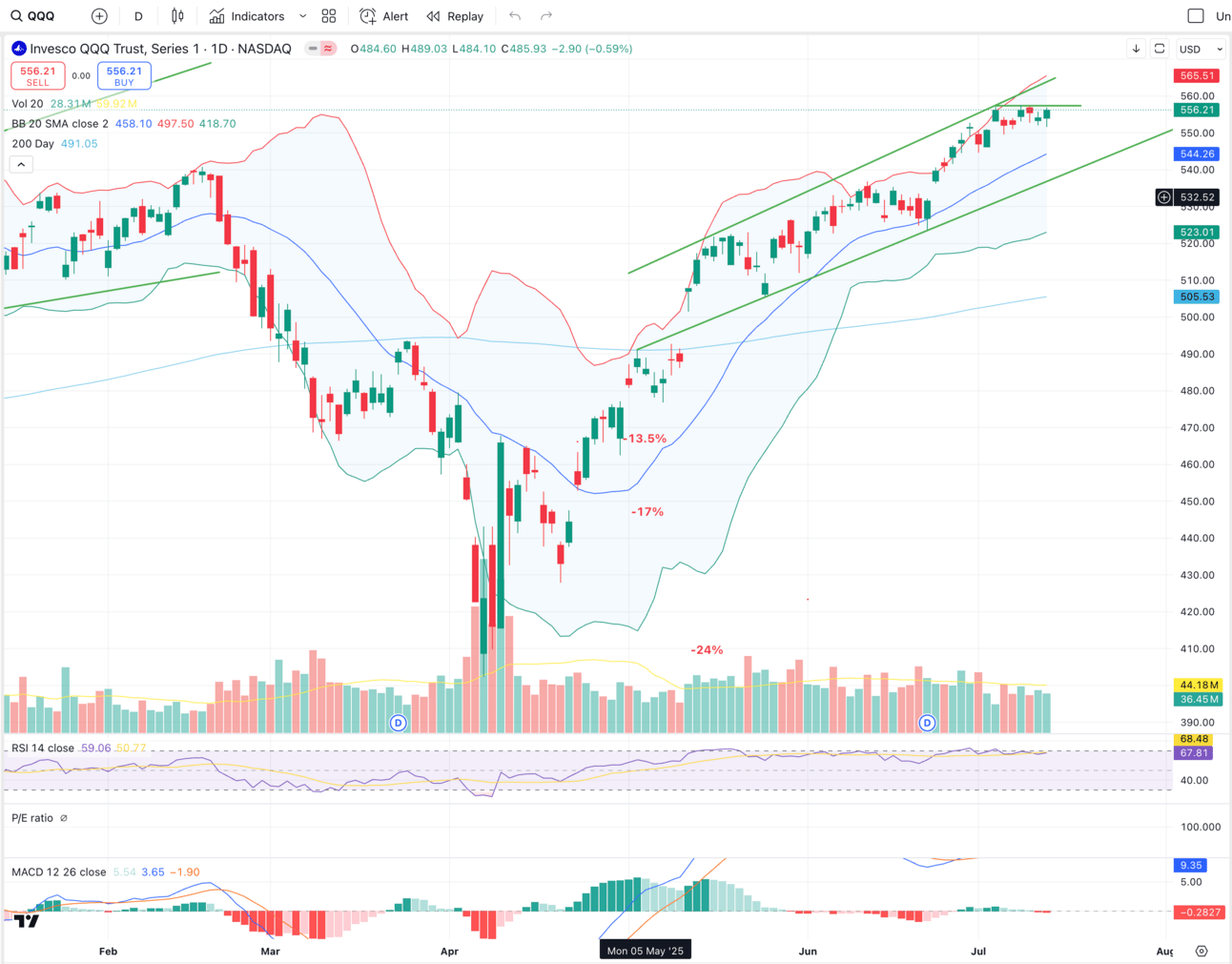

The market is consolidating beautifully. $QQQ is holding a tight range, and if this continues, we could easily see a breakout above the 570 level. On the downside, I’m watching 539 as a key support area to reload.

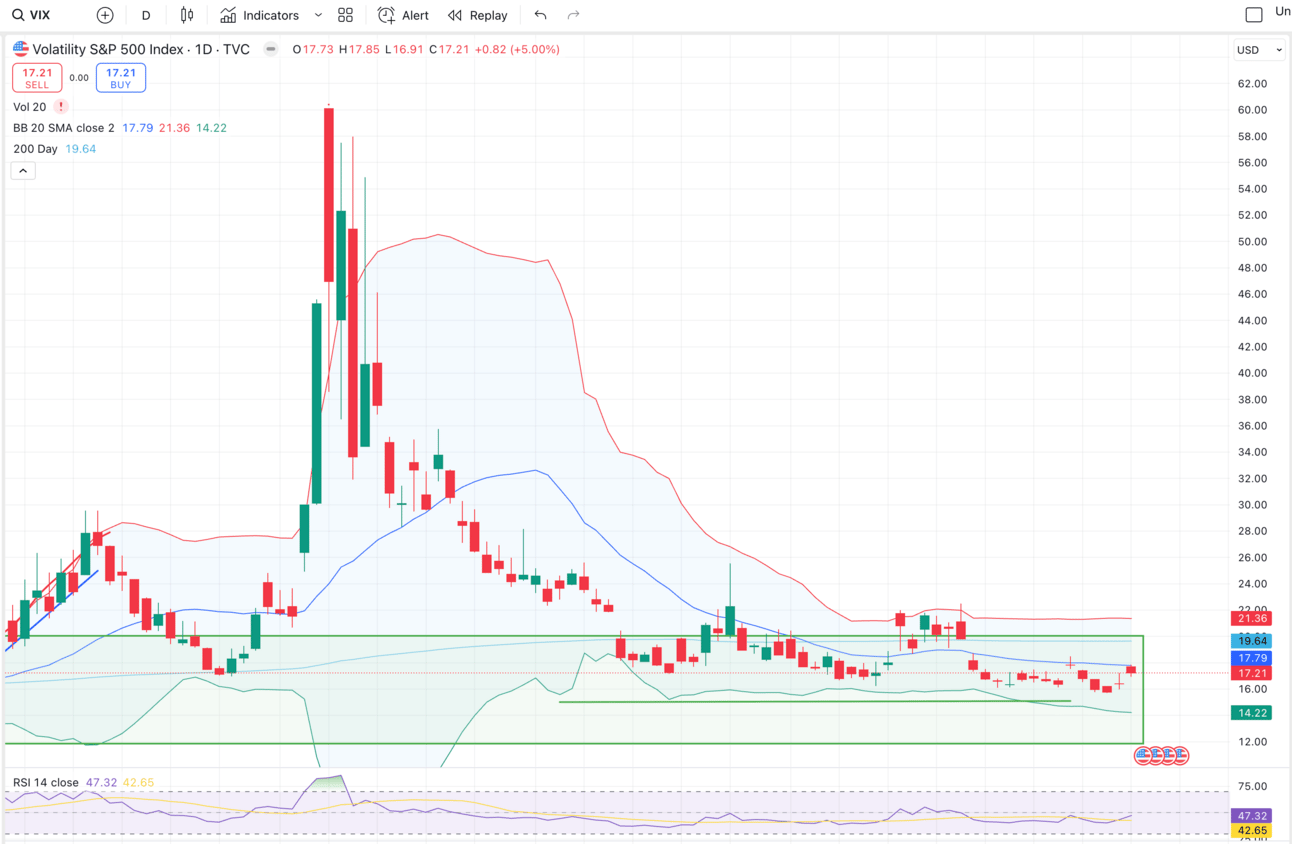

Despite the bullish setup, $VIX is still elevated at 17.21, which tells me there’s lingering fear in the market. I’m using that to my advantage by continuing to sell premium aggressively, while keeping some cash on the sidelines in case volatility spikes or the market rolls over.

Here’s what I’m watching this week:

Core CPI – Tuesday

Core PPI – Wednesday

These two data points could shape the timeline for a rate cut in either September or October. Stay nimble and tactical.

QQQ consolidation

VIX mini spike to $17

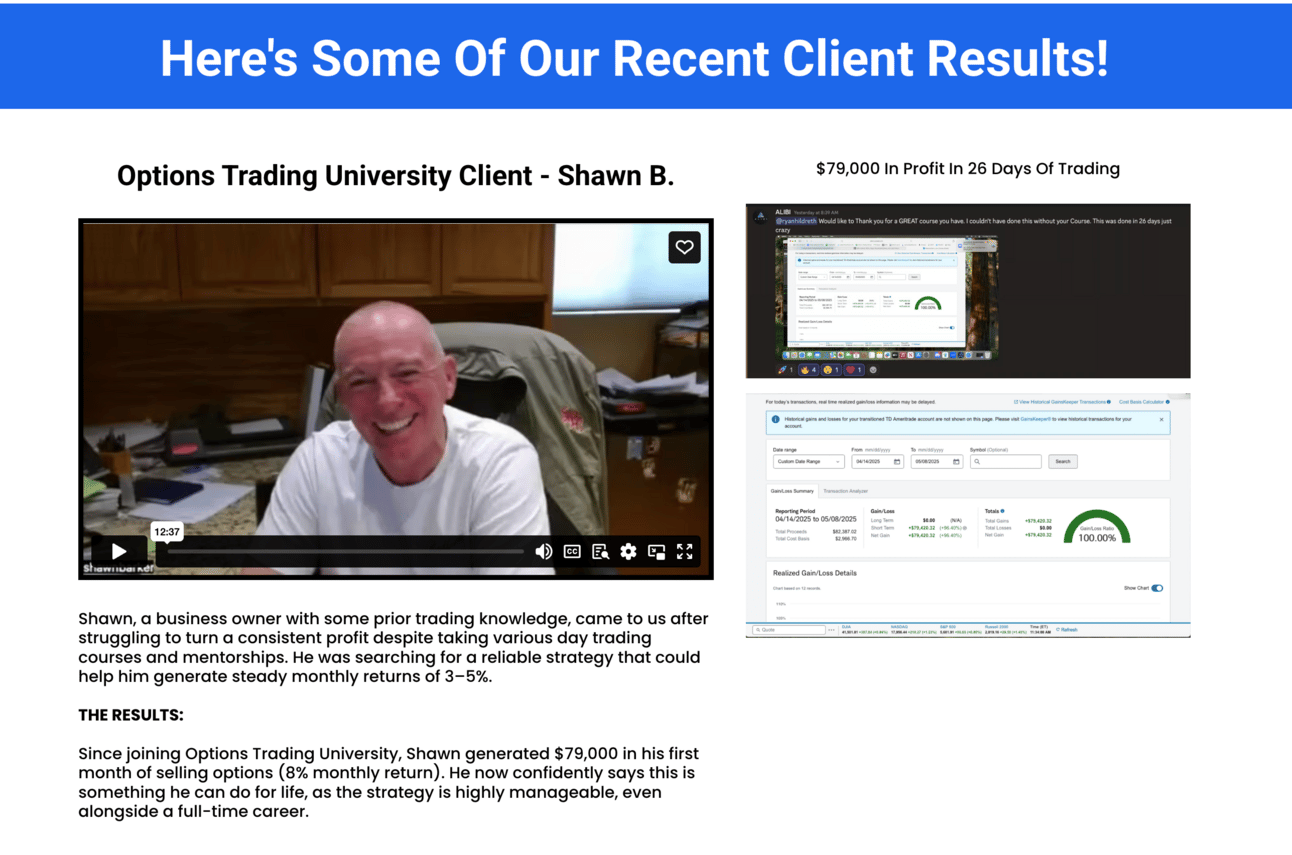

Client Win Spotlight – $79,000 in Month One?!

Sean had never sold an option in his life when he joined Options Trading University. Within just one month, he banked $79,000 in profit, and since then, he’s cleared multiple six figures.

What changed? Structure. Simplicity. A plan. And the right strategy for this market.

Want results like this?

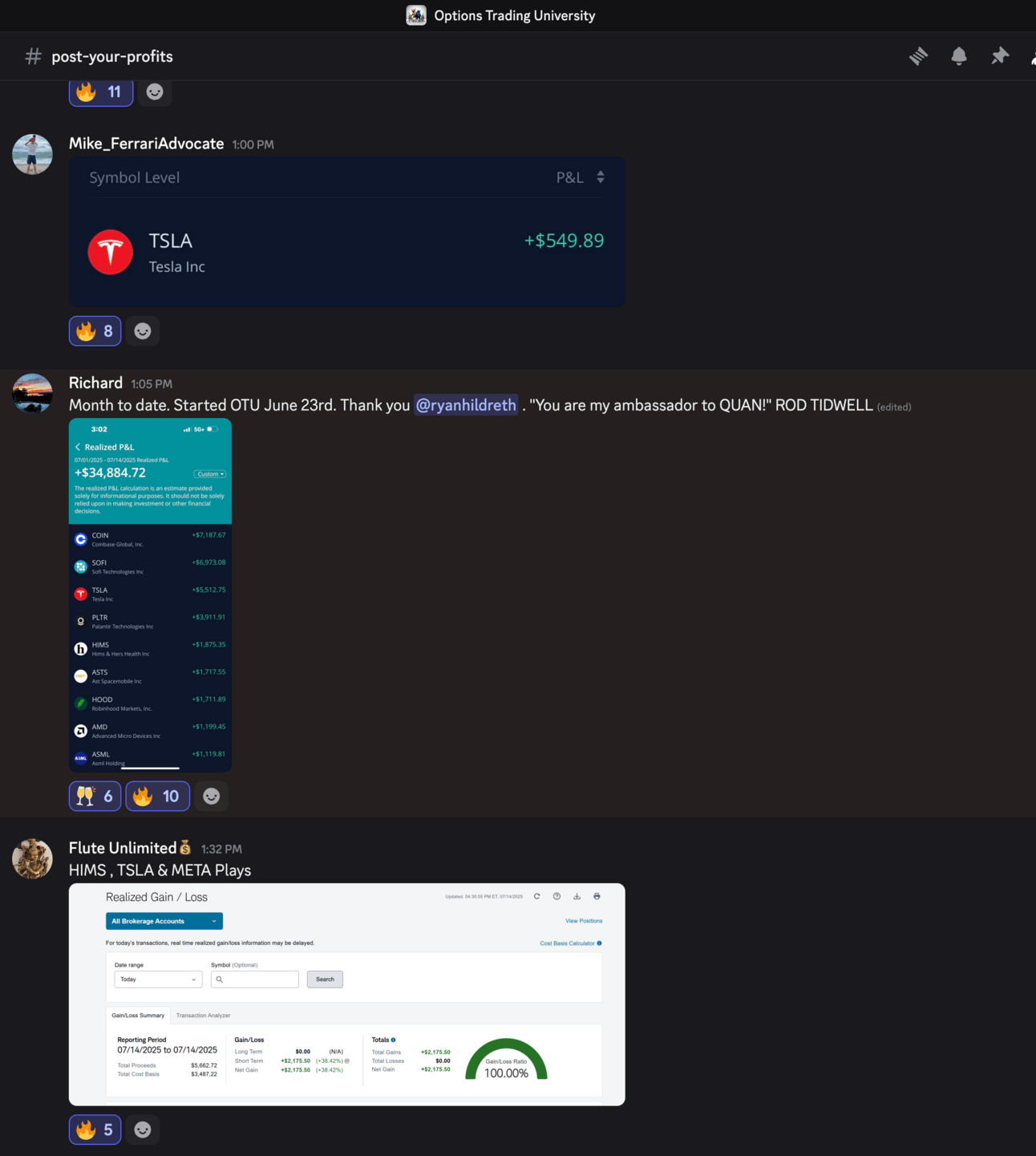

More Member Wins – $34,884 in Just 3 Weeks

We had another member join on June 23rd, and in just three weeks, he’s already locked in $34,884 in gains using the exact strategies I teach inside the program.

We’re seeing results like this every week — from small accounts to large ones. The system works when applied with discipline.

Free Trade of the Week DASH CSP (2.78% in 25 Days)

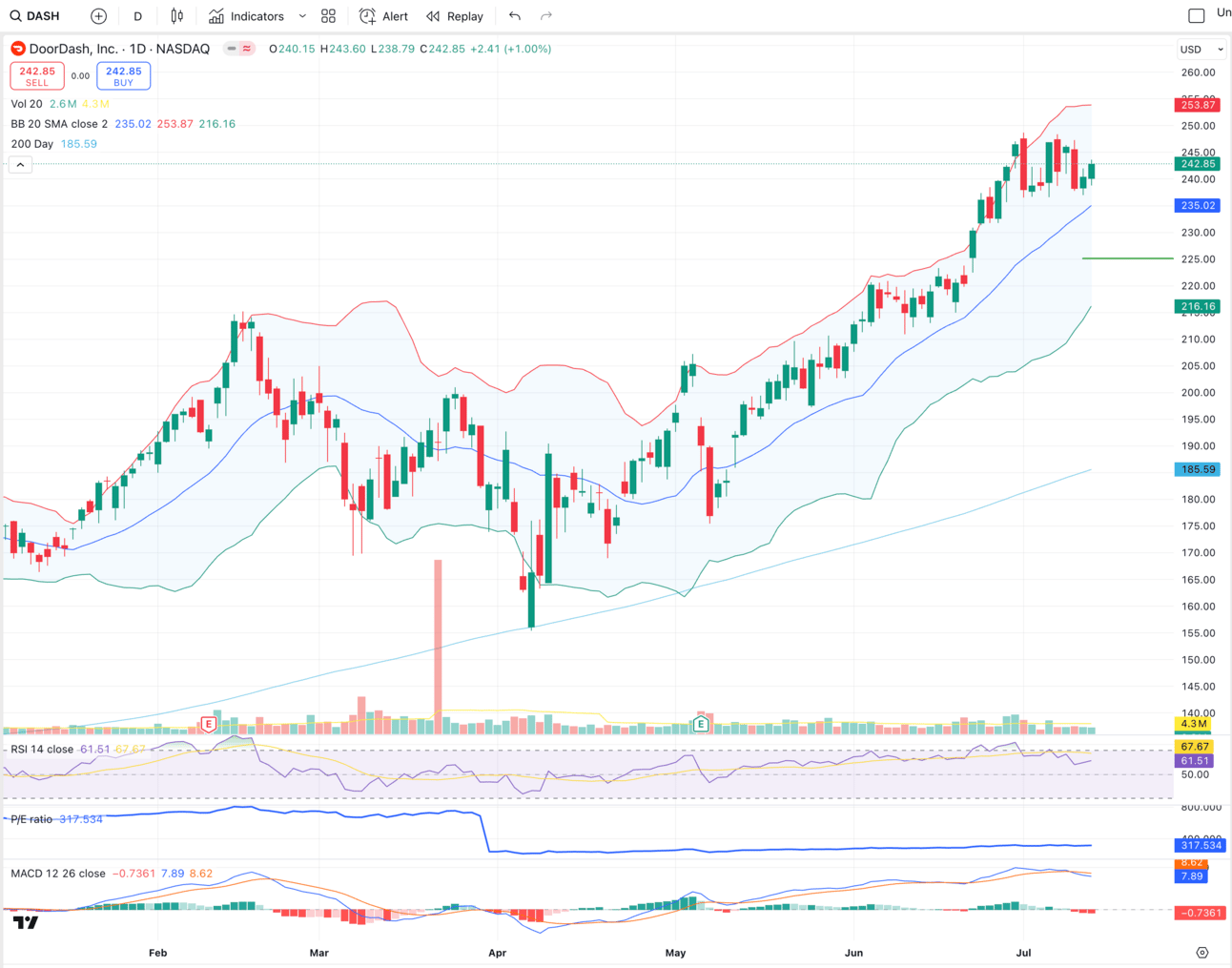

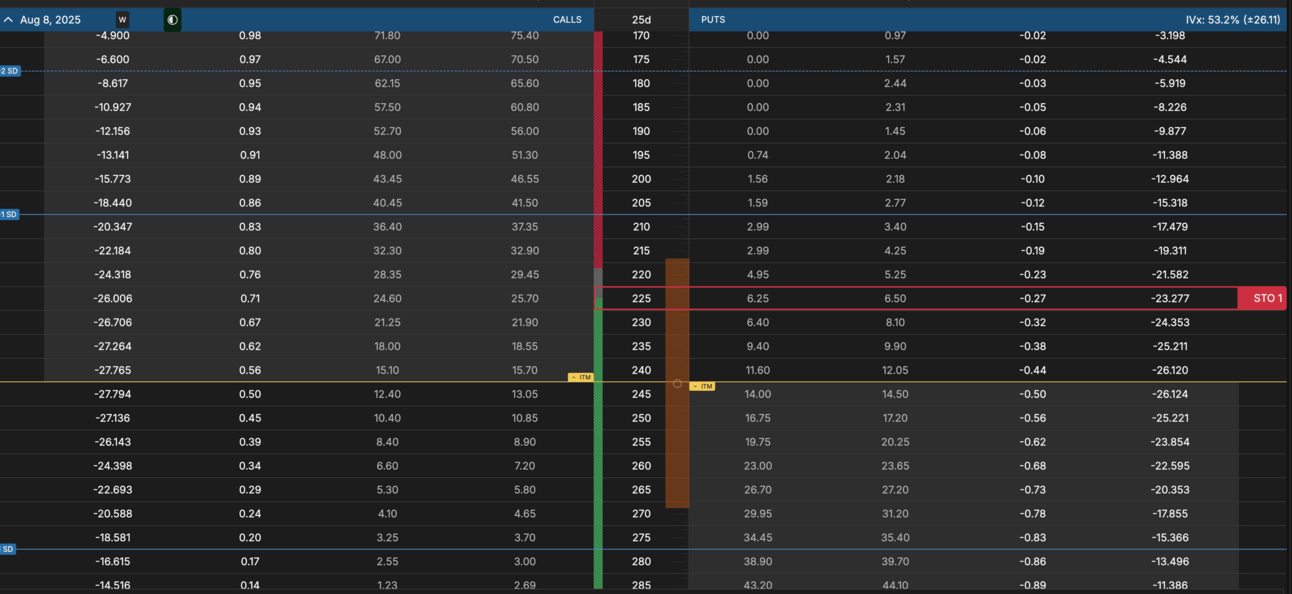

DoorDash ($DASH) has a strong long-term chart and solid fundamentals, despite its high P/E, the company has enough cash to cover its debts 4–5x over. I’m playing this one safe with a clean CSP setup:

Trade: Sell August 8th $225 cash-secured put

Premium Collected: $625

Delta: 27

ROI: 2.78% in 25 days (~40.5% annualized)

Why I Like It: Good chart, strong cash position, earnings play, and offers a chance to buy quality at a discount if assigned.

This is a trade I personally took today. Premium is still attractive so if you like it, don’t wait.

Nice consolidation to mid bollinger band on $DASH ( ▲ 5.28% )

Bonus Video – Palantir, NVIDIA, Robinhood: My Moves

In my latest video, I break down the 3 stocks I’m adjusting right now: PLTR, NVDA, and HOOD. I cover:

Expected price movement going into earnings

How I’m positioning around volatility

A brand-new trade I took today on Robinhood

If you’re holding any of these names, or plan to, this is a must-watch.

Let’s keep stacking wins this week.

Talk soon,

Ryan

Options Trading University